Hong Kong is one of the financial centres of the world, with a strong banking system offering a doorway to China.

According to the Hong Kong government's official website, there are 163 licensed banks, 17 restricted license banks, and 13 deposit-taking companies in Hong Kong. These include 78 of the top 100 international banks in the world that have some form of operation in Hong Kong. Furthermore. one of the world’s largest banking institutions, the Hong Kong and Shanghai Banking Corporation Limited, or HSBC, was founded in Hong Kong.

It is understandable why Hong Kong is often described as the financial centre of Asia for commercial banking and personal banking.

But which of the players in the Hong Kong banking sector is best for small businesses? In this article, we'll take a look at the 7 best banks to use as well as the pros and cons of each bank.

An Overview of the Banking System in Hong Kong

For any corporation to be considered a bank in Hong Kong, it must first be granted a license by the Hong Kong Monetary Authority (HKMA).

Hong Kong implements a three-tier system of institutions classified based on specific factors: the amount and term of deposits accepted and the nature of business. The three types of institutions are explained below. You can refer to this full list of these institutions.

- Licensed banks: These are the most common banks in Hong Kong. They can operate current (checking) and savings accounts, take deposits, and accept paychecks. These institutions can freely use the word 'bank' in their name. Examples of these banks include Dah Sing Bank, Bank of China, and ZA Bank (which is a virtual bank).

- Restricted license banks: These banks can do business like an investment bank in capital markets and can take deposits greater than HKD 500,000. There are only a few Restricted Licensed Banks in Hong Kong, such as Goldman Sachs Asia Bank Limited and Orix Asia Limited.

- Deposit-taking companies: These companies are associated with licensed banks and are involved in consumer finance, commercial lending, and securities. They can take deposits greater than HKD 100,000 with a maturity of three months or greater. Some examples of these companies are BPI International Finance Limited and Public Finance Limited.

Every international bank in Hong Kong is regulated and supervised to ensure stability for the financial sector and the country’s economy.

🔎 Tip: Explore the distinctions between online banking and traditional banking

The banks listed in this article are all licensed banks, each with its specialities and differences, which will be discussed below.

| Best For | Key Limitation | Key Fees | |

| Corporate preferring quick account activation and global recognition | Eligibility complexity | Account opening: HKD 1,200 - 10,000 Monthly: HKD 250 |

|

| High-net-worth clients preferring global presence and comprehensive business services | High fees | Account opening: HKD 1,300 - 11,000 Monthly: Waived or HKD 200 or HKD 450, depending on account type and TRB. |

|

| SMEs that prefer banks with a strong local presence | Limited global presence | Account opening: HKD 1,000 - 2,000 Monthly: Waived with TRB of HKD 100,000 or HKD 50,000 for specific account types; otherwise, HKD 200. |

|

| Hong Kong-China relations, offering a strong network and solid reputation | Language barrier, complex account opening process | Account opening: HKD 1,200 - 6,200 Monthly: Waived with TRB of HKD 50,000 to HKD 1,000,000; otherwise, HKD 120 to HKD 200, depending on account types. |

|

| International banking with a strong global presence and wide credit card options | Higher fees, website navigation challenges | Account opening: HKD 2,000 - 8,000; Monthly: Please contact Citi directly |

|

| Digital banking, offering global presence and relationship manager services | Higher fees, slower tech development | Account opening: HKD 1,200 - 10,000 Monthly: Please contact Standard Chartered directly |

|

| Local banking in Asia with a strong Hong Kong reputation and Asia market development | Limited global presence | Account opening: HKD 10,000 Monthly: Waived with an Average Daily Relationship Balance of HKD 10,000; otherwise, HKD 150. |

1. DBS

DBS is a leading financial services group in Asia with a presence in 18 markets, including Hong Kong. It was founded in 1968 and was previously called 'The Development Bank of Singapore Limited.'

Globally, DBS employs approximately 36,000 employees, with a total asset held of $424.483B as of the report in the quarter ending June 2023.

Most recently, they were named the World’s Best Bank for Corporate Responsibility and awarded the “Safest Bank in Asia“ award by Global Finance for 15 consecutive years from 2009 to 2023.

🔎 Tip: DBS is also on our list of The 5 Best Banks To Use in Singapore

Pros of DBS

- Third-Party Integrations: Compatibility with accounting software like Xero and API integration for customised solutions.

- Quick Account Activation: The account can be completed as fast as 15 minutes and activated as quickly as two business days according to the DBS Hong Kong Online Business Account Opening page, allowing businesses to get started without much delay.

- Global Recognition: Awarded as the world's best bank for five consecutive years by reputable publications, ensuring high trust and credibility.

- Diverse Account Types: Offers a range of business accounts, including Corporate Account, Social Enterprise Bundle, and RMB Business Account, catering to different business needs.

Cons of DBS

- Eligibility Complexity: The eligibility criteria can vary significantly depending on the account type, which might confuse some customers.

- Customer Support: Limited ways to contact customer support, including hotlines, email and virtual assistance.

- Limited to Certain Currencies: While it does support multiple currencies, the list is limited to 14, which may not cover all international business needs.

DBS Fees

In this section, our focus will be on the key service fees associated with business banking services offered by DBS.

| Service | DBS Fees |

| Account opening fee | Local Company Account: Min. HKD 1,200 Overseas Company Account: Min. HKD 10,000 Special Company Account*: Min. HKD 10,000 |

| Monthly Service Fee | HKD 250 |

| Inactivity of the Account (No transactions for 12 months with a balance less than the minimum) An exemption applies to Multi-Currency Savings Accounts holding deposits in multiple currencies, provided that at least one of the currency deposits has been active in the previous 12 months. |

HKD Corporate Accounts with less than HKD 5,000: HKD 150 USD Corporate Accounts with less than USD 600: USD 25 EUR Corporate Accounts with less than EUR 600: EUR 25 Please refer to this Full list of currency accounts and fees. |

*A Local Company is defined as a Hong Kong-registered company

Overseas Companies include companies not registered in Hong Kong or Hong Kong-registered companies with major corporate shareholder(s) incorporated overseas, or Hong Kong-registered companies with any corporate director(s) incorporated overseas or non-Hong Kong companies.

Special Company refers to but is not limited to, companies in special industries such as Money Services, Jewellery, etc.

| Transfer Type | Fees |

| Transfers within other DBS accounts | Free |

| Receiving (inward) a telegraphic transfer | HKD 65 |

| Sending (outward) a telegraphic transfer | Non-local transfers Via DBS Electronic Banking: HKD 115 SWIFT Transfers (MT103): HKD 240 SWIFT Transfers (MT202): HKD 80 Branch: HKD 200 - HKD 380 Local transfers in HKD/USD/RMB (RTGS) Via DBS Electronic Banking: HKD 55 SWIFT Transfers (MT103): HKD 200 SWIFT Transfers (MT202): HKD 30 Branch: HKD 200 - HKD 380 |

| Including a message in payment details in Chinese characters | HKD 150 (waived for telegraphic transfers performed via DBS Electronic Banking) |

| ATM cash withdrawal (per transaction) | From Macau/China: HKD 25 From China UnionPay network: HKD 15/RMB 15 From Visa Plus network: HKD 25 |

For additional details, please consult the rates and fees outlined on this DBS Hong Kong Corporate Banking Fees page.

2. HSBC

The Hong Kong and Shanghai Banking Corporation (HSBC) stands as one of the largest financial services organisations. Their global banking services serve over 60 nations and 39 million clients worldwide, making them a top choice among local and international customers.

In HSBC's latest annual report, they disclose a net new invested assets amounting to USD 34 billion for the quarter ended September 2023.

HSBC was established in Hong Kong in 1865 to facilitate trade between Asia and Europe. In Hong Kong alone, HSBC employs approximately 2,905 employees.

They ranked 2nd on The Asian Banker list for strongest Asia Pacific bank, which evaluates banks based on their balance sheet strength.

They were also listed by AsiaMoney as Hong Kong’s best domestic bank in 2022 and Best International Bank for the Greater Bay Area in 2023

Generally, HSBC is the preferred bank for high-net-worth clients.

🔎 Tip: Find out about the key features and fees of HSBC business banking in our detailed HSBC business account reviews.

Pros of HSBC

- Global Presence: Renowned global presence and reputation around the world

- Ease of Access: HSBC's mobile app is well-developed for easier access to your account

- Business Services: A wide array of financial products and services available for business customers, including business accounts catering to different levels of business, from startups to established SMEs, corporate cards, trade services, and business loan

Cons of HSBC

- High Fees: Considerably higher fees for some HSBC services like foreign exchange transactions

- Customer Support: As observed through reviews such as through Trustpilot, some customers complain about the difficulty of resolving issues with HSBC

HSBC Fees

| Service | HSBC Fees |

| Account opening fee | Account application fees via online Account Application Center: HKD 1,300 Account opening facilitated by an overseas HSBC branch: HKD 2,250 Overseas Company or Special Company Account Opening: HKD 11,000 An additional fee of HKD 300 will be charged for each application submitted in paper form or via other channels. |

| Initial deposit | HKD 10,000 |

| Monthly fees | Fee waived or HKD 200 or HKD 450, depending on the account type and the TRB over the previous 3 months. Refer to this list of monthly fees for HSBC business accounts. |

| Inactive account fee | Account with previous 3 months TRB* below HKD 50,000 AND Inactive for more than 1 year: HKD 350 semi-annually Account with previous 3 months TRB below HKD 50,000 AND Inactive for more than 2 years: HKD 450 semi-annually |

| Account reactivation | HKD 1,000 |

| Account closure | HKD 500 |

*TRB: Total Relationship Balance (TRB) is calculated based on the balances in the accounts maintained with HSBC in Hong Kong.

| Transfer Type | Fees |

| Receiving (inward) a telegraphic transfer | Crediting proceeds to an HSBC account: HKD 65 Crediting proceeds to another bank's beneficiary account via RTGS: HKD 255 or Cashier’s order: HKD 200 |

| Sending (outward) a telegraphic transfer | Mainland China: HKD 100 To all others: HKD 125 |

| Payment details | Max 140 characters, otherwise an additional fee of HKD 120 |

| Receiving foreign currency transfer or inward draft drawn on other local banks, credited to the HSBC account in the same currency | HKD 120, in addition to regular inward remittance charges |

| Local ATM cash withdrawal (per transaction) | No charge when using HSBC Group’s ATM network in HK HKD 15 for the UnionPay network in HK. HKD 25 for Visa/Plus in HK. |

| ATM cash withdrawal overseas (per transaction) | From the HSBC Group's ATM network outside HK: HKD20 From overseas networks/sites (ExpressNet or Megalink in the Philippines, ICBC in Guangzhou, Wells Fargo Bank in the USA): HKD20 From UnionPay network: HKD 50 From Visa, Plus, Mastercard®, Cirrus network: HKD 40 Overseas banks may impose surcharges (if applicable). |

Please refer to HSBC's commercial tariffs for the latest information.

If you're interested, we have a guide discussing How to Open an HSBC Business Account.

3. Hang Seng Bank

Hang Seng Bank Limited is a Hong Kong-based bank headquartered in Central, Hong Kong. They currently serve over half of Hong Kong's population with a comprehensive range of domestic and global services. Customers can open accounts in a range of foreign currencies.

Hang Seng Bank’s most recent annual report states that the bank has assets of approximately HKD 1.69 trillion at the June period end of 2023. According to Zoom Info's latest reports, Hang Seng Bank currently employs 3,800 employees in Hong Kong.

They ranked 4th on The Asian Banker list of strong Asia Pacific banks. Additionally, Asiamoney rated Hang Seng Bank as the best Hong Kong bank for SMEs in 2021. Hang Seng was also acknowledged as the Best Payments Bank in 2023 by The Asian Banker, marking the 7th consecutive year of winning this award.

Pros of Hang Seng Bank

- Strong Local Presence: Well-known local presence with a very solid reputation in Hong Kong.

- Focus on Innovation: Strong focus on the improvement of e-services such as Mobile Cash Withdrawal.

- Rewards Scheme: Encouraging rewards programs for bank customers such as credit card holders and Hang Seng Preferred Banking Club.

Cons of Hang Seng Bank

- Limited Global Presence: Limited international presence and bank account access from other countries.

- Limited Services: Considerably narrower range of financial products and services compared to other competitors.

Hang Seng Bank Fees

| Service | Hang Seng Bank Fees |

| Account opening fee | Apply remotely: HKD 1,000 Apply through the Business Banking Center: HKD 1,300 Opening a Company Account in Hong Kong via Video Conference: HKD 2,000 |

| Initial deposit fee | HKD 20,000 |

| Monthly fee | Waived if TRB meets the threshold (HKD100,000 for Integrated Business Solutions Account and HKD50,000 for Biz Virtual+ Account); otherwise, HKD200. |

| Inactive account fee | Inactive for 2 years with a balance below 2,000: HKD 100 payable semi-annually. There may be differences in details depending on the type of account you have, please contact Hang Seng directly for more information. |

| Account closure within 3 months | HKD 50 for savings accounts HKD 200 for currency/integrated accounts. |

**The Total Relationship Balance (TRB) is the sum of all your deposits, investments, credit card cash advances, and outstanding loans (except mortgages) plus the total premiums paid for your designated general insurance plans distributed by Hang Seng Bank.

| Type of Transfer | Fees |

| Transferring funds to another Hang Seng Bank account in Hong Kong using Business e-banking. | Free |

| Receiving (inward) a Telegraphic Transfer | To Hang Seng Bank account: HKD 65 To other local banks: HKD 150 - HKD 300 |

| Sending (outward) a Telegraphic Transfer | Remit to beneficiary account with Hang Seng in Mainland China / Macau: HKD 85 Remit to a beneficiary account with another bank in HK / Mainland China / Taiwan / Macau: HKD 125 Remit to a beneficiary account in other countries / territories: HKD 125 |

| Payment details | An extra charge of HKD 150 will be levied for instruction containing Chinese (except for remittance to Macau). |

| ATM cash withdraws overseas (per transaction) | HSBC/Plus/Cirrus ATM Network: HKD 20 UnionPay ATM Network: HKD 40 - 60 depending on the amount you withdraw (=< or > HKD5,000) |

Please refer to Hang Seng Commercial Banking Service Fee for details.

If you're looking to open a business account with the Hang Seng Bank in Hong Kong, refer to our step-by-step guide to opening a bank account.

4. Bank of China (Hong Kong)

Bank of China (Hong Kong) Limited, also known as BOCHK, is a subsidiary of the Bank of China. As the 2nd largest commercial banking group in Hong Kong, they employ approximately 14,220 people, establish over 190 branches, and hold a total asset of over HKD 3.6 trillion, according to released bank financial highlights.

Bank of China (Hong Kong) is ranked 1st on The Asian Banker list of strong Asia Pacific banks and named the best bank in Hong Kong for corporate social responsibility in 2022 by Asiamoney. More recently, in 2023, they earned the title of the "Best Retail Bank in Hong Kong" by The Asian Banker.

BOCHK offers a comprehensive range of commercial and consumer banking services.

Pros of Bank of China

- Hong Kong-China Network: The Bank of China boasts strong ties and networks between Hong Kong and Mainland China.

- Solid Reputation: Strong reputation and reliability as displayed by being 1st on The Asian Banker list of strong Asia Pacific banks.

- Developed Product Offerings: Wide range of financial products and services available to customers

Cons of Bank of China

- Language Barrier: Limited support in English available to customers

- Account Opening Process: This is a potentially complicated process of applying for an account. For instance, the process may involve visiting a physical branch and providing extensive documentation.

Bank of China HK Fees

| Service | Bank of China Fees |

| Account opening fee | Application fees for companies registered in different regions upon submission are as follows: Hong Kong: HKD 1,200 Mainland: HKD 3,200 Macau/Taiwan: HKD 6,200 Overseas: HKD 6,200 An extra fee of HKD 5,000 per application is applicable for companies with four or more layers in their structure. |

| Initial deposit fee | N/A |

| Monthly fee | Fee waived for savings and currency accounts with a combined average monthly balance below HKD 5,000. Business Integrated Account TRB at HKD 50,000 or above: Waived TRB Below HKD 50,000: HKD120 Business Integrated Account Plus TRB at HKD 200,000 or above: Waived TRB Below HKD 200,000: HKD 150 Business Integrated Account Elite TRB HKD 1,000,000 or above: Waived TRB HKD 500,000 to below HKD 1,000,000: HKD 100 TRB Below HKD 500,000: HKD 200 |

| Inactive account | We cannot find information regarding inactivity fees but if an account has no transaction record within a period of 12 months or more, the Bank will consider it as an inactive account and will make it dormant. |

| ATM cash withdraws overseas (per transaction) | HSBC/Plus/Cirrus ATM Network: HKD 20 UnionPay ATM Network: HKD 40 - 60 depending on the amount you withdraw (=< or > HKD5,000) |

| Type of Transfer | Fees |

| Receiving (inward) a Telegraphic Transfer | Remittance amount not more than HKD 500 or equivalent: Waived Remittance amount more than HKD 500 or equivalent: HKD 60 per item |

| Sending (outward) a Telegraphic Transfer | TT via branches: HKD 260 per item TT via electronic channels: HKD 120 Remittance to branches of BOC and Cooperative Banks in the mainland and designated branches outside Hong Kong: Via branches: HKD 260 Via electronic channels: HKD 115 |

| Including a message in payment details in Chinese characters | Via branches: Waived if the message is within 10 Chinese characters or 10 English words; HKD 100 per item if exceeded Via electronic channels: Waived |

| ATM cash withdrawal overseas (per transaction) | Cash withdrawal via ATMs of "JETCO" network in Mainland China/Macau: HKD 20 Cash withdrawal inside Hong Kong via ATMs of the “CUP” network: HKD 15 Cash withdrawal outside Hong Kong via ATMs of the “CUP” network: From RMB account: RMB 50 From HKD account: HKD 50 ATM cash withdrawal via "VISA / PLUS" and "MasterCard / Cirrus" network: HKD 25 |

| ATM cash withdraws overseas (per transaction) | HSBC/Plus/Cirrus ATM Network: HKD 20 UnionPay ATM Network: HKD 40 - 60 depending on the amount you withdraw (=< or > HKD5,000) |

Please refer to the BOCHK General Banking Service Charges and BOCHK Service Charge page for more details.

If you're looking to open a business account with the Bank of China in Hong Kong, refer to our step-by-step guide to opening a bank account.

5. Citibank Hong Kong

Citi or Citibank Hong Kong was the first foreign bank to offer services in Hong Kong in 1902, so they have a long history in the region. They also have a strong global brand, and one of the largest credit card issuers in the country, which is one of the reasons they were chosen for our list.

Citibank Hong Kong is ranked 43rd on The Asian Banker list for strong Asia Pacific banks. According to Citibank latest annual report, they have onboarded $1.2 trillion in new assets in 2022.

Citibank offers a full range of services for consumers and businesses, including fee-free account packages and private banking services. With a large presence in corporate banking in Hong Kong, they are often the chosen bank for expats and non-residents of Hong Kong.

They perform strongly in global private banking and wealth management awards, making their case to be placed among the top picks for best international banks. In 2023, Citibank was also named Hong Kong's best corporate bank by Asiamoney

🔍 Tip: Explore the key features and fees of Citibank business accounts in our detailed Citibank business account review.

Pros of Citibank Hong Kong

- Strong Global Presence: Citibank has a presence around the world and is well-recognized internationally

- Credit Giant: One of the largest credit card providers with a variety of available cards with rewards

- Ease of Access: Easy access to your account with Citibank's online and mobile banking services

Cons of Citibank Hong Kong

- Higher Fees: Considerably higher fees and interest rates compared to competitors

- Website Navigation Challenges: Some users may find Citibank Hong Kong's website challenging to navigate, potentially making it difficult to find specific information or access certain services.

Citibank Hong Kong Fees

| Service | Citibank Fees |

| Account opening fee | Local Company Account: HKD 2,000 Overseas Company Account (not registered in HK): HKD 8,000 |

| Initial deposit fee | No minimum deposit is specified |

| Inactive account fee | We cannot find information regarding inactivity fees but if an account has no transaction record within a period of 12 months or more, the Bank will consider it as an inactive account and will make it dormant. |

| Type of Transfer | Fees |

| Receiving (inward) a Telegraphic Transfer | Waived |

| Sending (outward) a Telegraphic Transfer | Citibanking: HKD 220 (physical branch) (HKD100 for transactions made online) CitiPriority: HKD 220 (physical branch) (Free for transactions made online) CitiGold: HKD 100 (physical branch) (Free for transactions made online) |

| Including a message in payment details in Chinese characters | N/A |

| ATM cash withdrawal overseas (per transaction) | For Global Wallet Transactions (AUD, CAD, CHF, EUR, GBP, JPY, NZD, RMB, SGD, THD, and USD): Flat fee waived For Non-Global Wallet Transactions (including foreign currencies not supported by Global Wallet): Flat fee waived but a conversion spread of up to 2.4% per HKD equivalent withdrawal applies. Note: a foreign exchange handling fee may add up. |

Please refer to the Citibank service fees page for more information.

We have a guide on How To Open A Citibank Account available if you're considering a Citibank business account.

6. Standard Chartered Hong Kong

Established in 2004, Standard Chartered Hong Kong is a licensed bank incorporated in Hong Kong and a subsidiary of Standard Chartered–a multinational bank operating in over 60 countries.

They are among the three commercial banks authorised by the Hong Kong Monetary Authority to issue Hong Kong dollar banknotes.

In 2023, they have approximately 5,500 to 5,800 employees in Hong Kong and have plans to hire 300 to 500 more as the city reopens its border with mainland China.

Their total assets are approximately HKD 2.4 trillion, as stated in their latest Standard Chartered Hong Kong financial report.

Standard Chartered Hong Kong offers a comprehensive array of services and is a leader in the digital banking world. They have lower fees for some services to accommodate all consumers. And they offer remote account openings, which is unusual in the region.

Standard Chartered Hong Kong is ranked 9th on The Asian Banker list of strong Asia Pacific banks. Most recently, Standard Chartered received top awards for its Digital Trading Platform and Customer Service/Customer Care at the Bloomberg Businessweek and Chinese Edition Financial Institution Awards 2023.

🔍 Tip: Learn about the features and fees of Standard Chartered Hong Kong in our Standard Chartered Hong Kong business account review.

Pros of Standard Chartered Hong Kong

- Global Presence: Standard Chartered is internationally recognised with a presence in multiple countries

- Market Insights and Support: Standard Chartered offers comprehensive investment insights and in-depth market information to businesses

- Relationship Manager: Customers holding a private and business account with Standard Chartered are provided with a Relationship Manager. They assist with financial needs and aid in selecting suitable investment solutions.

Cons of Standard Chartered Hong Kong

- Higher Fees: Relatively higher fees and interest rates compared to competitors

- Slower Development in New Technologies: Standard Chartered has been slower in investing in new technologies compared to competitors, resulting in weakening their competitive edge

Standard Chartered Fees

| Service | Standard Chartered Fees |

| Account opening fee (for business banking clients) | Local company: HKD 1,200 Overseas Company: HKD 10,000 Overseas company account set up for Corporate, Commercial, and Institutional banking clients: HKD 5,000 |

| Initial deposit | We cannot find information regarding the initial deposit |

| Inactive account fee | We cannot find information regarding inactive account fees. A Standard Chartered account becomes dormant automatically if there is no client-initiated transaction in the account for 12 consecutive months. |

| Transfer Type | Fees |

| Receiving (inward) a Telegraphic Transfer | HKD 55 |

| Sending (outward) a Telegraphic Transfer | International Trade Account Customers: HKD 140 Preferred Business Account Customers: HKD 160 Business Account Customers: HKD 200 Correspondent bank charges may be applicable |

| Additional fee for Non-Domicile Currency TT | International Trade Account Customers: HKD 70 Preferred Business Account Customers: HKD 80 Business Account Customers: HKD 100 Correspondent bank charges may be applicable |

| Including a message in payment details in Chinese characters | HKD 150 |

| ATM cash withdrawal overseas (per transaction) | HKD withdrawal: JETCO Network / Visa / PLUS / Mastercard®/ Cirrus Network: HKD 28 UnionPay Network: HKD 15 + 0.5% cross border Foreign Currency withdrawal: JETCO Network / UnionPay Network: No markup fee Visa / PLUS Network: 1.95% markup fee Mastercard® / Cirrus Network: 1% markup fee The transaction amount will be converted into HKD using the exchange rate provided by each card provider. |

Please refer to Standard Chartered Fees page for more information.

We also have a guide on how to open a business account with Standard Chartered. Learn how to apply here.

7. Bank of East Asia (BEA)

Bank of East Asia is the biggest independent Hong Kong bank and one of two family-run banks in Hong Kong.

According to the BEA’s latest financial reports, their total assets are approximately HKD 872 billion.

They provide various banking services. In their multi-currency accounts, the available currencies include the Australian Dollar, Canadian Dollar, Euro, Japanese Yen, New Zealand Dollar, British Pound, Renminbi, Swiss Franc, South African Rand, Thai Baht, Singapore Dollar, and US Dollar.

This service is similar to what you can find with a corporate bank account at a large global bank.

In 2023, Bank of East Asia received notable awards, including Outstanding Retail Banking from the Hong Kong Economic Journal Finance Services Awards of Excellence, Domestic Retail Bank of the Year in Hong Kong by Asian Banking and Finance Retail Banking Awards, and Outstanding Retail Bank of the Year from Bloomberg Businessweek Chinese Edition Financial Institutions Awards.

Pros of Bank of East Asia

- Hong Kong Reputation: Well-known reputation and long history in Hong Kong

- Development for Asia Market: Bank of East Asia has a reputation for industry-leading improvements for customers in Mainland China, with recognition for being the first foreign bank to provide RMB cards in mainland China

- Diverse Customer Base: Bank of East Asia is well known for its range of services that cater to a diverse customer base

Cons of Bank of East Asia

- Limited Global Presence: The Bank of East Asia is not so well-known internationally, which may make it difficult to access your account and seek support when outside of Asia.

- Limited Customer Reviews: Few public reviews make it challenging for potential customers to assess the bank's performance based on real user experiences.

Bank of East Asia Fees

| Service | BEA Fees |

| Account opening fee | HKD 10,000 for local and foreign companies Plus, a business registration search of HKD 200 Plus, Limited company search HKD 200, if applicable |

| Monthly fee | Waived or HKD 50 - HKD 200 depending on the type of account For "Corporate Plus" main corporate account: Fee waived with HKD 10,000 Average Daily Relationship Balance; otherwise, HKD 150 |

| Initial deposit fee | HKD 10,000 |

| Inactive account fee | Waived |

| Transfer Type | Fees |

| Receiving (inward) a Telegraphic Transfer | HKD 65 |

| Sending (outward) a Telegraphic Transfer | Branch: HKD 200 handling fee plus cable charge Cyberbanking/Corporate Cyberbanking: HKD 20 handling fee plus HKD 80 cable charge Cable charge: Telegraphic transfer to beneficiary’s account with BEA overseas branches: HKD 100 Telegraphic transfer to beneficiary’s account with other banks: HKD 130 |

| Including a message in payment details in Chinese characters | HKD 200 |

| ATM cash withdrawal overseas (per transaction) | Via a JETCO ATM in Mainland China or Macau: HKD 25 Via a BEA ATM in Mainland China: HKD 15 Via a UnionPay ATM: HKD 15 in Hong Kong and HKD 50 overseas |

Please refer to Bank of East Asia's Charges for more details.

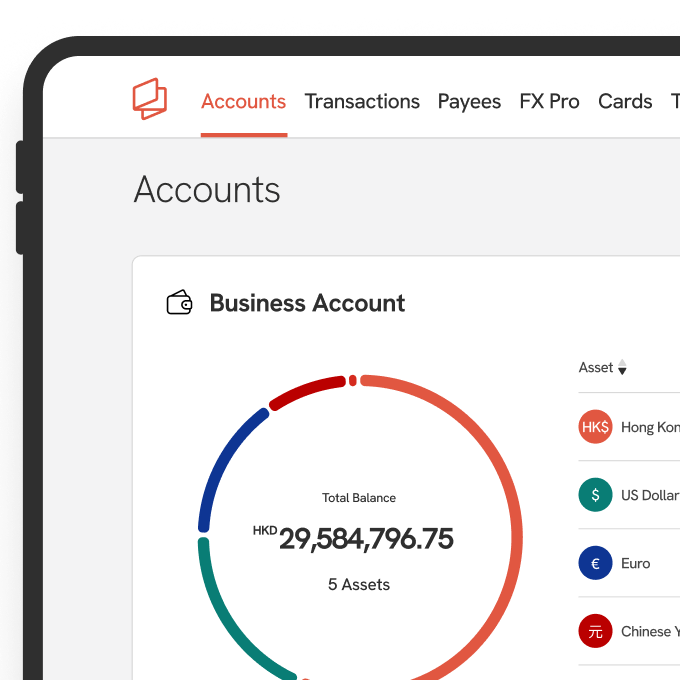

Alternative Business Account Solution: Statrys

All the banks listed are among the best choices in Hong Kong, but that depends on the needs of your business. Nowadays, there's a growing trend towards virtual banks that provide business accounts—usually with a package that includes more affordable fees and a simpler process.

At Statrys, we offer a multi-currency business account that allows you to make local and international payments at affordable rates with reliable customer support.

Here is the breakdown of our business account:

| Feature | Description |

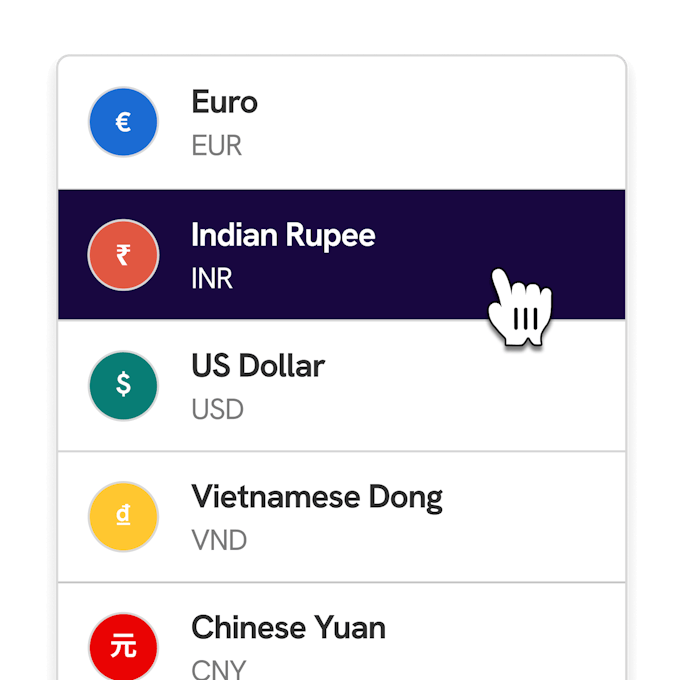

| Multi-currency business account | Hold, receive, and send money in 11 currencies: USD, HKD, CNY, AUD, EUR, GBP, SGF, JPY, CHF, NZD, and CAD. |

| Business account opening requirements | Must be incorporated in Hong Kong, Singapore, or the BVI. |

| Monthly fee | HKD 88 (with a dedicated account manager) |

| Initial deposit | HKD 0 |

| SWIFT payments & Tracking | Yes |

| Local payments | Send local payments in 14 currencies: HKD, AUD, EUR, GBP, IDR, INR, KRW, PHP, SGD, THB, TRY, USD, and VND |

| Payment cards | Physical and virtual cards |

| FX rate and fee | Competitive exchange rates with fees as low as 0.1% |

| Xero integration | Yes |

| Free Invoicing software | Create, manage, and send invoices efficiently |

| Company Registration Service | 100% online Hong Kong and Singapore company registration. |

| Customer Support Channels | Website, Live Chat, Email, Phone, WhatsApp, and WeChat |

| Trustpilot Score | 4.6/5, based on 256 Statrys reviews on Trustpilot |

FAQs

Which bank is the biggest in Hong Kong?

HSBC is the biggest bank in Hong Kong as well as one of the oldest banks in Asia.

How many types of banks are there in Hong Kong?

Can a non-resident open a bank account in Hong Kong?

Are there banking options for small businesses in Hong Kong?

Why is having a multi-currency account important in Hong Kong?

What are the typical fees and charges associated with Hong Kong bank accounts?

Which bank is best for expats in Hong Kong?

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C680%2C680&w=680&h=680)