All gain, no pain

Singapore Company Registration Services

Get your new company in less than 5 business days

Simple and

Transparent Pricing

One price covers everything you need.

No hidden costs, zero surprises.

Incorporation Services

- Incorporation Filing with the Accounting and Corporate Regulatory Authority (”ACRA”)

- Certificate of Incorporation

- Business Profile

- Company Chop

- Constitution of the Company

- Preparation of pre-incorporation documents

- Preparation of post-incorporation documents

- Provision of a Local Nominee Director (1 year)

Nominee Director

- A Singaporean Director appointed to fulfil regulatory requirements (1 year) Annual Renewal

Company Secretary Services

- Provision of Company Secretarial services (1 year)

- Annual Return Filing with ACRA for each calendar year

- To hold AGM 6 months after the end of each Financial Year End (”FYE”) and to file the Annual Return 1 month after holding the AGM

- Maintenance of the statutory records

- Preparation of Annual General Meeting (”AGM”) documents

- All of your statutory records and compliance documents all in one place, accessible online 24/7

Registered Address in Singapore

- Registered address (1 Year)

- Scanning and forwarding of mail

Everything included:

Your company up and running in 5 days!

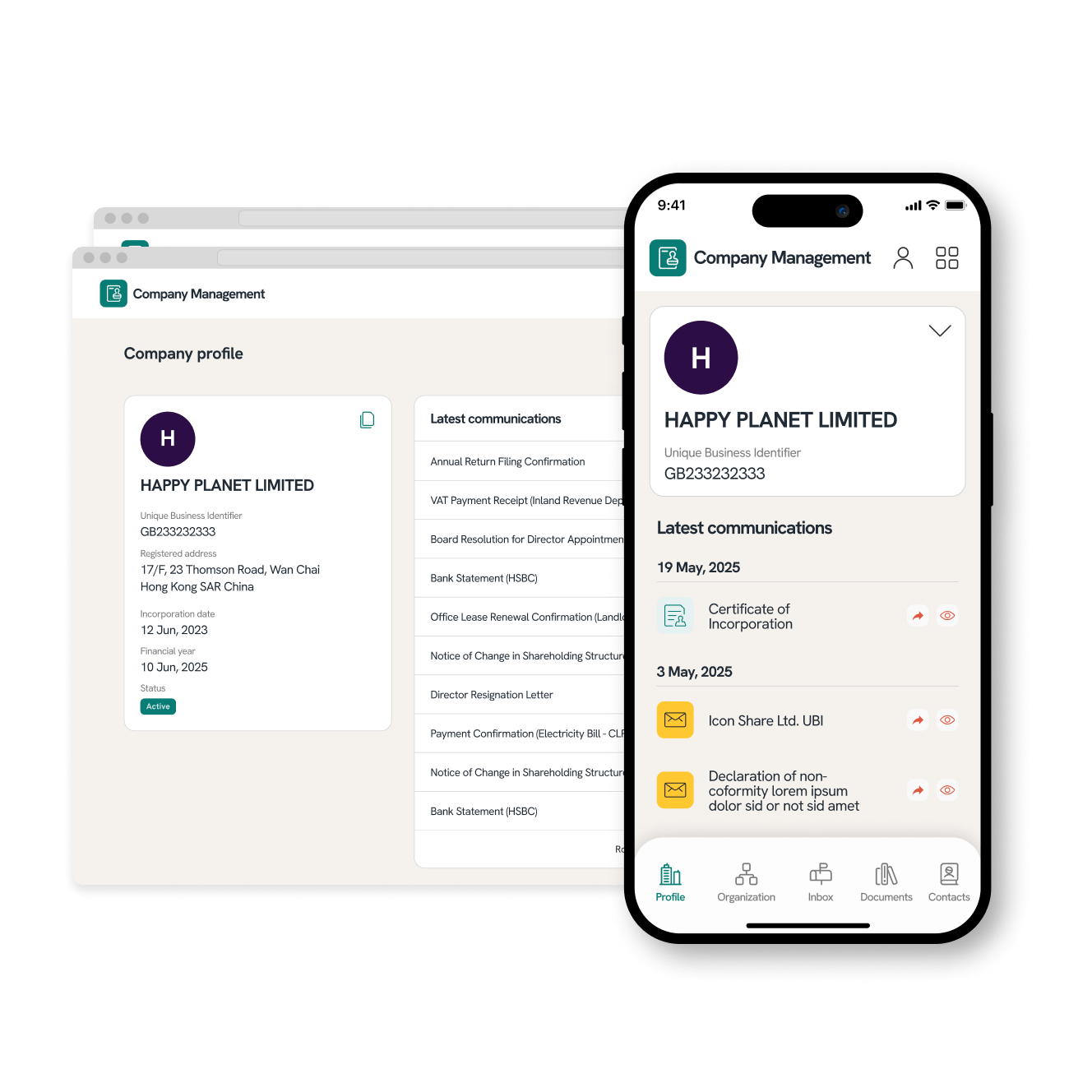

All Your Company Information in One Place

Keep all your company information within easy reach on your Statrys dashboard.

Enjoy convenient access anytime, anywhere:

Digital Document Storage

Safely store all corporate documents in one digital space.Complimentary Mail Scanning

Receive all your communications seamlessly with our free mail scanning service.

Smart Accounting Solutions

Our competitors rush you into purchasing an accounting package before your company sees any revenue.

Avoid this common pitfall and potentially high costs with our approach to smarter accounting:

Take Your Time

Operate your business for a few months to understand your needs.Get Tailored Quotes

Receive competitive quotes from accounting firms that match your actual activity level.

Zero Risk

We will refund our fees if you are not satisfied with our service within the first 30 days.

4 steps to start your business in Singapore

Apply with us online for your company registration

Quick 5-minute application - Just give us the details needed to meet Singapore's local company registration laws.

We prepare the necessary documents and send them to you for electronic signature.

Get started here

Submission of the application

We submit the application documents to the Accounting and Corporate Regulatory Authority (”ACRA”).

We actively monitor progress to ensure timely processing.

Your company is registered! 🎉

We gather all the official documents confirming the registration of your new Singapore company.

This includes the Certificate of Incorporation and the Business Profile from ACRA.

Save money on your accounting

Tell us your accounting needs, and we'll get price quotes from various Singapore accounting firms for you. Pick the one that best fits your budget.

Accounting and Tax

We help you save money with an accounting plan matching your needs:

Get expert accounting support

We have built a trusted network of accounting firms, rigorously vetted to ensure the highest quality of service for our clients.

Receive quotes from approved accountants

If you choose "Yes" to our accounting assistance, we will confidentially submit your request to the selected accounting firms and request quotations on an anonymous basis

Choose the best option for your needs

We will present you with the top three competitive quotes, allowing you to make an informed decision.

Why registering a Singapore company

Location

Singapore's strategic location in Southeast Asia, political stability, conducive business environment, and reliable legal framework make it an attractive choice for investors. Its competitive tax structure, financial hub status, skilled workforce, and global connectivity further enhance its appeal. This, along with a straightforward registration process, high quality of life, and innovation commitment, positions Singapore as a top destination for businesses in the Asia-Pacific.

Global mindset

Singapore, a premier international commerce hub, is an ideal corporate establishment location, offering political stability, a business-friendly ecosystem, and a robust legal framework. Its competitive tax structure, advanced financial infrastructure, and strategic market connectivity provide a resilient environment for global enterprises. A commitment to innovation, skilled workforce, and a reputation for excellence, make Singapore a preferred choice for businesses aiming for international expansion.

Low taxes

Singapore's corporate tax rate is a flat 17%. From the “Year of Assessment 2020”, new companies enjoy a 75% exemption on the first SGD100,000 of chargeable income for the first three years, under certain conditions. There's also a 50% exemption on the next SGD100,000, effectively lowering the tax rate to about 8.5% for this bracket. Income above SGD100,000 is taxed at the standard 17% rate.

Easy management

Incorporating a company in Singapore is streamlined and efficient, reflecting the country's business-friendly approach. The process involves minimal bureaucracy, with online registration, quick approvals, and clear guidelines from the Accounting Corporate Regulatory Authority (“ACRA”). This simplicity in management attracts both local and international businesses, further enhancing Singapore's status as an accessible and favorable business hub.

What Our Clients Say

Highly Professional Service

I used Statrys for my Company Incorporation in Hong Kong, as well as opening my Company Account. The service was very professional throughout and of absolute 5 star quality. I can't recommend it enough!

Frederik Schipper

HK

Very professional and high quality...

My experience with the company creation team, the first step in opening my business account, was fantastic. I talked with several people and all of them were polite and professional. Nestor went above and beyond from day one to the approval of the account, his in-depth understanding of Hong Kong made the proccess worry-free...

Lancelot Girard

TH

Fantastic service from Michelle in...

Fantastic service from Michelle in Singapore and Nestor for Hong Kong. Were able to get my new Singapore company set up with in 2 days. Highly responsive and quick for any questions I asked.

Robert King

SG

They are on time with promised schedules...

They are on time with promised schedules. Nestor is my account manager and super helpful during the process. Only thing is the physical card takes a while to arrive to me. Thanks again for the service.

EXPRESS STUDY SOLUTION LIMITED

TH

Boutique services from Statrys

We strongly suggest Statrys for the Company Incorporation Services. The easy process, outstanding customer assistance, and complete service offerings make them the ideal choice for company incorporation with peace of mind. Before we hired them, we read a lot of good reviews online, which made us feel confident in their honesty and we experienced the same during our company creation process.

Machinex Global Limited

UAE

Company Incorporation perfection

They helped me alot with getting my company up and running with HK. Perfect support and great help! Company Incorporation with them, haven't been easier.

Frederik Therkildsen

TH

The best way to incorporate in HK with a bank account

I have been very pleasantly surprised by the experience as a whole. Everyone I have communicated with has been polite, responded quickly and every issue solved in a short amount of time. The app and website work seamlessly. All around a great product that I have already recommended to friends.

Ken H.

TH

Featured on:

Frequently Asked Questions

Is there any difference between Singapore company formation, company registration, and company incorporation?

In the realm of establishing businesses in Singapore, terms like “company formation,” “company registration,” and “company incorporation” are often interchangeable, signifying the same procedural steps for creating a corporate entity. Regardless of the terminology used, these terms collectively refer to the legal processes and documentations required to formally set up a company in accordance with Singapore’s regulatory standards.

How does the company registration process work?

The company registration process for incorporating a Singapore Company is marked by its efficiency and transparency. Initial steps involve firstly, selecting an available company name, followed by the preparation of necessary documents like the company’s constitution, details of directors and shareholders and the registered office address. Once all the documents are signed, the company’s constitution is then submitted to the Accounting Corporate Regulatory and Authority (”ACRA”). Following a thorough review, successful applications receive an official business profile. The process is streamlined, offering online submission options, exemplifying Singapore’s dedication to providing a business-friendly and straightforward environment for company establishment.

What do you need to register a Singapore Company?

Company registration in Singapore can be very fast. Getting a business profile and certificate of incorporation from the Accounting Corporate Regulatory and Authority (”ACRA”) can be done within a few days and with very low bureaucracy if all is done well in advance. To set up your new Singapore company, and before registering with ACRA, you must prepare a few items, including some of the future company documents that will come in handy along the way.

A company name

Before starting a business registration process, every business entity must have a name. So first, select the company name you wish to register as your new Singapore Company. To save time during the incorporation process, it is always a good idea to have at least two backup names in case the one you want is already registered. You can check if your business name is available by doing a company name search on ACRA’s website.

Appoint a company secretary

In Singapore, a company secretary is an individual appointed by a company to ensure compliance with statutory and regulatory requirements. The role of a company secretary is essential for maintaining proper corporate governance and adherence to legal obligations. The Accounting Corporate Regulatory and Authority (”ACRA”) mandates that every Singapore company must appoint a qualified company secretary within six months from its date of incorporation. The company secretary is responsible for various administrative and compliance tasks, including maintaining statutory registers, filing annual returns, organizing board meetings, and ensuring that the company operates in accordance with its constitution and relevant laws. The company secretary is a crucial figure in helping the company and its directors understand and fulfill their obligations in a structured and compliant manner.

Choose the legal vehicle of your company

Before registering your company in Singapore, you need to decide on the structure of your business. Exempt Private Company Limited by Shares, Private Companies Limited by Shares, Public Company Limited by Guarantee, Public Company Limited by Shares, Limited Liability Partnership, and sole proprietorship (only Singaporeans can register, and the liability of the owner and the sole proprietorship are not separated), different partnerships, or other business structures. Limited liability companies, also known as private limited or Pte. Ltd. companies, are easier to manage and cover most business owners' needs. Company secretaries can be appointed six months after the date of incorporation.

A local Singapore registered office address

One of the requirements for Singapore companies is that every registered business must have a local company's registered office address. The Company Secretary usually provides this service. When you choose to have your company registered with Statrys, we include in our package a local registered office address that will be used during the process. This service has to be renewed every year.

IDs or passport copies of the company owners and directors

A Singapore company must have at least one local director and one shareholder. The local director must be either a Singaporean, a Permanent resident, or an Employment Pass Holder, while the shareholder can be you or anybody you appoint as an owner. In any case, prepare a copy of the passport of each one of the individual/corporate shareholders. A Singapore company cannot have a foreigner as a sole individual director, but as for shareholders, the shareholders can be individual or corporate shareholders, which is fine.

You will also need an identification document (such as passport copies for foreigners and NRIC for Singaporeans) and proof of residential address, which is fully translated into English and no more than three months from the date of application to incorporate the Company. Overseas residential address proof is fine but must be fully translated into English if it is in another language.

We will help you prepare all the documents necessary to register your business in Singapore. An application for a Singapore company is usually fast, with companies registered in only a few days.What is a Company Director?

Company directors are company officers responsible for running the company on behalf of its shareholders. They have a duty to act with good faith and in the best interests of the company's shareholders. The law requires directors to exercise their powers responsibly, honestly and in the best interests of the company. Where a director is not fulfilling this duty, they may be disqualified as a director. A company can appoint a director through an ordinary resolution or the decision of existing directors, who must inform the Company Registry within 14 days of the appointment being confirmed.

What is the Inland Revenue Authority of Singapore (”IRAS”)?

IRAS is the government body responsible for overseeing taxation matters. It plays a pivotal role in administering and enforcing tax policies, ensuring that individuals and businesses comply with tax regulations. IRAS manages various tax types, including corporate income tax, Goods and Services Tax (”GST”), and personal income tax.

The organization is committed to fostering a fair and efficient tax system, providing guidance to taxpayers and facilitating economic development through sound fiscal policies. Businesses and Individuals in Singapore interact with IRAS for filing tax returns, obtaining tax-related information and ensuring adherence to the country’s taxation framework.What is a Singapore business profile?

In Singapore, a business profile is a document provided by the Accounting and Corporate Regulatory Authority (”ACRA”), presenting a comprehensive summary of key information about a registered business entity in Singapore. This profile include vital details such as the company’s registration number, name, date of incorporation, principal/business activities, registered office address, number of shares held and the paid-up capital and information about its officers, including directors, shareholders and the company secretar(ies).

The business profile is a valuable resource for businesses and stakeholders, offering a convenient snapshot of essential company information. It serves various purposes, including due diligence, business transactions and ensuring compliance with regulatory requirements. Businesses can access their business profiles through ACRA’s online portal or authorized service providers.What is Statrys Corporate Services Singapore Pte. Ltd. Registered Filing Agent License Number?

Statrys Corporate Services Singapore Pte. Ltd.’s registered filing agent license number is FA20230475.

What are the next steps after your company’s first year of incorporation?

Following the first year of incorporation in Singapore, businesses prioritize key steps to ensure ongoing compliance and advancement. Activities include holding an annual general meeting (”AGM”) and submitting annual returns to the Accounting and Corporate Regulatory Authority (”ACRA”). It is also prudent to evaluate financial performance, update records, and strategize for the forthcoming fiscal year. This period presents an opportunity to refine business strategies, explore growth possibilities, and confirm the currency of licenses and permits. Regular engagement with a qualified company secretary, financial advisors, and legal professionals offers valuable support, aiding the company in adhering to regulatory obligations and establishing a robust foundation for future prosperity.

What is the annual fee for maintaining your company in good standing after the first year of incorporation?

Our annual maintenance fee is SGD3,000. This fee covers the same secretarial services provided in the first year, extending them for an additional one-year period.

What is a Singapore Certificate of Incorporation?

The certificate of incorporation is a document issued by the Accounting and Corporate Regulatory and Authority (”ACRA”).

This document certifies the incorporation of any Singapore company written in English language only.

The Certificate of Incorporation expresses the following:- Company Name

- Company Registration Number

- Date of Incorporation

- The vehicle type

Register Your Company in Singapore

One package, all included.

Everything you need to get your business started.