| Key Features ✅ Offers local currency accounts capable of holding up to 7 foreign currencies. ✅ Enables management of multi-currency payments from a single dashboard ✅ Streamlines the accounting process through Xero integration ✅ Facilitates convenient payments from clients worldwide via marketplace and payment gateway integration |

Key Features ✅ Provides a multi-currency account supporting over 40 currencies ✅ Offers both digital and physical multi-currency debit cards ✅ Allows for bulk payments to up to 1000 payees ✅ Features business API integration for automating payments |

| Best For Ecommerce sellers and any business with a global client base who can benefit from competitive FX rates. |

Best For Global businesses seeking a cost-efficient, flexible, and convenient way to send money internationally. |

| Trustpilot rating ⭐⭐⭐⭐ 4.4/5 Based on 9,792 reviews |

Trustpilot rating ⭐⭐⭐⭐ 4.3/5 Based on 213,034 reviews |

| Learn more about OFX | Learn more about Wise |

OFX Overview

OFX is an Australian fintech company that provides international money transfer services for personal and business customers. Founded in 1998 with headquarters in Sydney, the company has a strong global presence with offices in Auckland, Dublin, London, Toronto, San Francisco, Hong Kong, and Singapore.

OFX has served over 1 million customers worldwide and is listed on the Australian Stock Exchange. Its services include foreign currency accounts and currency risk management solutions.

- Eligible countries: Most countries in the world

- Eligible company type: Sole traders, partnerships, trusts, not-for-profits, private companies, and public companies

- Licenses: Australian Financial Services Licence (AFSL) and other related licenses in Singapore, Hong Kong, New Zealand, the EU, the UK, the US, and Canada

- Partner banks: Not specified

Wise Overview

Wise, formerly TransferWise, is a London-based international money transfer service provider founded in 2011. It offers cross-border money transfer services to over 10 million active individual and business customers, with offices in 11 locations worldwide.

Wise provides products to facilitate global money transfer needs, including virtual accounts that support transactions to over 70 countries in more than 40 currencies.

- Eligible countries: Most countries and regions

- Eligible company type: Any type of business, including sole traders, limited companies, and charities registered in the EEA, Switzerland, Canada, the US, the UK, Australia, and New Zealand

- Licenses: Wise is authorized as an Electronic Money Institution (EMI) in the UK and registered with the US Financial Crimes Enforcement Network (FinCEN). It also holds other financial service provider licenses in several locations, including Australia, the EEA (through Belgium), Brazil, Hong Kong, and India.

- Partner banks: Multiple banks in different regions, including Barclays, Citibank, Wells Fargo, and JP Morgan Chase.

📌 Have you used OFX or Wise? Share your review in our short survey and get rewarded USD 25 for your time!

Business Account Features

| Local Account Details | Up to 7 local currency accounts: AUS, CAD, EUR, GBP, HKD, USD, and SGD | 9+ Currencies, including GBP, EUR, USD, AUD, HKD, and SGD |

| Supported Currencies | 7 Currencies: AUS, CAD, EUR, GBP, HKD, USD, and SGD | Over 40 currencies, including GBP, EUR, AUD, NZD, HKD, and SGD. |

| International Payments (SWIFT) | ||

| Receive Payments From Online Marketplaces and Payment Gateways | (e.g., Amazon, eBay, Klarna, Laybuy, Shopify, and more) |

(e.g., Amazon, Etsy, Upwork, Stripe, Shopify, and more) |

| Accounting Software Integration | ||

| Multi-user Access | Allows adding up to 15 users with varying roles and permissions (upon request) | Enables team members to manage a business account with custom roles |

| Standout Pro | • Services are available for businesses registered in most locations worldwide • Receive payments conveniently from customers via payment gateway integrations • Flexible foreign exchange (FX) service options, including spot transfers and forward contracts |

• Payout automation API to streamline the payment process • Pay up to 1000 payees with the batch payment feature • Available in multiple countries and regions |

| Standout Cons | • Supports fewer currencies | • Business account features and fees vary by location |

OFX vs Wise Features Rating

OFX’s Features Rating is 4/5

OFX offers comprehensive foreign exchange options, along with convenient payment gateway and accounting software integrations. However, its business account supports payments in significantly fewer currencies than Wise. This limitation could restrict businesses looking to extend their operations across more countries worldwide, affecting their ability to compete in a global market.

Wise’s Features Rating is 4.5/5

The Wise account is an efficient option for companies operating internationally, with its capability to hold, receive, and send money in over 40 currencies. Features such as batch payments, large money transfers, and API integration cater to various business needs, making Wise a versatile choice for businesses looking to streamline their international financial transactions.

Business Account Fees

| Account Opening Fee | Free | Depends on your location US: Free UK: GBP 45 HK: Free |

| Getting Local Account Details | Free | USD 31 |

| Monthly Account Fees | Free | Free |

| Receiving Money | Free | Free for non-wire payments in AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, TRY, and USD USD 4.14 per transaction for receiving USD wire payments |

| Sending Money | Depends on a third-party intermediary or bank | From 0.43% (vary by currency) |

| FX Fee | Cannot find the information | From 0.43% (Varies by currency) |

| FX Rate | Based on the mid-market rate | Mid-market exchange rate |

⚠️ Important: Fees displayed in this table apply to services in the US. If you are applying from other locations, we recommend checking directly with OFX and Wise for the most accurate information.

OFX vs Wise Fees Rating

OFX’s Fees Rating is 4/5

OFX is a cost-effective choice for companies looking to minimize the costs of transferring money internationally, offering free business accounts with no account opening, monthly, or transfer fees. Although it claims to offer competitive exchange rates, it does not provide a transparent fee and pricing structure, which is a slight drawback.

Wise’s Fees Rating is 4.2/5

Although Wise charges some fees that OFX does not incur, it provides transparent information on account opening fees, monthly maintenance fees, and the cost of getting local account details. Overall, Wise is straightforward with its pricing and offers a competitive fee structure compared to traditional bank accounts, making it an attractive option for businesses in global markets.

Card Features and Fees

| Card Type | Not available | Physical and virtual debit cards |

| Card Base Currency | Not available | Multi-currency |

| Payment Limit | Not available | Varies by issuing country |

| ATM Withdrawal | Not available | Available in limited locations* |

| ATM Withdrawal Fee | Not available | First USD 100 within 2 (or less) transactions per month free; beyond that, a 2% fee plus USD 1.50 per withdrawal |

*Wise currently only issues cards for businesses in the UK, Switzerland, Australia, New Zealand, Singapore, Malaysia, Japan, Canada, Brazil, and most of the EEA.

OFX vs Wise Card Features and Fees Rating

OFX Has No Available Card

OFX does not offer card services, either physical or virtual debit cards. Because of this, it is not applicable to rate OFX on card features and fees.

Wise’s Card Features and Fees Rating is 4.3/5

Wise provides comprehensive card services with both physical and virtual debit cards, allowing for convenient global transactions. Features such as ATM accessibility and multi-currency support are valuable for eligible users. However, the restricted availability of these services by location is a slight drawback.

Customer Support

| Communication Channels | Email and Phone Call | Contact form, Phone, Email, and Personalised support for Wise account holders |

| Working Hours | 24/7 | Not specified |

OFX vs Wise Customer Support Rating

OFX’s Customer Support Rating is 4.6/5

OFX offers 24/7 customer support through email and phone calls, ensuring direct communication options are available for customers worldwide. With offices in 8 countries, customers can contact OFX customer service via local phone calls anytime, with free call options available in some regions. This support channel is accessible to potential customers as well.

Wise’s Customer Support Rating is 4.0/5

Wise offers a wide range of customer support channels for its customers, including contact forms, phone, and email. Although it provides more communication channels compared to OFX, the service hours are not specified on the Wise website, and you need to have an account with Wise in order to contact the support team.

Looking for an Alternative in Asia?

If you are looking for a multi-currency account to streamline your business operations in Asia or planning to set up your business in Singapore or Hong Kong, consider Statrys.

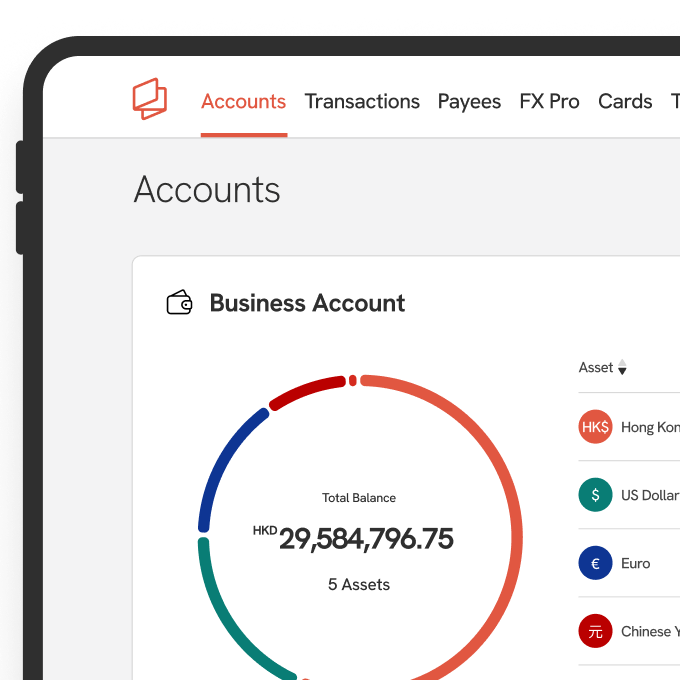

Launched in 2019, Statrys is a Hong Kong-based financial service provider that offers comprehensive products and services for global business growth. These include multi-currency business accounts and company incorporation services, supported by dedicated customer service from a multi-lingual team.

With a Statrys business account, you can send and receive money in 11 major currencies, including USD, HKD, CNY, AUD, EUR, GBP, SGD, JPY, CHF, NZD, and CAD, all under one account number. You can also benefit from real-time SWIFT payment tracking, free invoicing software, and integration with Xero.

| Key Services | Details |

| Multi-Currency Business Account | Hold, receive, and send money in 11 currencies: USD, HKD, CNY, AUD, EUR, GBP, SGD, JPY, CHF, NZD, and CAD. |

| Business Account Opening Requirements | Must be incorporated in Hong Kong, Singapore, or the BVI. |

| Monthly Fee | HKD 88 (with a dedicated account manager) |

| Customer Support Channels | Website, Live Chat, Email, Phone, WhatsApp, and WeChat |

| SWIFT Payments & Tracking | |

| Local Payments | Send local payments in 14 currencies: HKD, AUD, EUR, GBP, IDR, INR, KRW, PHP, SGD, THB, TRY, USD, and VND |

| Payment Cards | Physical and virtual cards |

| FX rate and Fee | Competitive exchange rates (interbank rates) with FX fees as low as 0.1% |

| Xero Integration | Yes |

| Free Invoicing Software | Create, manage, and send invoices efficiently |

| Company Registration Service | 100% online Hong Kong and Singapore company registration. |

| Trustpilot Score | 4.6/5, based on 261 reviews |

FAQs

What is the main difference between OFX and Wise business accounts?

Wise accounts can hold over 40 currencies, with an optional service for local account details in 9 currencies or more, depending on your location. On the other hand, you can open local currency accounts in 7 foreign currencies with OFX.

Is Wise or OFX cheaper?

Which is better for small businesses, OFX or Wise?

Disclaimer

Statrys competes directly with OFX and Wise in the payment industry. However, we're committed to providing an unbiased, thorough review to help you make an informed choice.