DBS Overview

Founded in 1968, DBS Bank (The Development Bank of Singapore Limited) is a leading financial services group in Asia, headquartered in Singapore. It started with a focus on industrial financing but has grown into a full-service bank offering a comprehensive range of products and services. These include retail banking, wealth management, SME banking, corporate banking, asset management, and more.

DBS Bank has been named the "World’s Best Digital Bank" for 5 years running. Listed on the Singapore Exchange, DBS is also noted for its robust financial health and excellent credit ratings, establishing it as a dependable banking partner in the market.

💡 Tip: Learn all you need to know about a DBS Hong Kong business account, including features, fees and customer service.

| Key Information | Description |

| Eligible Countries | Most countries |

| Eligible Company Types | Sole proprietors, limited companies, partnerships, clubs/societies/associations/owners' corporations. |

| Initial Deposit | Couldn’t find information on the website. |

| Account Opening Fee | • Hong Kong Company: HKD 1,200 application fee + HKD 150 search fee. • Overseas Company: HKD 10,000 application fee + HKD 2,000 search fee. • Special Company (with unique structures/requirements): HKD 10,000 application fee. The search fee is HKD 150 for local and HKD 2,000 for overseas. |

| How Long Does It Take to Complete the Application? | 15-20 minutes |

| Average Opening Time | As fast as 2 days for online account opening. |

| 100% Online Application | Only if your business meets the criteria for remote account application. |

| Key Things To Know | For remote account opening, your business must: • Be registered in Hong Kong as a limited company, partnership, or sole proprietorship. • Not include corporate entities as directors, shareholders, partners, or signatories. • Have 4 or fewer directors, shareholders, or partners, with at least one holding a valid Hong Kong ID card. |

| Best CCB Alternative | Statrys: A multi-currency business account supporting 11 currencies. The account opening process is completely online for any applicants, and the account can be active in as fast as 3 business days. |

Types of Accounts Available

DBS Hong Kong offers 3 types of business accounts, which are:

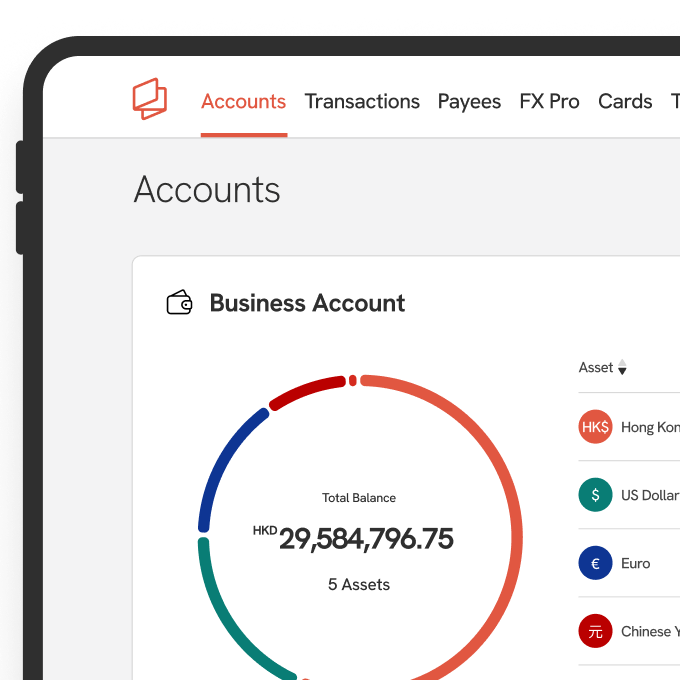

- DBS Business Account: A multi-currency account supports 14 currencies, including AUD, CAD, CNY, CHF, DKK, EUR, GBP, HKD, JPY, NOK, NZD, SEK, SGD, and USD.

- RMB Corporate Account: An account helps simplify RMB transactions outside mainland China, making it easier to do business with Chinese companies.

- Social Enterprise Account: An account that is designed to support social enterprises with lower-cost banking services.

You can refer to the DBS website for more information.

Eligibility

Next, we will outline the eligibility criteria to help you streamline your business account opening process. It is important to note that DBS may determine the eligibility of any Eligible Customer at their sole and absolute discretion.

Eligible Countries

According to DBS Hong Kong, they provide banking services to Hong Kong and overseas companies. However, we could not find a full list of eligible countries on their website.

💡 Tip: Discover the easiest way to set up your Hong Kong business.

Company Types Eligible

Sole proprietors, limited companies, partnerships, clubs/societies/associations/owners' corporations are eligible to open a business account with DBS Hong Kong.

What Documents Do I Need to Open a DBS Hong Kong Business Account?

DBS Hong Kong provides document guidelines to help businesses prepare necessary documents, including

- Account Opening Form

- A valid identity document for all Ultimate Beneficial Owners (UBO) and connected parties (i.e., directors and partners)

- Proof of residential address

- Certificate of Incorporation

- Memorandum and Articles of Association (M&A)

- Business licenses (if applicable)

- A valid Certificate of Incumbency

- A valid Business Registration Certificate (BRC)

- FATCA and CRS Documents

- Business financials (i.e., audited financial reports and annual returns).

- Ownership and control structure chart.

- Business proof (i.e., business plan, source of wealth and funds, and tax record).

All documents must be either original or certified true copies. The certified copy must be confirmed as a true copy of the original by a trusted and independent source or an authorized certifier. The list of eligible certifiers includes:

- Solicitors,

- Notary Publics,

- Certified Public,

- Professional Accountants,

- Auditors,

- Members of the Hong Kong Institution of Chartered Secretaries (HKICS),

- Financial institutions (licensed or regulated) in a member country of the FATF or a comparable jurisdiction acceptable to DBS.

How To Open a DBS Hong Kong Business Account Online

To open a DBS Hong Kong business account remotely, your business must meet the following criteria.

- Your business must be a limited company, partnership, or sole proprietorship incorporated and registered in Hong Kong.

- Your business must not include any corporate entities as directors, shareholders, partners, or authorised signatories.

- Your business must not have more than 4 directors, shareholders, or partners, and at least 1 of them must hold a valid Hong Kong ID card.

DBS Hong Kong also provides a specific document guideline to help businesses streamline the remote account opening process.

For Start-Ups (Established Within 1 Year)

- Business Plan and Professional Background: Start-ups need to provide a business plan and the LinkedIn profile or resume of the main owner or founder.

- Partnership Documents: If you have any contracts, quotes, or letters of intent with business partners, those should be included.

For Established Businesses (More Than 1 Year)

- Industry-Specific Documents: Depending on your industry, you'll need to submit relevant documents. These could include your company's website, social media pages, rental agreements, business licenses, invoices, and proof of deliveries from the government or utilities.

- Partnership Agreements: If your business is a partnership, you must provide a Partnership Agreement or Deed.

Additional Requirements

- Address Verification: If your main business address is different from your registered one, you'll need recent proof of address (last 3 months).

- For Non-Hong Kong Permanent ID Holders: Shareholders or partners without a Hong Kong permanent ID should submit their LinkedIn profile or resume and documents proving business activities, such as invoices, contracts, title deeds, or letters of intent.

- Financial Documents: You'll also need bank statements or tax returns from the past three months, audited financial reports, company management accounts, or a detailed business plan.

Once you have gathered all the necessary documentation, you're all set to apply for the business account.

Step 1: Start Your Account Application

Access your account application by clicking on the “Apply Now” button on the registration page.

Step 2: Fill in the Form

Provide your basic information, including full name, email address, and your position in the company.

Step 3: SMS Verification

Enter the 6-digit OTP you received from DBS.

Step 4: Provide Your Business Profile

Provide your business information, such as company name and company registration number.

Step 5: Provide Your Documents

Upload the necessary documents to complete the application process.

Step 6: Identity Verification

After you submit your application, DBS will send you an email within 2 working days, requesting you to perform identity verification. You will need to enter an OTP, scan your HKID card, and take a selfie to complete the verification process.

Upon successful verification, DBS will review your application and activate your business account within 2 business days.

How Long Does It Take to Open a DBS Hong Kong Business Account?

If you choose to open your business account remotely, DBS Hong Kong can complete the process within 2 working days after successful identity verification.

However, if you are required to visit a DBS branch to open an account, it may take several weeks or up to a month to activate your account after submitting your application.

How Much Does It Cost to Open a DBS Hong Kong Business Account?

| Application Fee | Fee |

| Hong Kong Company | Start from HKD 1,200 |

| Overseas Company | Start from HKD 10,000 |

| Special Company | Start from HKD 10,000 |

| Company Search Fee | Fee |

| Local Company | HKD 150 |

| Overseas Company | HKD 2,000 |

How to Contact DBS Hong Kong Customer Support

DBS Hong Kong offers various channels for customers to contact when issues arise, which include

- Call Business Care: +852 2290 8068

- Fill in the inquiry form

- Chatbot

- Visit any DBS branches.

The customer service team is available from 9 AM to 6 PM on weekdays and 9 AM to 1 PM on Saturdays, excluding public holidays.

FAQs

What is Hang Seng Bank?

Hang Seng Bank is one of the most popular banks in Hong Kong. Established in 1933, Hang Seng Bank has grown to serve over 3.9 million customers—more than half of the adult population—through a wide network of over 260 service outlets.

What kind of documents do I need to open a Hang Seng bank account?

What are the services provided by Hang Seng Bank?

Is Hang Seng owned by HSBC?

Disclaimer

Statrys competes directly with DBS Hong Kong in the payment industry. However, we're committed to providing an unbiased, thorough review to help you make an informed choice.