DBS Hong Kong Business Account Rating: 3.88/5

Features - 4.5/5

Fees - 3.5/5

Customer Support - 4/5

Ease of opening an account - 3.5/5

Our Rating Methodology

More info

Click "More info" to understand how we calculate our DBS Hong Kong Business Account ratings.

About DBS

DBS Bank Limited, also known as DBS, is a multinational financial institution headquartered in Singapore. Established in 1968, DBS has grown to become one of the leading banks in Asia, with 19 offices worldwide, including in Hong Kong. They offer various banking products to individuals and businesses, including retail banking, business banking, wealth and asset management.

In recognition of its global leadership, DBS has been awarded the title of "World's Best Bank" by Global Finance 5 years in a row.

DBS Hong Kong Pros and Cons

Why DBS HK may be a good option

- One of the renowned and established banks with an extensive global network.

- Multi-currency account in Hong Kong.

- A suite of business banking services, including loans, trade services, and insurance.

- Can track your transfers in real-time.

Why DBS HK may not be a good option

- If an in-person meeting is required, it can take up to several weeks or a month to open a business account.

- Numerous handling fees can significantly impact smaller businesses or those heavily making and receiving international transactions.

DBS Hong Kong Features

Without further ado, let’s dive into the essential business finance services offered by DBS Hong Kong.

Business Account

DBS Hong Kong offers 3 types of business accounts:

- DBS Business Account: A business account that can hold multiple currencies in one single account.

- RMB Corporate Account: A solution to manage business transactions with companies in Mainland China.

- Social Enterprise Account: An account that is designed to support social enterprises with lower-cost banking services.

Now, let’s take a closer look at each type of account.

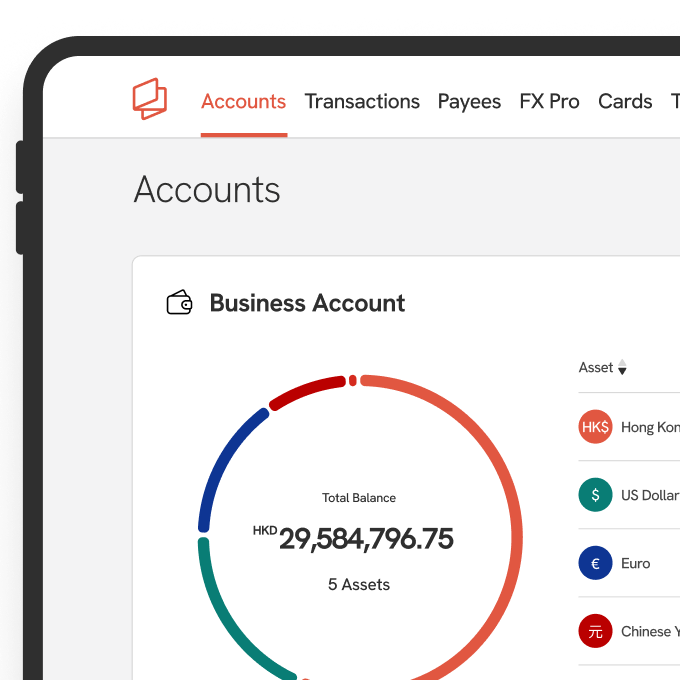

1. DBS Business Account

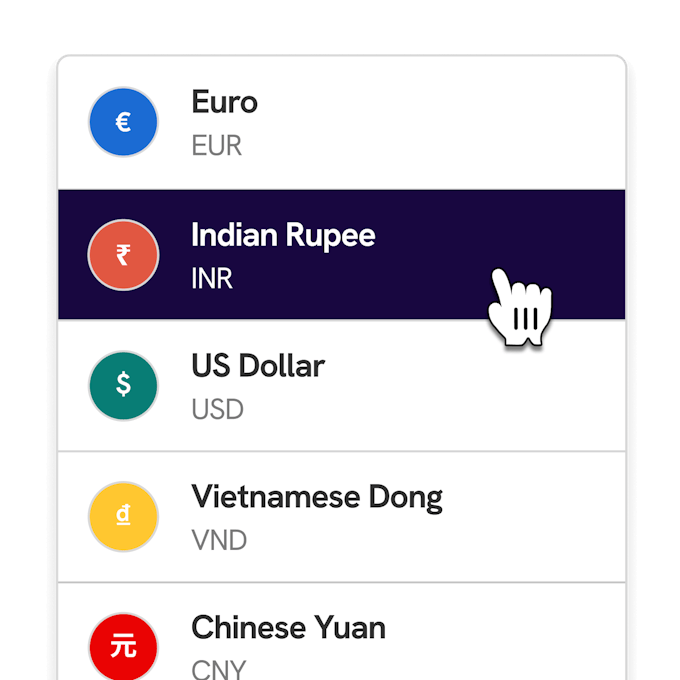

- The multi-currency account in Hong Kong supports 14 currencies, including AUD, CAD, CNY, CHF, DKK, EUR, GBP, HKD, JPY, NOK, NZD, SEK, SGD, and USD.

- Send instant local payments via the Faster Payment System (FPS) up to HKD/RMB 5 million per transaction.

- Make global payments via the SWIFT network in over 35 currencies.

- Can track the status of both outgoing and incoming telegraphic transfers in real-time with SWIFT gpi.

- International transactions between DBS accounts can be credited to the recipients' accounts within 10 minutes.

- Integrate with Xero, an accounting software, to enhance bookkeeping and accounting processes.

- Offer API integration to improve business operations and workflows.

2. RMB Corporate Account

- Enable faster RMB payments outside mainland China with no restrictions.

- Mitigate foreign exchange (FX) risks, especially when your company engages in both RMB inward and outward transactions.

- No daily cash withdrawal limit.

- Extended cut-off time (4:00 p.m.) for international and local payments in RMB.

3. Social Enterprise Account

- Exclusively for social enterprises listed in the Social Enterprise Business Centre.

- It offers the same features as the DBS Business Account with a better pricing package, including:

| Social Enterprise Fees | Fee |

| Business Account Set-up Fee | Waived |

| Business Account Monthly Service Fee | Waived |

| Business Account Annual Administration Fee | Waived |

| Online Banking Telegraphic Transfer Transaction Fee | Waived for the first 3 months. |

Foreign Exchange Services

DBS FX service has over 60 currency pairs available, including USD, EUR, GBP, AUD, NZD, SGD, HKD, CNH, JPY, CHF, and CAD. Clients can book transactions up to 1 year in advance, which means they can choose to trade at their preferred rate.

Other Services

Other business banking services offered by DBS Hong Kong include:

- DBS IDEAL: Online banking platform to access all DBS business banking services, available on desktop, tablet, and mobile devices.

- Corporate ATM Card: Link the card to your business account to withdraw, deposit, transfer, check balance, pay bills, or donate via JETCO and China UnionPay ATM networks across Hong Kong and abroad.

- Loan Services: Request loans online to fund and support your growing business.

- Trade Services: Offer products to facilitate import and export activities, making sure that your business operations run smoothly.

- Insurances: Offer different types of insurance, from liability to marine and cyber insurance, to mitigate and protect your businesses from unforeseen risks.

DBS Hong Kong’s Features Rating is 4.5/5

The overall rating of 4.5 out of 5 for DBS Hong Kong's business account services reflects their well-rounded and effective suite of banking solutions tailored to various business needs.

They stand out with specialised accounts, including multi-currency, RMB Corporate, and Social Enterprise options, which cater to specific financial requirements. The additional support services such as loan services, trade services, and insurance make them a one-stop banking solution for businesses operating internationally, especially engaging with Chinese companies.

DBS Hong Kong Fees

| All Business Integrated Accounts General Fees | |

| Account Opening Fee | • Local Company: Start from HKD 1,200 • Overseas Company: Start from HKD 10,000 • Special Company: Start from HKD 10,000 |

| Company Search Fee | • HKD 150 (for local company) • HKD 2,000 (for overseas company) |

| Monthly Fee | Waived if the average total deposit balance over the month reaches HKD 50,000 Otherwise, HKD 250 |

| Account Annual Administration Fee | • Overseas Company: HKD 5,000 • Special Company: HKD 5,000 |

| Account Closed Within 3 Months of Its Opening | HKD 200/USD 25 |

| Local Payments | |

| Via FPS system | |

| Receive | Non-merchant payment: Free Merchant payment: Refer to the bank charges schedule. |

| Send | First 50 transactions: Free Then: HKD 5 per transaction |

| Via RTGS system | |

| Receive | HKD 15 per transaction |

| Send | • HKD 55 per transaction (via online banking) • HKD 200 per transaction (via branch) |

| Correspondent Bank Charges | At cost |

| Via FPS system | |

| Receive | HKD 65 per transaction |

| Send | • HKD 115 per transaction (via online banking) • HKD 200 per transaction (via branch) |

| Cable Charges | HKD 100 per cable (waived if sent via online banking) |

| Corresponding Bank Charges | |

| RMB to Mainland China | At cost |

| RMB to overseas | HKD 250 per transaction |

| EUR/GBP | HKD 400 per transaction |

| JPY | 0.07% of the payment amount (HKD 250 - 1,000) |

| HKD/USD & other currencies | HKD 250 per transaction |

| ATM Card | |

| Annual Card Fee | Waived |

| Cash Withdrawal in Macau / China | HKD 25 per transaction |

| Visa Plus Service Cash Withdrawal | HKD 25 per transaction |

| China UnionPay Service Cash Withdrawal | HKD/RMB 15 per transaction |

DBS Hong Kong’s Fees Rating is 3.5/5

DBS Hong Kong's fee structure is rated 3.5/5 due to its complexity and potential costliness. The charges for local and international transactions can be unpredictable due to additional fees after initial free transactions and varied costs for SWIFT transfers.

Additionally, while ATM withdrawal fees are reasonable on a per-transaction basis, they could add up for businesses that require frequent cash access. This pricing model could pose a challenge for startups, smaller companies, and businesses that engage in frequent international money transfers.

DBS Hong Kong Customer Support

DBS offers multiple channels to contact its customer support team, which include

- Call BusinessCare: +852 2290 8068

- Fill in the inquiry form

- Chatbot

- Visit any DBS branches

Customer service is available from 9 AM to 6 PM on weekdays and 9 AM to 1 PM on Saturdays, excluding public holidays.

DBS Hong Kong’s Customer Support Rating is 4/5

While DBS's customer support offers in-person and phone call options for those favouring traditional methods, the absence of 24/7 support could be a significant drawback for businesses that operate across different time zones or require immediate help after standard hours. Considering these factors, DBS’s customer support earns a rating of 4 out of 5.

Requirements for Opening a DBS Hong Kong Business Account

DBS Hong Kong welcomes all types of business entities to open a business account. They provide an option for online account opening, subject to the fulfilment of the following conditions.

- Your business must be a limited company, partnership, or sole proprietorship incorporated and registered in Hong Kong.

- Your business must not include any corporate entities as directors, shareholders, partners, or authorised signatories.

- Your business must not have more than 4 directors, shareholders, or partners, and at least 1 of them must hold a valid Hong Kong ID card.

DBS notes that the online application can be completed in just 15 minutes, and your account can be opened in as fast as 2 working days.

If your business does not meet these requirements, you still have the opportunity to apply. You can fill out the application form either manually or online. Afterwards, you have to schedule an appointment with the DBS team to proceed.

💡 Plan to open a business in Hong Kong? Discover the easiest way to set up your Hong Kong business.

Required Documents

For a successful application, you need to prepare and submit the necessary documents, including:

- A valid identity document for all ultimate beneficial owners and connected parties (i.e., directors, partners, or natural person having executed authority)

- Proof of address

- Business activities proof (i.e., business agreements and invoices)

- Certificate of Incorporation

- Memorandum and Articles of Association (M&A)

- Business licenses (if applicable)

- Certificate of Incumbency

- Valid Business Registration Certificate (BRC)

- Ownership and control structure chart

- FATCA and CRS Documents

- Business financials (i.e., audited financial reports and annual returns).

For a comprehensive list of required documents, you can refer to the document guide.

The Ease of Opening an Account Rating for DBS Hong Kong is 3.5/5

We rate the ease of opening an account with DBS 3.5/5. This reflects the balance between the efficient, quick online application for businesses that meet specific criteria and the limited transparency regarding the timeframe for those proceeding via non-online channels, which could pose challenges for planning and operational setup for some businesses.

DBS Hong Kong Alternatives

| Multi-currency Business Account | |||

| Eligible Countries | Many countries, but we cannot find the list of eligible countries. | Hong Kong, Singapore, and the BVI. | Most countries |

| International Payments via SWIFT | |||

| Real-Time Payment Tracking | |||

| Account Monthly Fee | Waived if reached the required account balance. Otherwise, HKD 250. |

HKD 88 (with a dedicated account manager) | Couldn’t find information. |

| Required Minimum Account Balance | HKD 50,000 | ||

| Account Opening Time | 2 business days (for online applicants) Yet, we cannot find the expected timeframe for non-online applicants. |

3 business days | Can take up to 30 days |

| Cards | Applicable ATM card | Applicable physical and virtual cards | Applicable physical and virtual cards |

| ATM Withdrawal | |||

| Accounting Software Integration | |||

| FX Rates and Fees | Not specified FX rates and fees | Based on real-time mid-market rate + as low as 0.1% fee | Not specified FX rates and charges a fee of 1% or 3% (depending on the integration and conversion method) |

| Trustpilot Reviews | Doesn’t have reviews on Trustpilot | 4.6/5 based on 261 reviews | 2.3/5 based on 239 reviews |

| Customer Support Channel | Phone, Query form, Visiting branch, Chatbot | Website, Email, Phone, Live chat, WhatsApp, WeChat | Customer support portal, Hotline (only in the UK and Ireland), Query form |

FAQs

What is DBS Bank?

DBS Bank is a leading financial services group in Asia, known for its comprehensive range of banking and financial services to individuals, SMEs, and corporations.

What services does DBS Bank offer?

What are the key features of a DBS business account?

Can my business apply for a business account online with DBS Bank?

How long does it take to open a DBS business account?

Disclaimer