Key Takeaways

Invoice factoring is the selling of unpaid client invoices to a third party, transferring the responsibility of collecting payment from the business to the factoring company.

Businesses typically receive around 80-90% of the invoice amount upfront in exchange for a fee ranging from 1% to 5%.

Invoice factoring aids businesses in cash flow management without the necessity of a loan.

Most businesses follow a routine – a sale is made, an invoice is issued, and they wait for payment for 30, 60, or 90 days.

However, unexpected expenses like supply chain hiccups and urgent production needs can disrupt the planning, and waiting for invoice payments might not be enough.

After all, poor cash flow is the top cause of business failure among startup enterprises.

Loans are an option to access funds, but they aren't always the most suitable solution either. This is where invoice factoring can provide an alternative.

This article explains what invoice factoring is, how the process works, the main benefits and limitations, and factors to consider when selecting an invoice factoring partner.

What Is Invoice Factoring?

Invoice factoring is a form of business financing solution in which you sell some or all of your clients' unpaid invoices to a third party, commonly known as a “factoring company” or “the factor.”

In essence, when you sell these invoices – typically at a price lower than the total outstanding invoice amount or the full invoice amount after deducting the factoring company’s fees – the factoring company pays you an advance and takes over the responsibility of collecting payment directly from your customers.

This approach helps businesses access cash quickly instead of waiting for client payments, aiding in cash flow issues.

It's also known as accounts receivable factoring or debt factoring.

A global invoice factoring market is projected to be worth over $4618.9 billion by 2031.

🔎 Tip: Explore additional methods to improve cash flow in our article on practical tips for business cash flow management.

How Does Invoice Factoring Work?

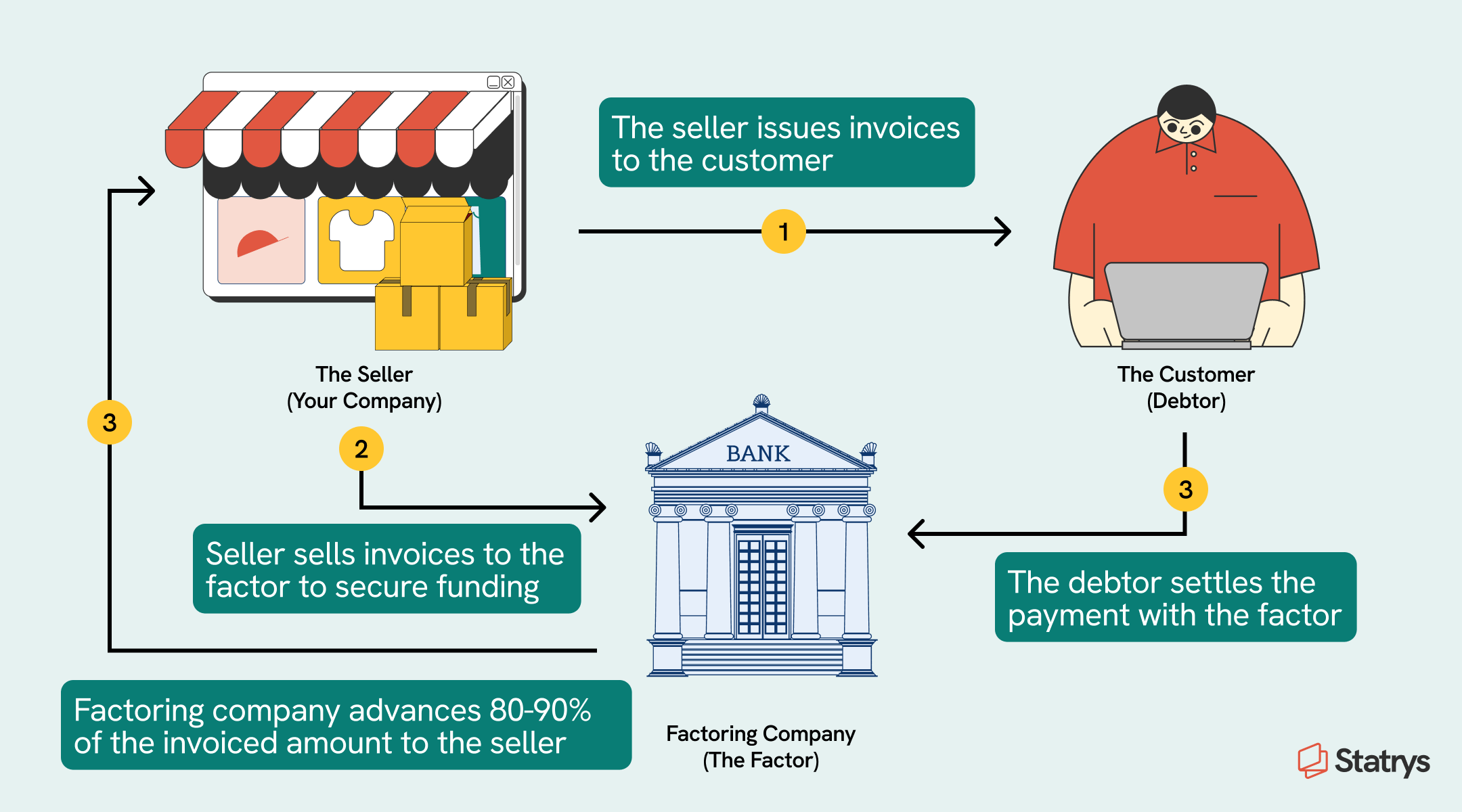

Invoice factoring involves the seller (your company), the debtor (your company's client), and the factor (The factoring company). The typical process involves the following steps.

Step 1: The seller forges a partnership with the factor - the seller finds and establishes a partnership with a factoring company.

Step 2: The seller issues invoices - After providing a service or delivering goods, the seller issues invoices to the customer (the debtor).

Step 3: The seller sells invoices to the factor - The seller sells the invoices to the factoring company to secure funding. Then, the factoring company advances 80%-90% of the invoiced amount to the seller's account.

Step 4: The factor does the collection - After the sale, the responsibility for collecting and chasing the invoice shifts to the factoring company.

Step 5: After the debtor settles the payment with the factor, the factor reimburses the seller - Once the customer pays the full invoice amount, the factoring company collects the funds, deducts a minor fee of around 1% - 5%, and sends the remaining 10%-20% to the seller.

If the factoring company encounters difficulty in collecting payment from customers, alternative arrangements are made to address the situation. For instance, businesses may be required to buy back the invoices or pay additional fees.

🔎 Insights: Not all invoices qualify for invoice factoring. Most factors won't buy overdue invoices, and many avoid those with payment terms exceeding 90 days.

Invoice Factoring Example

For a clearer picture, let's consider a hypothetical scenario.

Let’s say a small manufacturing business has secured a substantial order requiring upfront investment for the production. However, their pending account receivables have a 60-day payment term, which creates a cash flow constraint.

In this situation, they collaborate with an invoice factoring company, selling invoices totaling USD 60,000. They receive an immediate advance of 80% of the invoice amount, totaling USD 48,000 upfront. These funds allow for on-schedule production.

When the customer fulfills the 60-day payment terms, the factoring company collects USD 60,000 directly and deducts a small fee of 3% (USD 1,800) before transferring the remaining balance of USD 10,200 to the business.

In total, the business receives $58,200—less than the actual invoice amount, but this trade-off allows faster access to funds.

Invoice Factoring vs. Invoice Financing

Invoice factoring and invoice financing, though often confused, have key differences.

Invoice financing or accounts receivable financing involves borrowing money based on unpaid invoices, with the financing company providing the full invoice amount upfront. The business repays this loan within a set timeframe, along with possible interests.

This operates like a business loan, with the borrower responsible for repayment and collecting payments.

On the other hand, invoice factoring involves selling the invoice to a factoring company, with the business receiving 80%-90% of the invoice amount upfront. The factoring company takes over the responsibility for collecting invoice payments and focuses on the creditworthiness of the business's customers.

This table summarizes the key differences between the two:

| Invoice Financing | Invoice Factoring |

| Borrowing money based on unpaid invoices | Selling the invoice to a factoring company |

| 100% upfront financing of the invoice amount | 80%-90% upfront of the invoice amount |

| Business (borrower) repays the loan within a set timeframe, along with possible fees. | The factoring company sends the remaining 10%-20% amount to the business after deducting a minor fee. |

| The lender assesses the borrower's creditworthiness. | Invoice factoring relies on the creditworthiness of the business's customers. |

| The business retains responsibility for collecting payments. | Factoring company takes over the responsibility for collecting payment on the invoices. |

Despite distinctions, both methods accelerate cash flow for business growth. The choice hinges on control preferences and credit history:

If you have good credit and want control over your invoices, you may want to go for invoice financing. If you need quick cash without a loan and already have trustworthy customer relationships, opt for invoice factoring.

When to Use Invoice Factoring

The Ideal candidates for invoice factoring are often growing B2B businesses with reliable but slow-paying customers.

Invoice factoring makes the most sense when

- When cash flow is a significant constraint.

- When you have short-term expenses to cover.

- When you need to pay back a loan.

- When you want to make the most of seasonal business opportunities.

Common Service Types of Invoice Factoring

Invoice factoring provides various types of services to meet different business needs. The most common service types involve key considerations around risk allocation, flexibility, fees, and customer communication.

Let’s see the breakdown below.

Recourse vs. Non-Recourse

Recourse and non-recourse factoring concerns the liability for the invoice payment in case your customer defaults.

In recourse factoring, you bear the responsibility for the debt. You might need to repurchase the invoice from the factoring company or provide a replacement invoice of equal or greater value.

Non-recourse factoring, on the other hand, means the factoring company takes on the risk of your customer’s non-payment.

However, non-recourse factoring may have higher fees and stricter eligibility criteria. Moreover, it's important to review the terms and conditions of the non-recourse agreement, as some factors may only cover specific situations like bankruptcy and not disputes or fraud.

| Recourse Financing | Non-Recourse Factoring |

| You are responsible for the debt if your customer doesn't pay. You may need to repurchase the invoice or provide a replacement. |

The factoring company takes on the risk of non-payment. |

| Lower fees but higher risk. | Higher fees, stricter criteria, and limited coverage (e.g., only for bankruptcy). |

🔎 Insight: Non-recourse factoring, although available, is relatively rare, with recourse factoring being the more prevalent offer.

Spot Factoring vs. Whole Ledger

In essence, it’s about deciding which invoices to factor and how often.

With spot factoring, you can pick specific invoices to sell to the factor as needed.

In contrast, whole ledger factoring requires you to sell all your invoices to the factor regularly. While this usually offers more favorable fees, opting for this approach may mean paying fees for invoices that could have been excluded from the factoring process, incurring unnecessary costs.

| Spot Factoring | Whole Ledger Factoring |

| The company chooses specific invoices to sell as needed | The company sells the entire accounts receivables |

| Generally, higher fees | Lower fees but may incur costs for unneeded factoring |

Notification Factoring vs. Non-Notification Factoring

How the factoring arrangement is communicated to your customers matters, and there are types of service concerning this as well.

In notification factoring, the factoring company informs your customers of purchasing your invoices, potentially affecting relationships and image as some may perceive factoring as a sign of financial difficulty or distrust.

On the other hand, non-notification factoring collects invoice payments without revealing its involvement to your customers. However, it may come with higher fees and stricter requirements.

| Notification Factoring | Non-Notification Factoring |

| Factoring company informs your customers about the factoring arrangement. | The factoring company collects payments without disclosing its involvement to your customers. |

| Potential impact on customer relationships and business image. | Higher fees and stricter requirements. Less impact on customer relationships. |

Invoice Factoring Advantages and Disadvantages

While this financing option can support cash flow needs, it also carries certain drawbacks.

Below is an overview of the key pros and cons of invoice factoring to help you evaluate how well it fits with your business model.

| Invoice Factoring Advantages | Invoice Factoring Disadvantages |

| Swift funds. Hence, a better cash flow | Potentially comes with higher costs, especially if clients have a history of late payments |

| No collateral needed | High commitment, as many require a contractual minimum |

| Less impact on credit scores | No direct control, hence risk strain on customer relationships |

| Save time on invoice follow-up | It is not ideal for businesses with slim profit margins or in the B2C sector |

Invoice Factoring Advantages

1. Faster funds and a more predictable cash flow

Invoice factoring offers a speedier solution than waiting for customer payments (30, 60, or 90 days, not taking into account late payments) and the potentially lengthy processing of a bank loan, which may take weeks or months.

With invoice factoring, you can expect the funds within a few business days.

This quick access to funds brings more predictability to your business planning while allowing favorable payment terms with loyal customers.

2. No collateral needed

Unlike a traditional bank loan, invoice factoring doesn't ask you to use any assets or personal guarantees as security. Instead, the factoring company may assess your customer's payment history.

3. Limited impact on credit scores

Unlike traditional loans, which can harm credit ratings when unpaid, invoice factoring is the sale of accounts receivable and is based on the creditworthiness of clients rather than the borrowing business, making credit scores less relevant in this context.

Therefore, there is little to no concern about damaging your credit score.

4. Save time on invoice follow-up

Having the factoring company manage payment collections from your customers frees up your time and resources that would otherwise be dedicated to chasing overdue payments. This enables you to focus on your core business activities and boost sales.

Invoice Factoring Disadvantages

1. Potential increased costs due to late-paying clients

Invoice factoring could become costly, depending on the fees and how timely your customers pay. If your customers have a history of late payments or bad credit, the factoring company might charge you more or refuse to work with you.

Likewise, a late payment could lead to extra fees or interest from the factoring company. If your customer doesn't pay, you may even be responsible for repaying or buying back the invoices, potentially increasing your overall costs.

2. Lengthy commitment

Invoice factoring may involve a contract that requires you to factor in all your invoices or meet a minimum monthly invoice requirement, which can limit your flexibility and choices.

3. Loss of control, posing a risk to customer relationships

Handing over control of the invoice collection process may impact your connections with customers, especially with notification factoring.

If the factoring company acts unprofessionally or aggressively, it could harm your reputation and erode trust with your customers.

4. Not the best choice for those with smaller profit margins

Generally, invoice factoring is used for businesses that sell to other businesses (B2B).

With percentage-based fees, it poses a significant impact on profits when used with businesses that have smaller profit margins.

Additionally, most B2C involve collecting funds promptly, making them unsuitable for this context.

Businesses can often take up to 120 days to pay an invoice, and early access to funds through invoice factoring can alleviate temporary cash flow issues, one of the biggest risks to small businesses.

However, there are definite challenges that each business owner should determine for themselves if factoring is suitable.”

Q&A

What is the biggest risk in invoice factoring?

The biggest risk involved is if your customer fails to make payment. The most common method of factoring is recourse factoring, which places the liability for unpaid invoices on you.

What are the typical fees involved in invoice factoring?

What other factors should be taken into account?

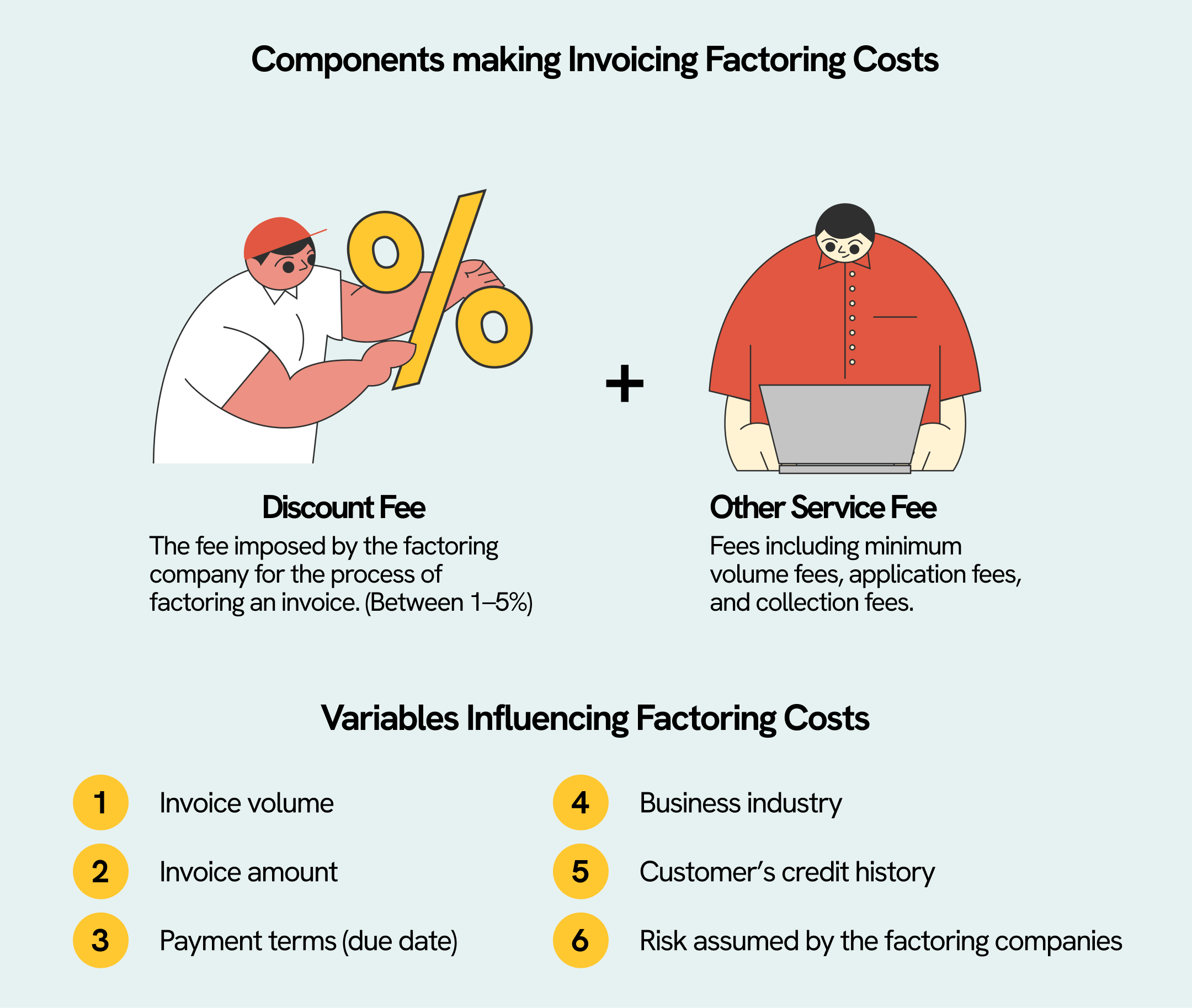

How Much Does Invoice Factoring Cost?

The primary cost of invoice factoring is the "discount rate," which signifies the sale of invoices at a reduced rate or the rate from which fees must be deducted.

This fee or rate typically ranges between 1% and 5% of the total invoice value.

However, the rate can vary based on factors such as the volume and dollar amount of the invoices, the due date, industry, customer credit history, and the risk assumed by the factoring company.

Higher invoice volume and amounts may lead to lower rates, but increased risk can elevate costs. The risk is influenced by customer payment history and the days remaining until payment is due.

Other possible expenses include minimum volume fees, application fees, collection fees, and risk assessment fees.

How to Choose the Right Invoice Factoring Partner?

For many business owners seeking increased cash flow, invoice factoring can be transformative, but only with the right factoring company.

This section details important criteria for evaluating suitable invoice factoring partners, including cost, service types, and whether to pursue invoice factoring with independent companies or banks.

Asses Costs

Invoice factoring’s primary purpose should be to enhance your liquidity without compromising your profitability. Therefore, the cost is a crucial criterion to consider.

Consider asking for a quote that includes the following information:

- Advance rate: This represents the portion of the invoice amount the factoring company provides upfront. It should range from 80% to 90%.

- Fee or discount rate: This is the percentage of the invoice amount charged by the factoring company as a fee. It can range between 1% and 5%.

- Minimum volume and fees for not meeting minimum volume: Check if there's a minimum volume of invoices required to be sold to the factor and the associated fee for falling below this set minimum.

- Terms for late or non-payment by customers: Find out the terms related to late or non-payment by customers. Some agreements may have extra fees for late payments, and there could be rules about repurchasing unpaid invoices.

- Any additional fees: Ensure whether extra services like credit checks, collections, and wire transfers incur separate fees.

Evaluate Services Types

Some of the common aspects that you should look for are whether you prefer recourse or non-recourse factoring, spot or whole ledger factoring, and notification or non-notification factoring.

Each invoice factoring company does things a little differently, too. The way they handle invoice processing, collection, accounting, or credit check support can vary. Understanding the full package of services you'd be getting allows you to properly compare your options before making a decision.

Factoring Companies vs. Factoring With Banks

Lastly, there are two primary types of factoring providers to consider: independent factoring companies and banks that provide factoring services.

Factoring companies are specialized firms focused on offering invoice factoring services to businesses.

They might have more expertise in factoring, lower eligibility criteria, and faster approval processes. However, they may have higher fees and less stability as they rely on external sources for funding invoices.

On the flip side, Banks' factoring services offer competitive fees and stability but come with higher eligibility criteria and slower approval processes.

Final Note

Invoice factoring can provide businesses with short-term cash flow.

The process involves selling unpaid invoices to a factoring company in exchange for immediate payment. In turn, businesses pay a fee of around 1%-5% to the factor.

This alternative to loans is particularly preferable for B2B companies with creditworthy clients.

However, it's important to weigh the advantages, like swift funds and no collateral requirements, against potential downsides, such as higher costs and potential impacts on customer relationships.

Choosing the best invoice factoring companies for your needs is crucial as well. Consider factoring fees, types of service, and the nature of the provider, whether it's an independent company or a bank.

FAQs

What is invoice factoring?

Invoice factoring is a form of business funding where you sell your outstanding invoices to a third party at a reduced rate in return for receiving an upfront payment.

Is invoice factoring risky?

What are the types of invoice factoring?

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C680%2C680&w=680&h=680)