Which is Better for Business: Hong Kong or Singapore?

Between Hong Kong and Singapore, here are the key findings derived from this study together with some of the major factors affecting these decisions.

65.3% of businesses preferred Hong Kong over Singapore in 2024 compared to 56.6% in 2021.

Hong Kong's low tax rate starting at 8.25% continues to be the main factor in bringing in businesses compared to Singapore's 17% flat tax rate.

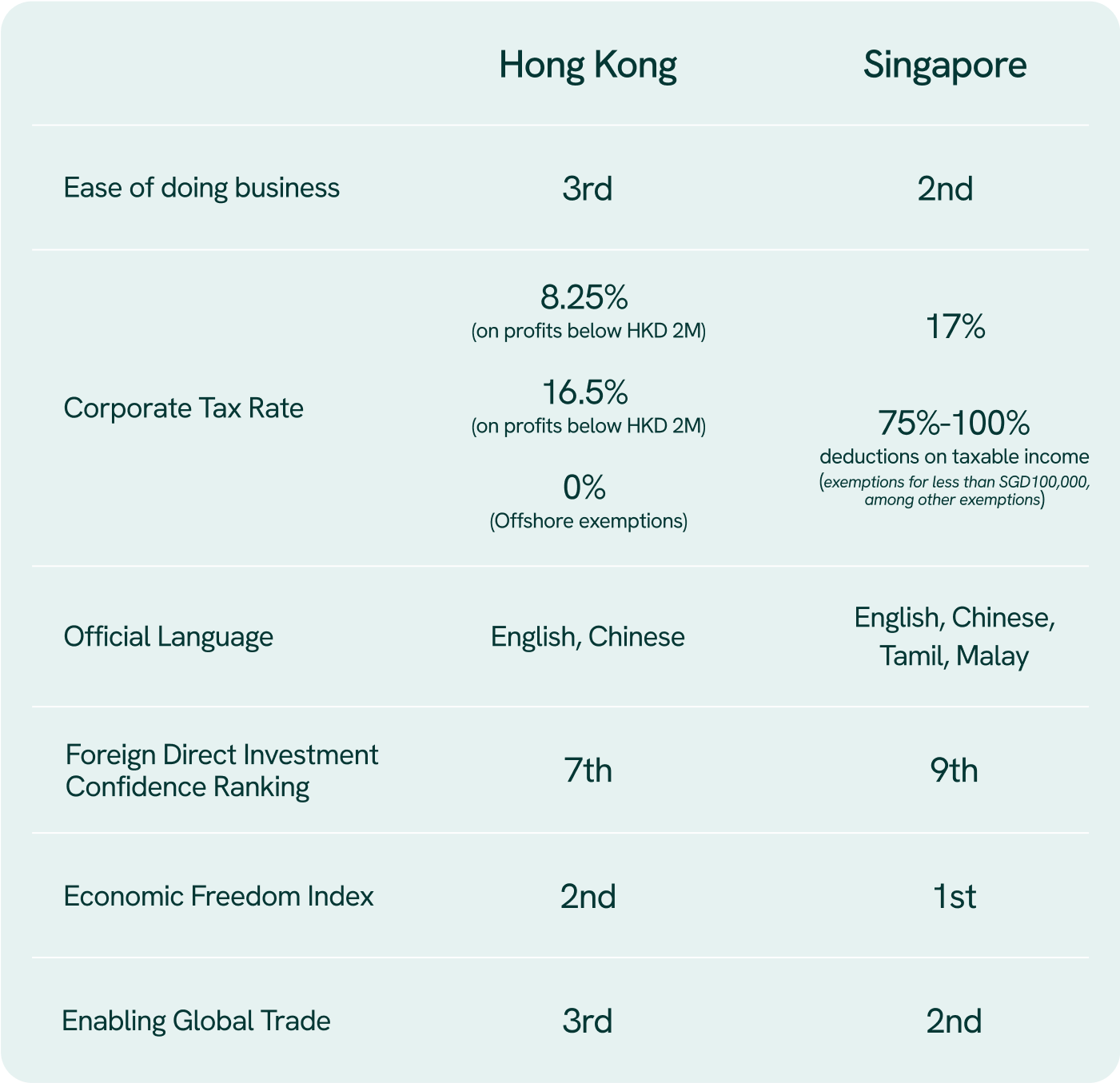

Singapore ranks higher in Ease of Doing Business, Enablement of Global Trade, and Economic Freedom in comparison to Hong Kong.

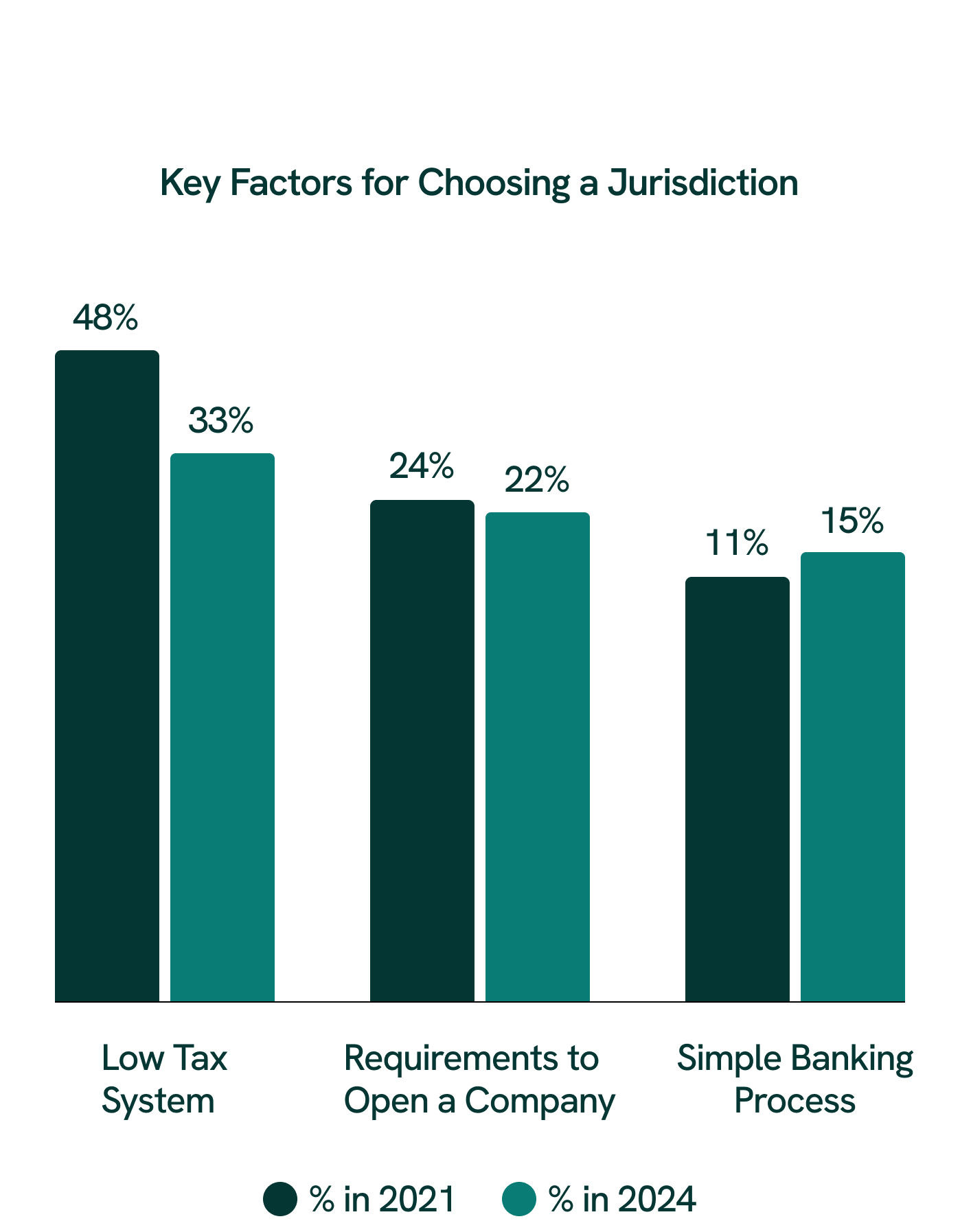

Top Factors Affecting Jurisdiction Preference

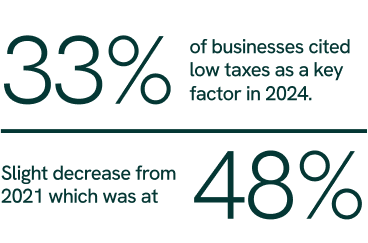

Low Tax System: The priority given to low tax systems as a key factor for choosing a jurisdiction declined significantly, dropping to 33% in 2024 from 48% in 2021.

Requirements to Open a Company: The requirements for company incorporation decreased slightly, to 22% in 2024 from 24% in 2021.

Simple Banking Process: The preference for a straightforward banking process increased, rising to 15% in 2024 from 11% in 2021.

Singapore vs Hong Kong: A Global Business Hub Rivalry

It is no surprise that the rivalry between Hong Kong and Singapore as leading global and Asian business hubs continues. Both Hong Kong and Singapore’s governments are consistently enhancing their business-friendliness.

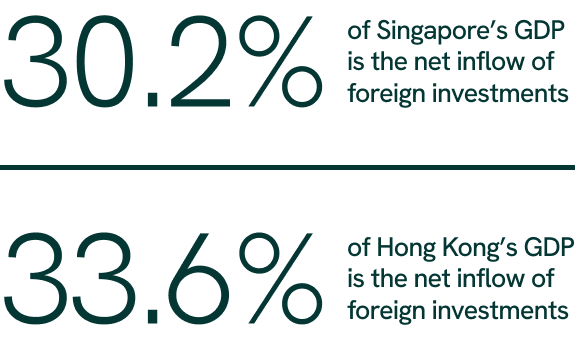

Today, Singapore’s GDP is 467 billion USD, while Hong Kong’s GDP is 360 billion USD. The net inflow of foreign investment in Singapore is 30.2% of the GDP, while in Hong Kong it is 33.6%. Regarding economic metrics, comparing Singapore and Hong Kong looks like comparing apples to apples – they are mostly on equal footing.

Strategic Positioning: Business Location Matters

Though both are strategic locations for accessing Eastern markets, Singapore’s may be broader to include South Asia and Southeast Asia. Still, Singapore maintains ties to East Asia, such as by using the same time zone as businesses do in Hong Kong and making Mandarin an official language. Meanwhile, Hong Kong is more suited for accessing North APAC (Japan, Korea, Taiwan), especially China, due to its geopolitical ties as a Special Administrative Region (SAR) of China.

Geography and geopolitics can give your business a real advantage over time. Factors such as the alignment of time zones facilitating seamless interactions with potential partners or clients or geopolitical cooperation such as tax reliefs and so on all bear tangible implications both directly and indirectly for your business.

Top 3 Factors For Choosing A Location For Business

We asked businesses in our survey to tell us their top reasons for preferring to do business in Hong Kong over Singapore or vice versa. We found that Low Tax, Requirements to Incorporate, and Simple Bank Opening processes were the top three answers.

Low Tax System

A slight decrease in prioritising tax systems, but it remains a key reason at 33% in 2024 – down from 48% in 2021.

Singapore’s corporate tax is a flat 17% on taxable income. Some tax reliefs and exemptions are offered, especially for foreign companies, potentially lowering this rate greatly. There’s also a Goods and Services Tax, known as Value Added Tax in other jurisdictions, which impacts doing business in Singapore, especially if you are in international trade.

Hong Kong’s corporate tax is 8.25% for the first HKD 2 million of taxable income, then 16.5% on the remaining. However, the corporate tax can be 0% if your business qualifies for Hong Kong’s offshore tax exemption scheme, which may make Hong Kong more favourable than Singapore in terms of its tax regime for foreign companies that will not operate in Hong Kong. Note that this will likely be affected by the upcoming global minimum tax rate, which will be set at 15%. This rate only applies to large multinational corporations (revenue exceeding EUR 750 million), which might not apply to your business.

Requirements to Incorporate a Company

A slight decrease in prioritisation, too for the requirements of company creation. In 2024, 22% of businesses say this is a key factor, slightly down from 24% in 2021.

The basic requirements to incorporate a company in Hong Kong include deciding on a name, company structure, identification documents, and defining the intended business activities. The requirements in Singapore vs Hong Kong are virtually the same, except for a few minor differences that will only apply in rarer cases.

For example, while Hong Kong and Singapore both require a local director, Singapore requires that it be a resident or citizen, while Hong Kong does not require this. However, a local secretary who is a resident is required in both jurisdictions.

The financial cost to incorporate in Singapore is typically around 3,500 SGD (equivalent to EUR 2200 or 2390). The financial cost to incorporate in Hong Kong is normally 9,000 HKD (equivalent to EUR 1000 or USD 1090). With a company creation service, these costs can usually be lowered substantially.

Note that the documents authorities accept vary depending on your specific circumstances. Always check the relevant official resources. If you are just getting started, you can look through our guide to easy company creation in Hong Kong or our guide to company creation in Singapore.

Alternatively, you may choose to use a company creation service. Hong Kong’s company creation services rival Singapore’s company creation services – it is a diverse and competitive market, so it is recommended to carefully research which service is best for you.

Simple Bank Opening Process

A slight increase from 2021 when it was at 11%, now 15% of businesses say a simplified bank account opening process was one of their top reasons for preferring Hong Kong over Singapore. Traditionally, opening a business bank account in Hong Kong is a complicated process that could take several weeks. Interestingly, opening a business bank account in Singapore might only take a few days.

This shift underscores the evolving expectations of enterprises seeking efficiency and convenience in their financial operations. Particularly in Hong Kong, virtual banks are gaining popularity for their efficient and convenient online services. Similarly, in Singapore, virtual banks are also on the rise, thus making both jurisdictions competitive for these kinds of financial services.

Best for Foreign Investors

In 2024, Hong Kong takes the lead. Over 65.2% of businesses said they preferred Hong Kong over Singapore for foreign investing. This is interesting because, in 2021, Hong Kong had a narrower lead at 58.6%.

Hong Kong and Singapore Are Both Financial Hubs

Both jurisdictions have similar proportions of their GDP coming from the inflow of foreign investment. They are both considered international finance hubs. Despite comprising less than 2% of the global population, these jurisdictions are home to some of the world's top multinational banks across various metrics, a key infrastructure in foreign investment. Multi-currency account offerings, a staple in international investment, are also plentiful here.

Credit Ratings

Interestingly, Moody’s, a top credit rating service, rated Hong Kong’s outlook as negative for the third time in the past decade, though it still has an Aa3 credit rating. Aa3 is the third runner-up position, with Aaa being the highest rating.

In contrast, Singapore’s outlook has remained stable in its entire history and its credit rating has always been Aaa, the highest rating, or simply not rated at all.

Investment Confidence

It is likely other factors, such as the simplicity of foreign investment and a desire to prioritise China directly, explain the preference of Hong Kong for these businesses. China, including Hong Kong, moved up to 1st in Kearney’s Foreign Direct Investment Confidence Index for emerging markets and 7th overall in the world. Singapore ranks 9th overall and is not considered an emerging market.

Overall Business Climate Comparison: Singapore vs Hong Kong

Singapore and Hong Kong both stand as appealing locations for business operations.

Across various recent authoritative reports, Singapore and Hong Kong continue to compete for the top spot to do business.

Fraser Institute’s Economic Freedom Report

According to the Fraser Institute's report on economic freedom, in 2021, Singapore and Hong Kong were 2nd and 1st, respectively. However, in 2023, Hong Kong's ranking declined to second, while Singapore rose to the top rank.

Global Enabling Trade Index

Singapore's prominence is underscored by its first-place ranking in the Global Enabling Trade Index, as detailed in the World Economic Forum's report. This index seeks to rank countries for how much they enable cross-border trade. Hong Kong maintains a strong standing, securing the third position in the same index.

Ease of Doing Business

The World Bank ranks Singapore second and Hong Kong third in terms of ease of doing business. Though this ranking has been discontinued after receiving criticism, the mere fact that Singapore and Hong Kong were in consideration for the top positions still speaks to their business favourability.

What’s Next For Businesses in Hong Kong and Singapore?

Hong Kong and Singapore both offer compelling advantages as business hubs. But they also present unique hurdles that enterprises must adeptly manage to thrive. Here’s a summary of what to expect in the medium term in these jurisdictions.

Despite all this, businesses we surveyed still believe Hong Kong is a viable option when asked to compare Singapore vs Hong Kong.

We asked them where they would do business in the next 12 months. Around 62% said they would do business from Hong Kong only. Around 30% said they would operate from both Hong Kong and Singapore. And less than 1% said they would operate from Singapore only.

Here is a review of all the responses from the businesses we surveyed.

Conclusion

While low taxes, ease of company incorporation, and banking processes are critical, businesses must also weigh factors like the talent pool, innovation ecosystems, and the quality of life for expatriates.

Businesses in Hong Kong and Singapore must remain agile, adapting to global economic shifts, technological advancements, and changing consumer preferences. The ongoing US-China trade tensions, global supply chain disruptions, and the push towards digitalisation and sustainability are just some of the factors that will continue to influence business strategies in these jurisdictions.