In today's dynamic financial environment, virtual banks have emerged as game-changers, redefining how banking services are delivered and experienced.

As the founder of Statrys, a fintech in Hong Kong providing multi-currency business accounts for businesses, I’ve witnessed firsthand the transformative impact of digital innovation on financial services.

In this article, we'll explore the top 8 virtual banks in Hong Kong, analysing their features, benefits, and unique propositions. This comprehensive comparison aims to provide you with the insights needed to make an informed choice.

Without further ado, let's get started!

What Is a Virtual Bank?

Unlike traditional banks, a virtual bank is a financial institution that conducts all its operations and offers all its services online, from account opening to daily transactions and customer support, providing a seamless and efficient digital banking experience.

Virtual banks operate and offer banking services through digital platforms such as websites or mobile apps without having physical branches.

Despite the absence of physical locations or in-person services, virtual banks have safe and secure measures to safeguard their virtual bank accounts, such as encryption and multi-factor authentication. Registered virtual banks are typically protected under the local government’s deposit insurance or protection scheme.

As fintech eliminates the need and cost of renting a banking hall or expanding physical branches to reach broader markets, virtual banks can provide almost all the primary services available at any conventional bank but with fewer or lower fees. Moreover, customers can save time by skipping queues.

You may have heard some other common terms that have similar concepts thrown around. Virtual banks are also referred to as neobanks, online banks, digital banks, or branchless banks.

Insight: Check out our article to discover the meaning, functionality, and advantages of a virtual bank account.

Traditional Online Banking vs. Virtual Banking

The main difference between traditional online banking and virtual banking is the physical presence of branches. Online banking refers to traditional banks extending their services to digital platforms in addition to their physical branches, while virtual banking operates exclusively online without physical locations.

Almost all traditional banks have features for online banking. This is because online banking creates many advantages for both the bank and its customers.

Firstly, it saves customers the stress of visiting the bank to conduct many different financial transactions. Financial tasks that once could take an hour or two out of one's day now only take a few clicks on a computer's enter button or a few taps on mobile phones.

Secondly, banking online makes managing your finances more private. This means you don’t have to worry about walking across town with large sums of cash for transactions.

From the bank's perspective, allowing customers to bank online saves business time and money. By eliminating trivial financial tasks from everyday responsibilities, staff can focus on more strategic tasks that keep an institution competitive.

How Did Virtual Banking Start in Hong Kong?

Virtual banking started as an innovative solution to some of the pitfalls and restrictive processes offered by traditional banks.

Here are some facts about the evolution of virtual banking in Hong Kong:

- The first virtual banking license in Hong Kong was issued in 2018

- Virtual banks are under the regulation of the Hong Kong Monetary Authority (HKMA).

- Licensed virtual banks in Hong Kong are members of the Deposit Protection Scheme (DPS). The Scheme generally protects each depositor's combined deposits with a member bank up to a limit of HKD 500,000.

- According to the regulation, the banks are meant to be primarily concerned with retail banking.

- They are obligated to accept all interested clients without setting any minimum account balance.

- They are also required to have a physical head office in Hong Kong even if they don’t have branches.

While virtual banks only came about in 2018, digital payment solutions have existed concurrently in Hong Kong and provide similar services. Digital payment solutions are a different alternative to traditional banks and virtual banks.

In 2023, a survey commissioned by the Hong Kong Association of Banks found that 70% of individuals and over 90% of SMEs viewed virtual banks as convenient and beneficial. For individuals, 63% used them for deposits or savings and 49% for credit or debit cards. Among SMEs, 38% used them for deposits or savings, 28% for investments, and 28% for money transfers.

Choosing the Right Virtual Bank in Hong Kong

There are 4 key considerations you should keep in mind when choosing a virtual bank in Hong Kong:

- Intuitive App & Website: Since virtual banks operate entirely online, a user-friendly mobile app and website are crucial. A seamless interface allows for easy account management, smooth transactions, and a frustration-free banking experience.

- Reliable Customer Support: The lack of physical branches makes responsive customer support extremely important. Look for virtual banks that provide different ways to get help, like phone, chat, or email.

- Features Tailored to You: Virtual banks have different offerings than traditional banks. Some may focus solely on personal accounts, while others cater only to businesses. Identify your banking needs and choose a provider that offers all the features that matter most to you.

- Fee Structure: While virtual banks often have lower fees than traditional counterparts, it's still important to compare. Look for affordable transaction fees and compare foreign exchange rates if you anticipate handling multiple currencies.

Insight: Each virtual bank has different requirements to open a business account. To learn more about this topic, we recommend reading our guide on opening a business bank account in Hong Kong.

What Virtual Banks Are Available in Hong Kong?

There are 8 virtual banks licensed in Hong Kong. These are:

- ZA Bank

- Airstar Bank

- WeLab Bank

- Livi Bank

- Mox Bank

- Ant Bank

- PingAn OneConnect Bank

- Fusion Bank

Many virtual banks only offer services targeted to individuals or for personal banking purposes.

In addition, there is a high chance of limited personalized support, no multi-currency business accounts, or targeted features that cater to businesses or Small and Medium Enterprises (SMEs).

Let’s get to know each virtual bank in Hong Kong.

1

ZA Bank

.png?ixlib=gatsbyFP&auto=format%2Ccompress&fit=max)

ZA Bank Limited was established by ZhongAn Technologies International Group Limited ("ZA International"), and they were the first virtual bank to operate fully in Hong Kong in March 2020. They provide online accounts for permanent and non-permanent residents of Hong Kong. However, the eligibility requirements may vary depending on whether you want to open a personal or business account.

Since November 2023, ZA Bank has received regulatory approval to prepare for the U.S. stock trading service launch, allowing users to access investment opportunities from stocks and ETFs in the U.S. markets. Furthermore, ZA Bank is the first virtual bank in Hong Kong to offer a dedicated "Banking for Web3" service, and it has launched operating accounts for OKX Hong Kong.

ZA Bank was recognised as “Virtual Bank of the Year – Consumer (Hong Kong)” in The Asset Triple A Digital Awards 2023.

According to the ZA Bank website, in May 2024, the virtual bank served more than 700,000 users on its platform, which makes it the largest virtual bank in Hong Kong in terms of user base.

Important Details about ZA Bank Limited

- Launch date: 24 March 2020

- Type of accounts offered: Personal accounts, business accounts

- Cards/services: Physical and virtual Visa debit card, insurance, and loan services

- Eligibility criteria: Companies have to be established and incorporated in Hong Kong, the company's director has to be in Hong Kong and present for a face-to-face meeting, and all signatures must be done in front of ZA Bank.

- Time for opening an account: As fast as 2 minutes for a personal account. We cannot find information for a business account.

- Channels of contact: Customer enquiry hotline +852 3665 3665, email Bank.opinion@za.group, website live chat

- Customer service hours: 24/7 via hotline and online channels

ZA Bank Account Key Features

✅ HKD, USD, and CNY are supported currencies

✅ Local funds transfers and payment services (FPS/CHATS)

✅ Inbound and outbound overseas transfers in HKD, CNY, and USD

✅ Time deposit

✅ Business instalment, revolving term loan services available for registered clients only

ZA Bank Fees

For business clients, ZA Bank will deduct an HKD 1,200 opening fee and HKD 300 company search fee after you deposit funds to your account, making the total account opening fee HKD 1,500.

Here are the other ZA Bank business banking fees:

Type | Fees |

Monthly fee for a business account | Waived |

Outward transfers to other local banks via CHATS | Handling fee: HKD 50 Cancel or amend payment: HKD 200 |

Outward transfers via FPS | Below HKD 1 million: HKD 1 Above |

Telegraphic transfers | Inward: HKD 50 Outward Handling fee: HKD 100 Cancel or amend payment: HKD 200 |

Receiving CHATS payments | HKD 15 |

Receiving FPS payments | Non-Merchant: Waived Merchant: 0.6% of the transferred amount |

Receiving telegraphic transfers via SWIFT | HKD 50 |

If you want to learn more about ZA Bank's features, fees, and application process, read our guide on ZA Bank business account review and how to open a ZA Bank Account

2

Airstar Bank

Airstar Bank is the second virtual bank to commence operation in Hong Kong in June 2020 and they are a subsidiary of Xiaomi Corporation. Their banking license was granted by the Hong Kong Monetary Authority on 9 May 2019 and they aim to become the "Bank for Everyone" by making virtual banking services accessible to customers. Currently, Airstar Bank provides services for both personal and corporate clients.

Corporate clients can sign up for Airstar Bank's "Stellar Corporate Banking Services" to access business banking services. For a personal account, sign up via the Airstar Bank mobile app on Apple's App Store or Google Play.

Currently, Airstar Bank Limited is part of the Deposit Protection Scheme, which means that deposits with Airstar Bank are protected up to a limit of HKD 500,000 per depositor.

Important Details About Airstar Bank

- Launch date: 11 June 2020

- Type of accounts offered: Personal accounts, corporate accounts

- Cards/services: Loan services and foreign exchange

- Eligibility criteria: Aged 18 years old or above, have an HKID holder, Hong Kong tax residence only - Non-US person

- Time for opening a corporate account: As fast as 48 hours

- Time for opening a personal account: As fast as 5 minutes

- Channels of contact: Banking hotline at +852 3718 1818, customer opinion hotline at +852 3961 3973, email enquiry@airstarbank.com, contact within the mobile app

- Customer service hours: 24 hours via banking hotline, Monday to Friday (excluding public holidays) from 9 am to 5 pm via customer opinion hotline.

Airstar Bank Account Features

✅ HKD, USD, and CNY are supported currencies

✅ Savings accounts which allow for withdrawal of the account balance as needed

✅ Time deposit accounts where you can put money aside for a specified period of time to enjoy a fixed interest rate that is locked in

✅ Transfer limit - HKD 10,000 (small value transfer FPS), HKD 100,000 (non-registered bank account), HKD 500,000 (registered bank account)

✅ Local funds transfers and payment services (FPS/CHATS)

✅ FX service for HKD, USD, and CNY

Airstar Bank Fees

Type | Fee |

Account opening fee | Free |

Account monthly fee | Free |

Fund transfers in HKD and CNY via FPS | Waived |

Receiving cross-border remittance | Waived |

Request for a reference letter | HKD 250 per copy |

Request for a paper statement | HKD 50 per statement cycle |

Handling fee for instalment loans: | 0.25% |

3

WeLab Bank

WeLab Bank was the third bank in Hong Kong to be given a virtual banking licence in 2019. It is owned by Hong Kong fintech company WeLaB Limited.

WeLab Limited has been providing financial services in China and Indonesia since 2013; however, it ventured into the Hong Kong Fintech market to provide virtual banking in 2019. They entered Hong Kong with its experience and its huge capital base, acquired in its services in Asia.

As a virtual bank, WeLab Bank provides all of its services on its app, and it only has an office in Hong Kong for its customer support team. To download WeLab Bank's application, visit the Apple App Store or Google Play Store.

In 2022, WeLab Bank has achieved the top ranking as the most innovative company in Hong Kong, as per the inaugural 'Corporate Innovation Index (CII).

Important Details About WeLab Bank

- Launch date: 30 July 2020

- Type of accounts offered: Personal accounts only

- Cards/services: Physical and virtual debit mastercard®, loan services, foreign exchange and insurance services

- Eligibility criteria: Individuals must be aged 18 years or above, hold an HKID, be physically in Hong Kong, have a Hong Kong mobile number, and have a Hong Kong residential address

- Time for opening an account: Within a day to a few days

- Channels of contact: Call +852 3898 6988 or email at wecare@welab.bank

- Customer service hours: Monday to Sunday, from 9 am to 10:30 pm

WeLab Bank Account Features

✅ HKD supported currency

✅ Transfer Limit - HKD 30,000 and can be increased to HKD 500,000 after internal review

✅ Local funds transfers and payment services (FPS/CHATS)

Type | Fee |

Account opening fee | Free |

Account monthly fee | Free |

FPS transfer fee | Waived |

RTGS transfers in HKD | HKD 50 per transaction |

Foreign currency transaction fee | 1.8% of transaction value |

Request for a reference letter | HKD 200 |

Request for a paper statement | HKD 100 per statement cycle |

4

Livi Bank

Livi Bank is another virtual bank in Hong Kong that began operating in 2020. It is co-owned by Jingdon Digits Technology, Bank of China (BOC) Hong Kong, and Jardine Matheson Group. According to reports, Livi Bank has a total balance deposit of 3.1 billion Hong Kong dollars in 2022, according to its annual report.

Currently, Livi Bank provides a business account service called "Livi Business" and a personal account service called "Livi Personal." To register an account online, you must download the Livi app from the Apple App Store or Google Play Store.

In 2022, Livi Bank reported more than 200,000 users on their platform. By the end of 2023, Livi customer deposits amounted to HKD 2.2 billion.

Important Details About Livi Bank

- Launch date: 12 August 2020

- Type of accounts offered: Personal accounts, business accounts.

- Cards/services: Virtual debit mastercard®, loan services, and travel insurance services

- Eligibility criteria: Individuals must be aged 18 years or above, hold an HKID, be physically in Hong Kong, have a Hong Kong mobile number, and have a Hong Kong residential address

- Time for opening an account: Within a day to a few days

- Channels of contact: Live chat on the Livi app (for registered customers only), feedback page on the Livi app (for registered customers only), email livicare@livibank.com, call (+852) 2929 2998 or (+86) 4001200099

- Customer service hours: We cannot find information

Livi Bank Account Key Features

✅ HKD, USD, and CNY are supported currencies

✅ Local funds transfers and payment services (FPS/CHATS)

✅ Instant USD transfers via RTGS.

✅ Business instalment loan with speedy approval and up to 60-month repayment period

✅ Time deposit with fixed-tiered interest rates

✅ Pay later function

Livi Bank Fees

Livi Bank has different pricing for personal and business bank accounts. Please refer to their website for personal account fees & charges.

Below are the Livi business banking fees:

Type | Fees |

Account opening fee | HKD 1,200 (including HKD 300 company search fee) |

Account closure fee | HKD 300 per account closed within 3 months |

Outward FPS transfers to other local banks | Below HKD 1 million: HKD 3 Above HKD 1 million: HKD 15 |

Outward RTGS transfers to other local banks | HKD 25 |

Receiving funds from other local banks through FPS/RTGS | Waived |

Request for a paper statement | HKD 50 per statement cycle |

Tip: You can follow our guide on how to open a Livi Bank virtual bank account.

5

Mox Bank

.png?ixlib=gatsbyFP&auto=format%2Ccompress&fit=max)

Mox Bank is another virtual bank in Hong Kong that opened to the public in 2020. It is backed by Standard Chartered in partnership with HKT, PCCW, and Trip.com. Today, Mox provides many retail banking services for personal account users, including credit cards, savings, loans, cashback rewards, and more.

According to their website, Mox is the top-rated virtual banking app for Hong Kong in the Apple App Store. Lastly, Mox reported that they have over 500,000 real users on their platform.

They received recognition as the best digital-only bank in Hong Kong in 2023 by The Asian Banker.

Important Details About Mox Bank

- Launch date: 22 September 2020

- Type of accounts offered: Personal accounts only

- Cards/services: Debit and credit Mastercard®, loan services, foreign exchange - Mox also provides a unique numberless card

- Eligibility criteria: Individuals must be aged 18 years or above, hold an HKID, be physically in Hong Kong, have a Hong Kong mobile number, and have a Hong Kong residential address

- Time for opening an account: Within a day to a few days

- Channels of contact: Hotline +852 2888 8228, email care@mox.com, in-app chat, voice call, online form, postal mail

- Customer service hours: We cannot find information

Mox Bank Account Key Features

✅ HKD supported currency

✅ Local funds transfers and payment services (FPS/CHATS)

✅ Convert between 10 currencies, including HKD, AUD, CAD, CNY, EUR, GBP, JPY, NZD, SGD, and USD

✅ Time deposits starting from HKD 1 for up to 24 months

✅ Smart Borrowing feature to apply for loans directly within the app

✅ Trade stocks in the Hong Kong and US markets with limit or market orders

Mox Bank Fees

Type | Fees |

Account opening fee | Free |

Account monthly fee | Free |

Cash withdrawal at JETCO ATMs in Hong Kong | Free |

Overseas ATM cash withdrawal at JETCO ATMs | HKD 30 per transaction |

Foreign exchange handling fee | 1.95% (1% imposed by Mastercard® plus a 0.95% fee charged by Mox) |

Request for a paper statement | HKD 50 per copy |

Discover Mox Bank’s key features, fees, customer service rating, account opening process, and more in our detailed Mox Bank Review and How to Open a Mox Bank account guide.

6

Ant Bank

Ant Bank is another early virtual banking contender that began offering its services in Hong Kong in 2020. Ant Bank is owned by the FinTech company Ant Group, an affiliate company of the Chinese Alibaba Group and the owner of the Alipay payment platform.

It is a well-known financial institution worldwide. According to the latest reports, Ant Group is considering selling its stake at Ant Bank, but there have been no new updates so far.

Ant Bank currently provides personal and business account services in Hong Kong. Their corporate banking account offers features such as dual currency accounts (HKD and USD) for savings and fund transfers and zero cost to apply for loans. Ant Bank's personal accounts also provide attractive loan options for their users.

Important Details About Ant Bank

- Launch date: 28 September 2020

- Type of accounts offered: Personal accounts, Corporate Banking Accounts for SMEs

- Cards/services: Loan services

- Eligibility criteria: Individuals must be aged 18 years or above, hold an HKID, be physically in Hong Kong, have a Hong Kong mobile number, and have a Hong Kong residential address. Business clients must be registered and operated in Hong Kong for over a year

- Time for opening an account: Anywhere from 1 day to a few days after submitting all the required documents

- Channels of contact: Call +852 2325 0303 or email customeropinion@antbank.hk

- Customer service hours: Monday to Friday, from 9 am to 6 pm, excluding public holidays.

Ant Bank Account Features

✅ HKD supported currency

✅ Dual currency account supporting HKD and USD savings and fund transfer

✅ Transfer Limit - HKD 200,000

✅ Local funds transfers and payment services (FPS/CHATS)

✅ SME Loans

✅ Pay later function

Ant Bank Fees

Type | Fees |

Account opening fee | Free |

Local bank transfer | Waived |

Returned local bank transfer | Waived |

7

PAO Bank Limited (Formerly Ping An OneConnect Bank)

Ping An OneConnect Bank (PAOB) began offering virtual banking services in Hong Kong in 2020. PAOB is a subsidiary of OneConnect Financial Technology Co., Ltd. It is a member of Ping An Insurance (Group) Company of China, Ltd.

Today, PAOB provides both personal and business account services to its clients. These services include business loans, savings, and cardless withdrawals. It provides retail and SME banking services online through the PAOB app.

In 2024, Ping An OneConnect Bank (Hong Kong) Limited underwent an official name change to PAO Bank Limited and now operates under the name "PAObank".

Important Details About PAObank

- Launch date: 29 September 2020

- Type of accounts offered: Personal accounts, business accounts

- Cards/services: Loan services, foreign exchange

- Eligibility criteria: Companies have to be established and incorporated in Hong Kong

- Time for opening an account: Within a day to a few days

- Channels of contact: Call +852 3762 9900 or email at: paob_cs@pingan.com

- Customer service hours: 24 hours, excluding public holidays

PAObank Account Features

✅ As of this moment, the business account only supports HKD

✅ Business instalment loan service available for registered clients only

✅ Local funds transfers and payment services (FPS/CHATS)

✅ Time deposit

✅ Various business loans, such as trade-connect loans, eFast, and business revolving loan

PAOB Fees

Type | Fees |

Account opening fee | Free |

Account maintenance fee | Free |

Outward FPS transfers | Free |

Receiving FPS payments | Free |

Find out how Statrys compares to PAOB regarding business accounts, foreign exchange services, cards, loans, and more.

8

Fusion Bank

Fusion Bank Limited is a virtual bank established in 2020, just like other virtual banks on this list.

It is a joint venture set up by businessman Adrian Cheng, the owner of Perfect Ridge Limited, in partnership with other companies, including the Industrial and Commercial Bank of China Limited, Hong Kong Exchanges and Clearing Limited, Tencent Holdings, and Hillhouse Capital.

Currently, Fusion Bank provides both personal and business banking accounts. Furthermore, they are the first Hong Kong virtual bank to apply self-developed AI eKYC technology (Co-developed by Tencent Cloud and Fusion Bank), reducing user application time.

Applications are 100% online, and users can download the Fusion Bank App to sign up.

Important Details About Fusion Bank

- Launch date: 21 December 2020

- Type of accounts offered: Personal accounts, business bank accounts.

- Cards/services: Loan services, foreign exchange

- Eligibility criteria: Individuals must be aged 18 years or above, hold an HKID, be physically in Hong Kong, have a Hong Kong mobile number, and have a Hong Kong residential address

- Time for opening an account: Within a day to a few days

- Channels of contact:

Personal banking hotline: +852 2111 2688

Business banking hotline: +852 3187 1333

Customer feedback hotline: +852 3976 6658

Email at: CustomerService@fusionbank.com - Customer service hours: 24/7 via banking hotlines, Monday to Friday from 9 am to 5 pm via customer feedback hotline

Fusion Bank Account Key Features

✅ HKD, USD, and CNY are supported currencies

✅ Transfer Limit - HKD 50,000 and can be increased to HKD 500,000 after internal review

✅ Local funds transfers and payment services (FPS/CHATS)

✅ Time deposit

Fusion Bank Fees

Type | Fees |

Account opening fee | HKD 1,200 per business account application online |

Account monthly fee | Free |

Outward FPS | Waived if less than less than HKD 1,000,000. Otherwise HKD 10 |

Outward CHAPS payments | HKD 15 |

Receiving FPS and RTGS payments | Waived |

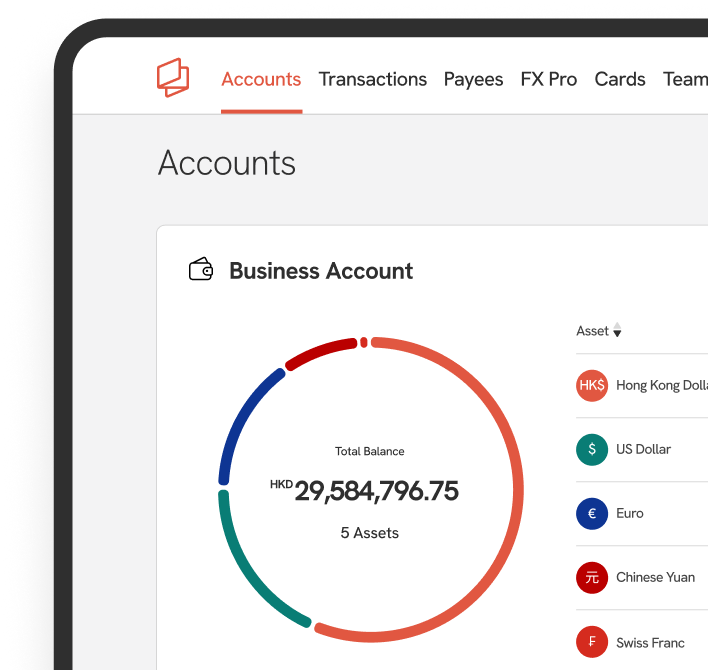

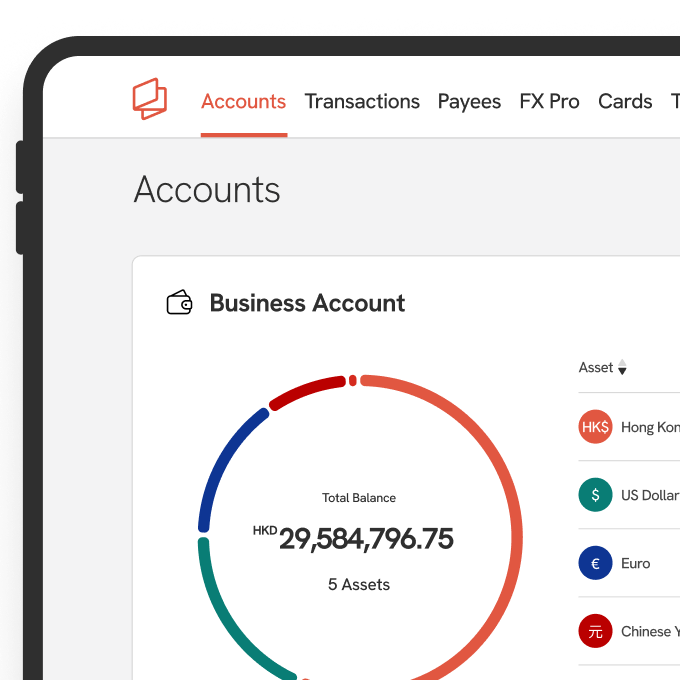

Virtual Bank Alternative: Statrys

Statrys is not a bank but a financial institution holding a Money Service Operator licence in Hong Kong. Statrys' mission is to bridge the gap between technology and people by developing the most functional payment services on the market while providing personalised support for each client.

Statrys is currently providing services to over 3,500 SMEs across 70+ countries and continuing to provide the best customer support services, with a score of 4.7 out of 5 based on Trustpilot.

Today, Statrys provides multi-currency business accounts to small to medium-sized businesses registered in Hong Kong, Singapore, and the BVI, and businesses can open a business account remotely, even outside of Hong Kong.

Important Details About Statrys

- Launch Date: 2018

- Type of accounts offered: Business Accounts

- Cards/Services: Virtual and Physical Mastercard®, Foreign Exchange, Hong Kong and Singapore Company Registration, and Invoicing Software

- Eligibility criteria: Companies must be registered in Hong Kong, Singapore, and the BVI.

- Time for opening an account: 85% of the clients have their accounts approved in less than 48 hours.

- Channels of Contact: Customer enquiry hotline at +852 5803 2818, WhatsApp +852 6452 3564, email support@statrys.com, live chat on the website, and WeChat

- Customer service hours: Monday to Friday, from 9 am to 7 pm

Statrys Account Key Features

✅ A multi-currency business account in Hong Kong with 11 currencies, including HKD, RMB, AUD, CAD, CHF, EUR, GBP, JPY, NZD, SGD, and USD

✅Local payment in 12 currencies, including AUD, USD, THB, VND, INR, EUR, GBP, PHP, SGD, IDR, TRY, KRW

✅ International payments via SWIFT

✅ Virtual and physical payment cards for more flexibility in making payments

✅ FX services at competitive exchange rates (spot and forward contracts)

✅ A dedicated account manager for every client

Statrys Fees

Type | Fees |

Account opening fee | Free |

Free (if 5 or more outgoing transfers are made in the month) | |

Outward payments in HKD within Hong Kong | HKD 5 |

Receiving payments in HKD within Hong Kong | Free |

Local payments in USD, AUD, INR, EUR, GBP, SGD, IDR, PHP | HKD 25 |

Local payments in THB, TRY, KRW | HKD 35 |

FAQs

What is a Virtual Bank?

A virtual bank offers banking and financial services similar to traditional banks, but through digital channels, removing the need to visit a physical branch.

How many virtual banks are there in Hong Kong?

What are the virtual banks in Hong Kong?

What is the difference between online and virtual banking?

Are Virtual Banks considered a Fintech?

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C680%2C680&w=680&h=680)