Setting up a company in Hong Kong

Hong Kong is one of the most business-friendly cities in the world, and as a result, it attracts global entrepreneurs and companies. According to the Companies Registry, 132,246 new companies were registered in Hong Kong in 2023. Comparatively, only 70,402 new companies were registered in Singapore.

With favourable tax regimes, a strategic location in Asia, and a highly skilled workforce, it makes sense for businesses to set up a company in Hong Kong.

In this article, we will use our experience from incorporating hundreds of companies in Hong Kong and show you the necessary steps, requirements, costs, and tips for setting up a company that will help you get started.

However, if you do not have time to set up a company on your own, we recommend you choose from one of the best company incorporation services in Hong Kong instead.

Why Set Up a Company in Hong Kong in 2024?

Beyond its vibrant culture, superb infrastructure, and high standard of living, Hong Kong is renowned as one of the world’s hubs for international trade and investment. Here are four reasons why setting up a company in Hong Kong can help your business thrive.

1

It’s Straightforward and Has Low Set Up Costs

Company registration in Hong Kong is fast and cost-efficient. You can get a business registration certificate from the Hong Kong Companies Registry within a few days, and the government fees for incorporation are reasonable and transparent.

Hong Kong offers a business-friendly environment with minimal bureaucratic constraints; it does not require minimum registered capital or a local director, and there is no restriction on foreign investment.

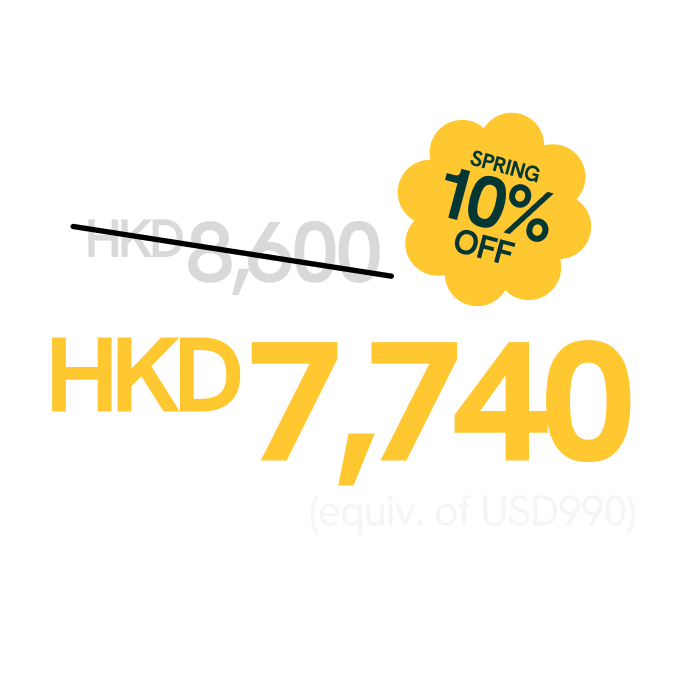

Industry Insight: How much does incorporating a Hong Kong company cost? According to Statrys' survey study of 120 entrepreneurs, it typically costs around HKD 9,053.

2

Hong Kong Offers a Vibrant Business Environment

Hong Kong is home to over 360,000 SMEs, and it is a dynamic hub for start-up growth and development. This is because of Hong Kong’s adaptability and innovative environment, which are extremely favourable for SMEs.

According to IMD’s World Competitiveness Center’s 2023 report, Hong Kong ranks among the world’s top ten countries with a competitive economy.

The Hong Kong Government also supports innovation and technology development. In 2023, it allocated HKD 500 million to launch a Digital Transformation Support Pilot Programme to provide SMEs with essential digital solutions.

That’s why many entrepreneurs use Hong Kong as a strategic location to expand their businesses in the rest of the region.

For more information, we interviewed InvestHK, the government body in charge of attracting and retaining foreign direct investment, which is strategically important to Hong Kong's economic development.

3

Taxes Are Business-Friendly

Hong Kong has a two-tiered profit tax rate for corporations with an exemption for the first HKD 3,000 profit in 2024. Incorporated companies pay 8.25% tax on earnings up to HKD 2 million and 16.5% on any part of the profits over HKD 2 million. This tax system is one of the lowest in Asia and globally.

Additionally, it has a territorial tax regime, which means there is no corporate tax for companies conducting their business outside Hong Kong.

4

No VAT or Tax on Capital Gains

Another significant benefit of setting up a company in Hong Kong is the absence of certain taxes common in other jurisdictions, such as Value-Added Tax (VAT) or Goods and Services Tax (GST). Profits from selling an asset, such as property or shares, are also not subject to capital gains tax.

Step 1. Get Familiar with Local Organisations and Institutions

When setting up your company, you will have to engage with two government departments mainly:

1

The Companies Registry

The Companies Registry is the government’s business registration office that is responsible for the incorporation of companies in Hong Kong.

The Companies Registry’s role is to oversee companies to ensure they comply with corporate laws and regulations following the Companies Ordinance guidelines.

2

The Inland Revenue Department

The Inland Revenue Department (IRD) in Hong Kong is responsible for the administration of taxes and duties as a government department.

You must file your company tax return with the IRD every year to determine how much tax your company has to pay.

Tip: Read our beginner’s guide on Hong Kong’s corporate tax rates in 2024.

Step 2. Choose Your Company Name

The actual company registration process begins with choosing a name for your company. It can be in Chinese, English, or both. However, the name must not combine both English and Chinese characters.

If your company name is in English, it must end with “Limited.” You must use traditional characters if you name your company in Chinese, and it must end with “有限公司.”

The Companies Registry may reject your application if you choose an unregistrable name. To avoid that, here are some helpful tips on company naming.

Tip #1 – Check the name’s availability

Check if the name is available on the Hong Kong Company Registry’s website. Alternatively, you can send a list of names to your company secretary for checking.

Tip #2 – Check the trademarks

Make sure your company name is not trademarked in Hong Kong or other regions to avoid legal cases. You can verify that your company name is free to use on the Intellectual Property Department’s Online Search System.

Tip #3 – Trademark your company name

Protect your company name by registering it as a trademark at the Hong Kong Intellectual Property Department.

If you need more details on company name registration, check the Companies Registry guideline.

Industry Insight: Check out our detailed guide on the do’s and don’ts for company names in Hong Kong.

Step 3. Choose the Legal Entity of Your Company

Now that you have your company's name, the next step is to decide which type of legal entity is best for your business.

Choosing the right business structure is essential in new company formation, as it affects your tax responsibilities, flexibility of business operations, and legal liability.

There are three main types of business entities in Hong Kong:

- Public and Private Limited Company

- Sole Proprietorship

- Partnership

Among these options, a limited company is the most popular and common type of company structure in Hong Kong for multiple reasons.

Firstly, this business type offers the shareholders limited liability. This means that their financial risks do not extend beyond the amount in their share capital investment, protecting their personal assets from the company’s financial obligations.

Secondly, the share-based structure of a private limited company facilitates capital growth and expansion as it attracts external funding from investors.

On that note, transferring shares from one shareholder to another is a very straightforward process in a limited company. This convenience makes it an attractive choice for businesses aiming to expand and readily adapt their ownership structure to include new investors.

Step 4. Appoint a Company Secretary

All companies in Hong Kong are required to have a local company secretary.

It is mandatory to appoint a company secretary when registering your company, as they are a direct point of contact for inquiries from authorities, ensuring regulatory compliance and operational transparency.

Your company secretary will be in charge of ensuring that your company is in good standing with the regulations governing the incorporation and maintenance of companies in Hong Kong. They also have other responsibilities, including filing annual returns, managing company seals, and helping with company restructuring.

Looking for a Company Secretary? With over 6,000+ company secretaries in Hong Kong, it's hard to find the right one. Read their reviews first before choosing a company secretary.

Who Can Be Your Company Secretary?

A company secretary can be an individual Hong Kong resident or a certified company. You can appoint your friends or family, provided they reside in Hong Kong and are familiar with a company secretary's complex responsibilities and duties.

To ensure your company complies with Hong Kong corporate laws and regulations, we recommend choosing a qualified company secretary with a TCSP licence.

What Does a Company Secretary Do for Your Business?

Company Secretaries are important for all companies in Hong Kong. They help ensure that your company is compliant with the local laws and regulations.

Here are some of the key services that company secretaries provide:

- Maintaining your company records, such as the register of directors, the register of shareholders, the share certificates, and the significant controller register

- Organising, preparing the agendas for, and taking minutes of your board and annual general meetings

- Arranging your tax filings

- Monitoring changes in relevant legislation and the regulatory environment and taking appropriate action

Overall, having a company secretary is a must if you want to start a business here in Hong Kong.

Step 5. Select the Registered Address of Your Company

Your company's registered address is the address at which governmental departments will send correspondence.

Using your company secretary’s address as the registered address is common and recommended to ensure you receive all official communications and legal documents, especially if you do not have physical offices in Hong Kong.

If you change your office address, ensure that you fill in the NR1 Form and notify the related authorities to prevent missing important correspondences.

Step 6. Prepare the Incorporation Documents

Unlike many countries, the incorporation process in Hong Kong does not require an extensive amount of documentation.

Here are the required documents for company incorporation:

- NNC1 and IRBR1 Forms for companies limited by shares. The incorporation forms must be filled out and signed by one of the shareholders.

- Copies of the directors’ and shareholders’ identification documents (Hong Kong ID cards for Hong Kong residents and passports for foreigners).

A copy of the company’s Articles of Association outlining the company's internal governance rules, such as director appointments, share transfers, and financial management. The company secretary typically provides this document.

Recommended read: We have a detailed guide on company formation in Hong Kong in 2024. It covers the company types, pre-registration, and post-registration tips you might need.

Step 7. Submit to the Companies Registry

Incorporating your company with the Hong Kong Companies Registry is a straightforward process.

You can submit the incorporation documents in one of the following ways:

- Online submission through e-Registry Portal

- Send by mail to the Companies Registry’s address to 14/F, Queensway Government Offices, or

- In person at the Shroff Counters at the Companies Registry office.

Within 2 to 6 business days after submission, the Companies Registry will issue two documents evidencing the incorporation of your company. Those documents are:

Certificate of incorporation

The certificate of incorporation is issued only once when your company is set up and remains valid during the entire lifetime of the company.

Business registration certificate

The business registration certificate is only valid for one or three years. It must be renewed every year within one month following the anniversary date of the establishment of your company (otherwise, fines will be issued).

Both certificates can be collected in person at the Companies Registry or electronically.

Important: Once you have registered your business, you must display your Business Registration Certificate at your place of business.

Step 8. Pay the Government Fee

At the time you submit the incorporation documents to the Companies Registry, you will be required to pay the applicable government fee.

Below are the incorporation fees for Hong Kong private limited companies. Please refer to the Companies Registry’s official website for other related service fees.

Type of Fee | Amount |

Online application through electronic portal | HKD 1,545 |

Application with hard copies of documents | HKD 1,720 |

Fee and levy for 1-year Business Registration Certificate | HKD 2,150 |

Fee and levy for 3-year Business Registration Certificate | HKD 5,650 |

Did you know? In cases of unsuccessful applications, the Companies Registry may refund around 80% of the application fee.

Step 9. Get Relevant Permits and Licences (If Necessary)

Typically, you would not need permits or licences to do business in most industries in Hong Kong.

However, some types of businesses need to apply for licences and permits, such as restaurant licences, liquor licences, money service operators licences, and import and export licences.

For instance, if you’re opening a restaurant, you must obtain a General Restaurant Licence, a Provisional General Restaurant Licence, and a Liquor Licence from the Food and Environmental Hygiene Department.

You can visit the Trade and Industry Department website to find out which licences, permits, certificates, and approvals are needed for certain businesses

Step 10. Keep Up With Your Taxes & Financial Reporting

At the time of incorporation, the Companies Registry will automatically report your company's existence to the Inland Revenue Department.

However, it is your responsibility to keep up with your financial reporting. Typically, your company secretary should handle your reporting and tax notifications, as well as communicate with you on this matter, depending on the level of service your company secretary provides.

For more information and updates regarding the rules and regulations for tax in Hong Kong, you can check the Hong Kong Government’s website.

The Easiest Way To Set up a Company in Hong Kong

Setting up a company in Hong Kong can be a tedious process if it is your first time. That is why Statrys offers a Hong Kong company registration service that makes it simple for individuals or businesses to set up a company. When you incorporate or register your Hong Kong company with us, you will get the following:

Pre-Incorporation Services

- Verification of availability of the company name in Hong Kong

- Preparation of documents for incorporation

- Filling out the incorporation application with the Companies Registry in Hong Kong

- Certificate of Incorporation

- Business Registration Certificate (annual renewal)

- Company kit: Company chops (corporate seals) and Set of Articles of Association

- 24/7 access to company documents on our online platform

Post-Incorporation Services

- Company secretary services for one year

- A registered business address for one year

- Significant controller register

- Designated representative

- Government fees (included in the price)

- Incorporation fee

- Business registration fee and levy.

After setting up a company, we recommend you get a local business account that can help you streamline payments.

Statrys also offers a multi-currency business account for companies incorporated in Hong Kong, Singapore, or the BVI. Once you have finished setting up a company, you can apply to open a business account in Hong Kong.

FAQs

Why set up a company in Hong Kong?

Hong Kong is renowned as one of the world’s international trade and investment hubs. Its vibrant business environment, low corporate tax rates, and straightforward registration process make Hong Kong a great location to set up your company.

Which department is responsible for taxes in Hong Kong?

What are the different types of legal entities in Hong Kong?

Can a foreigner register a company in Hong Kong?

How long does business registration take in Hong Kong?