Your Statrys Journey

Get Started

Fast, Easy, Online

Their approval and onboarding process is simple and transparent. Smooth, streamlined, polite. Well done guys.

L. Joseph

HU

00:00’

Start Application

06:34’’

Done!

Get Ready

Quick Process, Minimal Waiting

We highly recommend using Statrys. The whole process of opening our account was quick and easy.

Patrick

ID

96%

Of our Clients get Their account

Get things done

Pay with confidence

We can pay and receive payments super-quick, their platform is simple to use, and their customer service is faultless.

JB

AU

Your Statrys Experience

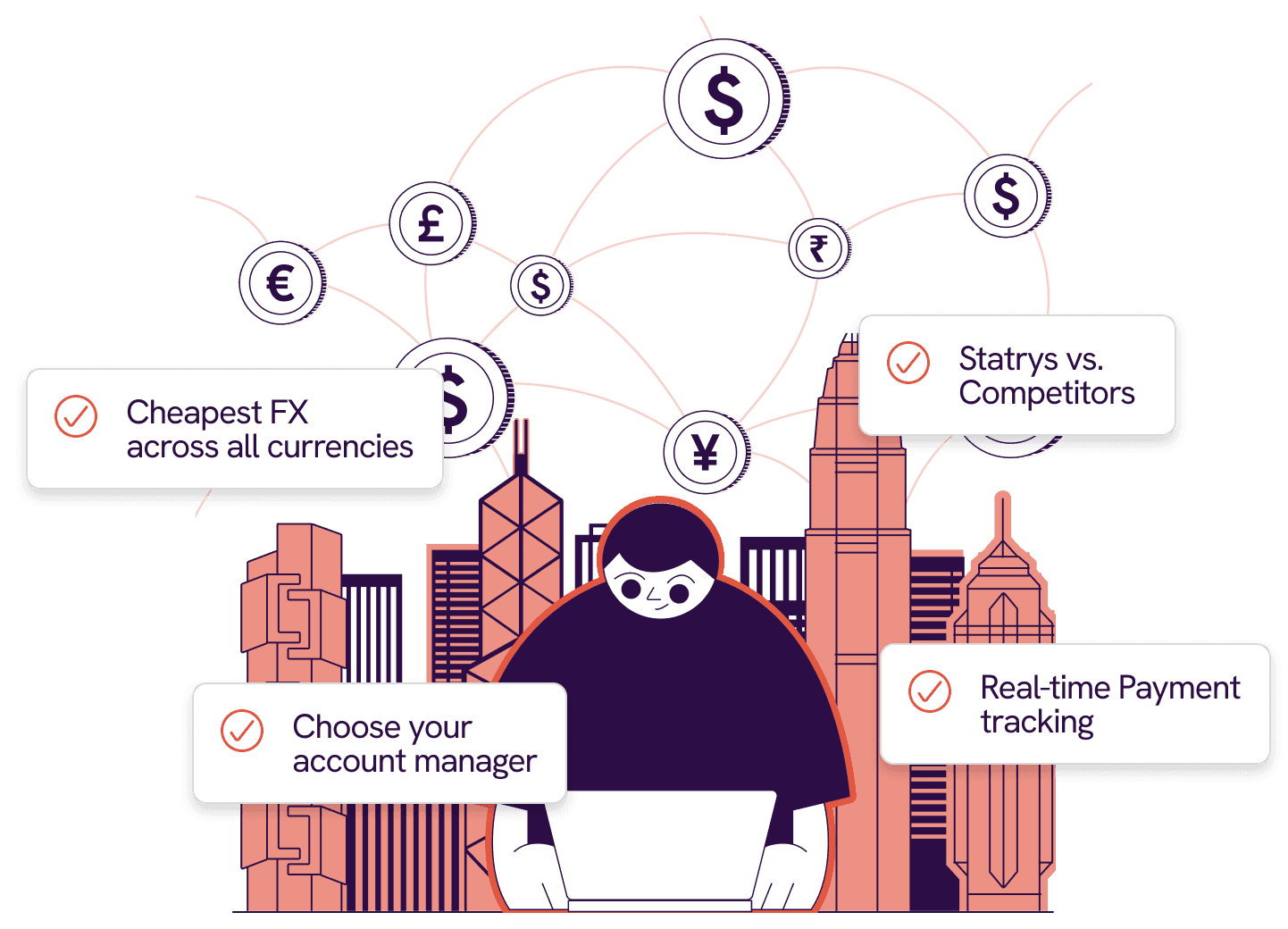

Exclusive Mix of Services & Features, unrivalled Benefits

An account that just works

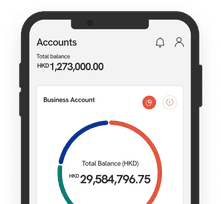

Multi-currency business account

Get paid in 11 major currencies.

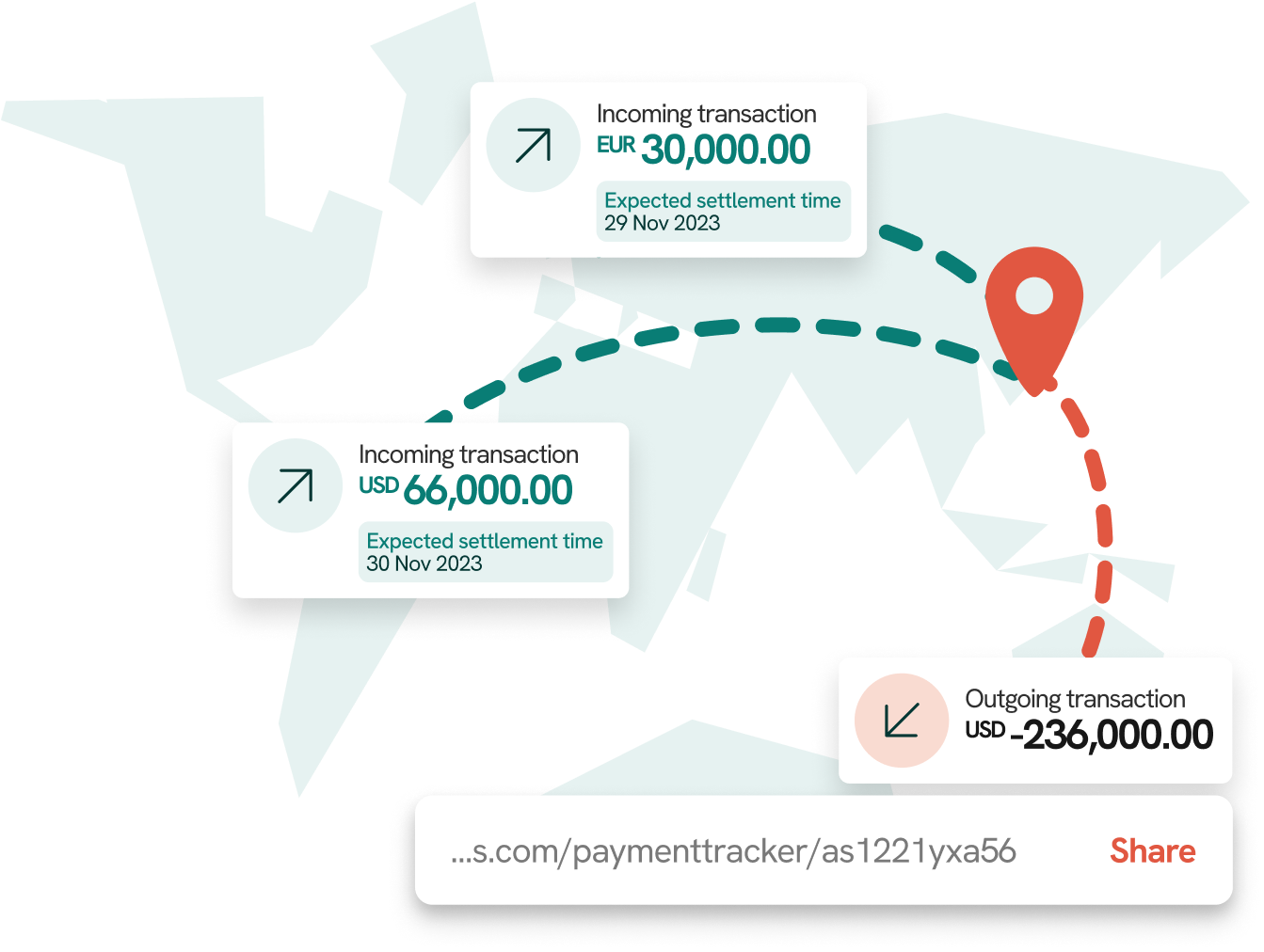

International and local transfers

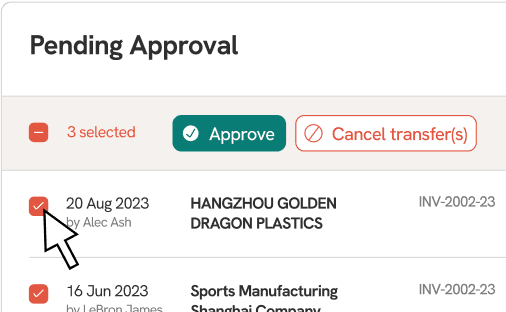

Send and receive money with minimal fees and maximum convenience.

Mastercard® physical and virtual cards

Account Management

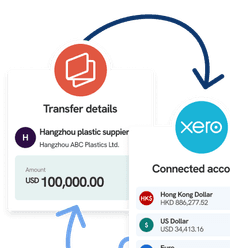

Effortless accounting with Xero integration

Mobile App

Slash Your FX Costs

“Entrepreneurs often miss out on a simple way to increase their profits: actively managing their FX. Doing this can boost your margins right away”

Jonathan Cusimano

Head of FX

Major currencies

0.15%

HKD

USD

EUR

CNY

GBP

SGD

JPY

AUD

CHF

NZD

CAD

Other currencies

0.25%

INR

IDR

PHP

KRW

THB

TRY

VND

What are you looking for?

A First Business Account

Recently started your company? You need a business account fast. That's what we're here for.

Fast, easy and online application

Business account name matching your company’s name

One single account number supporting 11 currencies

Receive and make payments locally in Hong Kong and internationally in 140+ countries

All other features for the smooth use of the account

More

A Second Business Account

Frustrated with your current account? Switch to our hassle-free, easy-to-use payment experience. We deliver exactly that.

Fast and straightforward online application

Intuitive user-friendly payment platform

One single account number supporting 11 currencies

Diverse payment solutions at competitive costs

The lowest FX commissions in Hong Kong

More

Featured on: