Key Takeaways

Cash flow is the money that is recorded moving (or flowing) in and out of a business account and is critical to ensure the smooth functioning of a company.

Profit does not equal cash, so it is important to have enough cash in a company's account to pay for monthly and ongoing payments.

To manage cash flow effectively, businesses need to monitor it on a regular basis, cut down costs, get customers to pay faster, get cash for unused assets, and obtain a line of credit or loan.

For many entrepreneurs starting a company for the first time, cash flow management is often the last thing on their minds. Most entrepreneurs will focus on things such as developing new products or services, launching marketing campaigns, or even setting up meetings with new clients.

This is part of the reason why about 20% of new businesses fail by the end of the 1st year.

In this article, we will share 10 practical tips for managing cash flow in your business. By implementing these strategies, you can improve your business's financial stability and ensure that you have the resources you need to grow and succeed in the future.

What Is Cash Flow in Business?

When running a business, it may sometimes feel like cash only flows one way (out of your business), but actually, it moves in both ways.

- Cash coming into the business: This usually takes the form of clients purchasing your goods or services. In a case where clients don’t pay at the exact time of purchases, some of your business’s cash flow will show up in the form of accounts receivable in your cash flow statement.

If you have more money coming in than going out, then your business is in a positive cash flow position or ‘in the black.’

- Cash going out of the business: This would namely be payments or expenses to produce your goods or services. This can include a range of expenditures, such as rent or a mortgage, which need to be paid back in monthly loan settlements. These would show up in your cash flow statement as various forms of accounts payable.

When more money is going out than coming in, your business is at risk of being overdrawn or in debt.

Having control over your cash flow will empower you to spot where your business could be doing better, whether it be in your incoming or outgoing.

📑 Facts: Cash flow and revenue are two separate things. Cash flow represents the cash coming in and going out of your business, whereas revenue measures the total of money coming into your business.

Why Is Cash Flow Management Important?

The lack of cash is one of the primary reasons why businesses fail.

According to Guidant Financial, about 33% of small business owners find it difficult to achieve enough cash flow to keep their businesses from failing in 2023.

Cash is particularly important in some business scenarios, including:

- When starting a business: Cash flow problems are more difficult when launching a business, particularly in the first six months. Money has a tendency to fly out of the company faster at the start when you are still setting up your operations but may not yet have many customers or sales. Suppliers do not often offer credit terms to new companies, worried that they will not have the funds to pay them, which increases their financial strain.

- Seasonal work or business: If your product or service is only seasonal (e.g., Christmas-themed merchandise), then having a grasp over your cash flow will allow you to make provisions for the large fluctuations in business and, essentially, income. Cash flow, in this case, will be vital to keep your business afloat during the off-season.

- Profit does not equal cash: Technically, it is possible for your company to turn a profit even if it records no cash. The reason behind this is that profit is just a concept used in accounting, whereas cash is the amount of available money in your business’s bank account. But remember, profit does not enable you to pay bills and meet your financial obligations. Profit will include assets like accounts receivable (money which is owed to your business by customers), which are not immediately collectible and, as such, are not able to receive immediate cash. Always make sure you have enough cash in your company’s account to pay for monthly and ongoing payments.

Tips to Manage Cash Flow Effectively

The most important aspect of cash flow management is to understand how much 'cash in hand' you can use for your business.

By organizing your business cash flow consistently, you will have an accurate idea of how it should be managed effectively.

Here are 10 steps you can follow to increase your business' cash flow.

1. Monitor Your Cash Flow on a Regular Basis

As we mentioned above, it is advisable to prepare a monthly record of your cash outgoings and incomes, at least on a monthly basis.

This will ensure that mistakes and cash shortages are spotted quickly and do not cause any damage to your business.

2. Cut Down Your Costs

Use your cash flow statements to do a cash flow analysis and try to see whether there are any recurring expenses that you could cut back on.

They could be in the form of bills on utilities, rent, payroll, subscriptions, or frequent services.

If you think you need to reduce your expenses, try to cut the costs or negotiate payments where possible.

3. Get Your Customers to Pay Faster

The best way to do this without upsetting your clients or customers is by offering them sales discounts on SaaS billing and benefits to get them to pay faster.

For example, if you offer a 30-day credit term, you can give your customers a 5% discount when you send an invoice if the bill is paid within ten days of receipt.

If not, the full amount will be due by the end of the 30-day credit term.

4. Get Cash for Your ‘Unused’ Assets

This tip is particularly important if you are looking to make some cash fast.

Perhaps your business has some old equipment that is sitting in a storage room collecting dust. Do not let it become obsolete.

Consider selling it or renting it out to get cash out of it. This is not only one of the quickest ways to earn cash and generate your cash flow, but it also helps to get rid of unused assets.

5. Obtain a Line of Credit or a Loan

Use your cash flow statement to forecast your cash requirements and get a line of credit or loan as a safety net against cash flow problems.

Be mindful of the line of credit or loan you get.

Just ensure that whatever money you are borrowing is worth the investment and cost of the loan or credit you are receiving.

6. Rent Equipment Rather Than Buy It

Avoid tying up cash in big expenditures where necessary, especially when it comes to cars or vehicles, computers, and other business hardware.

If you can rent it, then do it.

This means you can hand it back at any point and can quickly change it for the latest model or features.

7. Keep Up With Your Invoicing

We recommend designing your own invoice template so that it becomes easy and straightforward to fill in. You do not want something that will make invoicing your clients too difficult or cause you to make mistakes.

Another suggestion is to send the invoices by email so that they do not get lost in the post and get to your recipient as quickly as possible. It also makes chasing overdue invoices much easier because there will be records of communication that you may need in the future.

8. Finance Large Orders or Long-term Contracts

Asking for a deposit or partial payment means you have some cash to use to purchase the materials you need or to pay the team required to perform the job your business is being contracted for.

It is not uncommon to ask for up to a 25% deposit upfront before beginning any work on the job at hand.

9. Try to Delay Payments to Vendors

It may be worth trying to negotiate more favorable payment terms with your vendors or figuring out how late you can pay them.

Avoid late fees and try to engage your vendors in a transparent and respectful way that honors your working relationship.

10. Get a Virtual Credit Card for Business

Business credit cards can offer a comfortable cushion when your business is running low on immediate cash, not to mention statements provided by the bank will guarantee that you are able to track all expenses made through any cards you take out.

Keeping track of your business’s cash flow through efficient cash flow management will inevitably help you avoid simple cash mishaps that could cost you your entire business.

Managing Cash Flow Using a Cash Flow Statement

The most effective way to track your company’s cash flow is through a cash flow statement (or report).

It enables you to get an overall view of all money that has come in and out of your business’s bank account, and basically to understand your company’s cash position (whether it is positive or negative) every month.

Keeping track of your cash position is much more significant and fundamental to keeping your company afloat.

The statement is normally split into three parts:

- Cash from operating activities

- Cash from investing activities

- Cash from financing activities

In all those parts you will be able to identify every cash transaction (both in and out) that has occurred in your business.

Your outgoings will be deducted from your incoming to get your business’s net cash flow.

Why Use a Cash Flow Statement?

- To track where your business’s money is coming in from

- To understand where your business spends the most money

- To get the ‘cash reality of your business, as opposed to the abstract accounting

- To spot a cash inconsistency or shortage and help you plan for future cash flows. The longer you wait to fix a cash shortage the further your business’s cash flow will fall.

Simple Methods to Prepare a Cash Flow Statement

- Use accounting software: certain tools will be integrated to help you to construct a cash flow statement. If you are unsure how to use it, ask your accountant to assist you with it.

- Find help online: many services are available online to connect you to experts or offer free templates and tools to enable business owners to put together a cash flow statement.

💡Tip: You can try using templates offered by Bench, Spreadsheet, or SCORE to get started on preparing your cash flow statement.

Conclusion

Understanding the concept of cash flow is important for businesses, especially If you are just starting out because mismanaging cash flow is one of the most common reasons why startups fail.

Hopefully, the 10 tips that we provided earlier gave you a much better understanding of why it is important to manage cash flow and how to manage it.

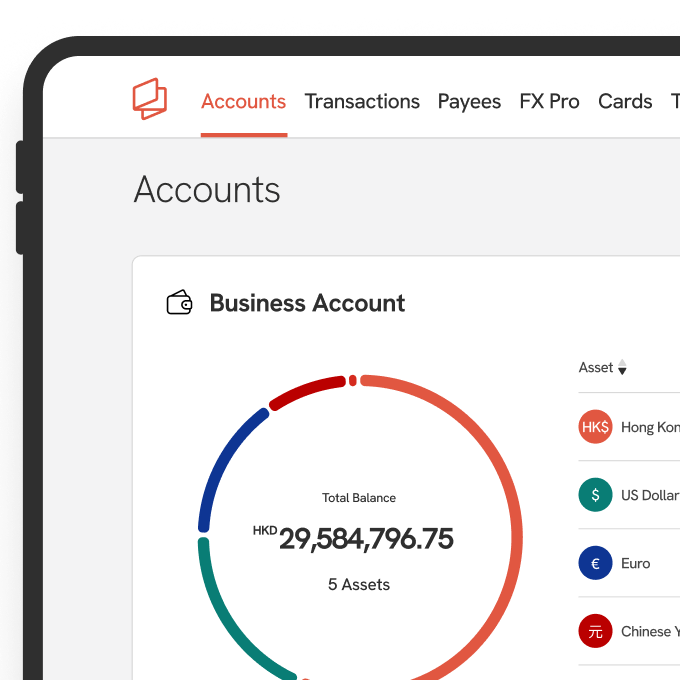

Having a snapshot of these expenditures can help you realize where you could be saving money and how your business can grow internationally efficiently.

Lastly, if you also happen to be looking for a virtual business account that has all major currencies in one account and affordable rates, then we recommend you learn more about Statrys today.

FAQs

How to prepare a cash flow statement?

You can prepare a cash flow statement using accounting software or using templates available online.

What are some effective ways to manage cash flow?

Why is managing cash flow important?