If you have clients and suppliers abroad, you're receiving and making payments in foreign currencies.

And, you know that currency fluctuations will directly impact how much money hits your account.

This is called the exchange rate risk or currency risk.

Repeated fluctuations are likely to have a profound effect on your profitability...

But good news!

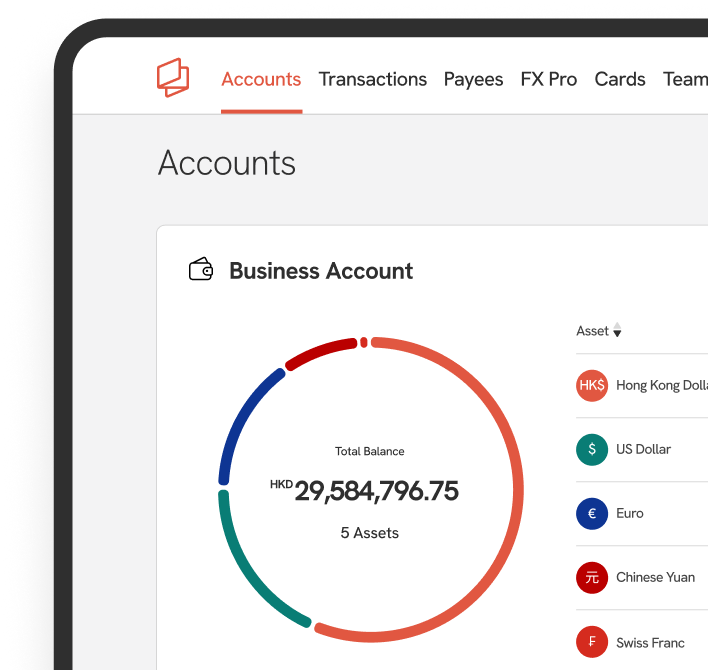

We have a number of FX tools that you can use to minimize the exchange rate risk. You can use one or several, depending on the type and amount of FX risk.

1. How can foreign exchange risks be decreased?

There are three ways in which a business can protect its profit margin: the use of :

- spot transfers

- forward exchange contracts

- limit orders

These three options enable the business owner to lock in the rate at which they will transact.

2. When should I use spot orders to limit my currency exchange risk?

FX spot orders or transfers specify the terms for an immediate transaction between two currencies.

When you make an order, you must agree on:

- The type of currencies that will be exchanged in the transaction

- The amount in value for each currency that will be transacted

- The exchange rate at which the transfer will be executed

3. What is a forward contract and how to use it?

When you want to avoid taking the unnecessary risk of exposing your business to currency fluctuation.

An FX forward contract is a "buy now, pay later" type of contract with a financial services provider.

It allows you to lock a rate even if you are not ready to make a transfer at this moment.

You can use today’s exchange rate for a particular future transfer.

This tool helps if you are working on sensitive pricing or a fixed currency budget to avoid problems that come with sudden shifts in the money market.

4. Can I enter a forward contract without committing to making the future transfer?

Then you should go for a limit order. It allows your business to set a target rate at which to make a transfer. This FX tool is used with the help of a forex organization that notifies you when the rate has reached the set target. Depending on the forex organization you are working with, there may be fees if you do not make transfers at the target rate.

5. Spot transfers, forward exchange contracts, and limit orders

None of the above can be termed as the best solution considering that every SME has its own business model.

The amount of money a business is willing to spend during the trade will determine the option selected. Generally, companies use spot orders for quick purchases.

However, when it comes to less time-sensitive ones, businesses prefer to use FX contracts and limited orders.

It’s entirely up to you to pick the one that suits your needs. Or get advice from a Statrys FX specialist if you are not sure about your business needs.

FAQs

What is an FX forward contract?

An FX forward contract is a "buy now, pay later" type of contract with a financial services provider. It allows you to lock a rate even if you are not ready to make a transfer at this moment.

When should I use limit order?

What is spot order?