Tide Business Account Rating: 3.85/5

Features - 4.15/5

Fees - 3.25/5

Customer Support - 4/5

Ease of opening an account - 4/5

Our Rating Methodology

More info

Click "More info" to understand how we calculate our Tide Business Account ratings.

What is Tide?

Tide Platform Limited (Tide) is one of the UK’s digital-only neobanks. It is an Electronic Money Institution authorised by the Financial Conduct Authority (FCA). With headquarters in London, Tide also has offices in Sofia, Hyderabad, Delhi, Berlin, and Belgrade.

Founded in 2015, Tide provides a wide range of financial products and digital business banking services for small to medium-sized businesses based in the UK. It previously offered e-money accounts. However, Tide currently provides business current accounts that are protected by the Financial Services Compensation Scheme (FSCS) through its partnership with ClearBank.

Tide Pros and Cons

Why Tide May Be a Good Option

- Business bank account with FSCS Protection

- Four tiers of business accounts for small business owners to limited companies

- 24/7 customer support through in-app chat

- Dedicated fraud response team

Why Tide May Not Be a Good Option

- Only support GBP

- Only UK-based businesses and sole traders are eligible

- Does not support international payments

- No physical branches

Featured Reviews

Neil Rates Tide ⭐⭐⭐⭐⭐

I’m thoroughly impressed with my…

I'm thoroughly impressed with my account at Tide Bank, I'm a small business owner and find the tools available, such as accounting, very useful and time-saving. The ease at which I can categorise my income and outgoings makes filing my return a breeze and keeps me on top of my cash flow. It's very simple to use, always a bonus, and thus far I've had no issues whatsoever. I'd recommend to any small business owner. Source: Trustpilot

Chris rates Tide ⭐⭐⭐

Good but there is more competitive out there

I used Tide for quite a while everything is good and reliable however when I actually was starting to use my account regularly I realised the major downside. The charges for every transfer in or out at 20p will soon add up. Monthly cost is high in comparison to competitors. Ultimately I switched my bank account to another provider that gives all of the features Tide offered but free transfers always and a lower monthly cost. Source: Trustpilot

Tide Features

Tide provides financial products and services tailored exclusively to meet the needs and challenges faced by UK-based self-employed professionals and small business owners. It does not offer multi-currency accounts, as its primary market is local small businesses. However, Tide account users can benefit from the following features.

Business Accounts

Tide offers free and paid accounts to companies and self-employed individuals. Directors of active registered companies are eligible for a Registered Business Account, while sole traders and freelancers can open a Sole Trader Account. Both types of accounts can choose from the four plans: Free, Tide Plus, Tide Pro, and Tide Cashback.

Here are some of the key features of Tide business accounts.

| Free | Plus | Pro | Cashback | |

| Mastercard® Expense Cards | ||||

| ATM withdrawals | ||||

| Scheduled payments | ||||

| Multi-user read access | ||||

| Access to Tide Invoicing Software | ||||

| Accounting software integration | ||||

| 24/7 fraud helpline | ||||

| 24/7 legal helpline | ||||

| Phone support | ||||

| Exclusive member perks (e.g., courier service discounts or free business phone number) | ||||

| Dedicated account managers | ||||

| 0.5% cashback with Tide card |

Tide provides business bank accounts in partnership with ClearBank Limited, a registered bank authorised by the Prudential Regulation Authority (PRA). Eligible deposits up to GBP 85,000 are protected by the UK’s deposit guarantee scheme (the Financial Services Compensation Scheme).

You can get an IBAN and BIC to receive euro SEPA payments, but you will get the funds in GBP, minus a 0.50% FX markup, in your Tide account. Tide has yet to support international outbound payments.

Expense Card

Customers with every Tide business account are eligible for Mastercard® Expense Cards. You can order this card for up to 50 people per Tide account.

If you are the account manager, you can set monthly and individual spending limits and freeze, unfreeze, and cancel cards in the Tide app. Moreover, each spending is automatically categorised to simplify financial management. Tide Cashback clients can also benefit from 0.5% cashback when paying with Tide cards.

Tide does not provide business credit cards.

Other Services

Tide also offers additional services, including:

- Business Loan: Get UK government-backed start-up loans from GBP 500 to 25,000 with a fixed 6% annual interest rate.

- Credit Builder: Improve your Experian business credit score by making monthly payments into a locked Tide account and get all the money minus interest back in 12 months.

- Free Company Registration: Register a UK limited company and get a London virtual office address free of charge. This service is only available for single shareholders.

Tide’s Feature Rating is 4.15/5

Tide's features are well-tailored for UK-based companies and sole traders, offering a variety of account plans to suit the needs of businesses of all sizes. The company registration service, credit builder programme, and loans make Tide a convenient one-stop option for business banking services. However, the limited capabilities for international transactions are a slight drawback.

Fees Charged by Tide

Applying for a Tide business account is free, while the monthly fee depends on your chosen account plan.

The table below details the fees charged by Tide for each business account plan.

| Free | Plus | Pro | Cashback | |

| Monthly Fee (excl. VAT) |

Free | GBP 9.99 | GBP 18.99 | GBP 49.99 |

| Mastercard® Expense Cards | GBP 5/month | 1 free card included | 2 free cards included | 3 free cards included |

| Bank transfers in and out of accounts | GBP 0.20/ transaction | Free 20 transactions/ month |

Free | Free |

| Transfers between Tide accounts | Free | |||

| ATM cash withdrawals | GBP 1 | |||

Tide charges a GBP 2.50 minimum fee for Post Office cash deposits and a 3% fee for PayPoint cash deposits.

Tide’s Fee Rating is 3.25/5

Tide’s fee structure is straightforward and offers flexibility for businesses of various sizes and needs. Its services are affordable compared to traditional high street banks. However, even though there are no monthly fees for the free account, the transfer and cash handling fees could add up and become a concern for businesses on a tighter budget. Overall, the cost-effectiveness of Tide’s services depends on the specific needs and transaction frequencies of different companies.

Tide Customer Support

Similar to other digital business banking service providers, Tide offers an in-app messenger service as a primary way to contact customer support. You can also email hello@tide.co for general queries or call 020 3893 2915 from 9 a.m. to 6 p.m. on weekdays (UK time) for questions about the application process.

In cases of fraud, scams, or lost cards, you can contact the Fraud Rapid Response team 24/7 by calling 159 if you are in the UK. This service is available for customers of all Tide account plans.

Tide's Customer Support Rating is 4/5

Tide provides satisfactory customer support, especially with its dedicated fraud response team. Its multiple support channels, including in-app chat, email, and phone support, eliminate the need for time-consuming visits to physical bank branches.

Eligibility Requirements for Opening a Tide Business Account

Your company must be registered with UK Companies House to open a Tide business account. If you are a sole trader, freelancer, or self-employed, you must be registered with HMRC and can provide proof of address in the UK. You can apply for Tide accounts from anywhere as long as you have a UK residential address and a valid UK phone number.

You must be over eighteen years old to apply for a Tide account.

Businesses funded by regular donations are not eligible to open a Tide business account. Tide also does not provide business accounts for businesses in some high-risk industries, for example:

- Cryptocurrencies

- Real estate investments

- Money services, including foreign exchange and money transfers

- Sale of unlicensed pharmaceuticals and cannabidiol (CBD) products

- Non-profit organisations, including charities, CICs, and CIOs

For a complete list of prohibited industries, please refer to Tide’s FAQs page or contact Tide to check your eligibility.

The application process to open a business account is completely online. It can be completed on the Tide app or website, but you will need to verify your identity on a mobile phone. The average wait time for account approval is 10 minutes to 48 hours.

The Ease of Opening an Account for Tide is 4/5

Tide offers a convenient business account opening process, especially for UK-based businesses and sole traders. Its digital application process and quick approval time are significant strengths. Additionally, the efficient mobile phone identification verification adds to its appeal. Although there are restrictions for certain industries, these are reasonable, given the nature of those businesses.

Tide Alternatives

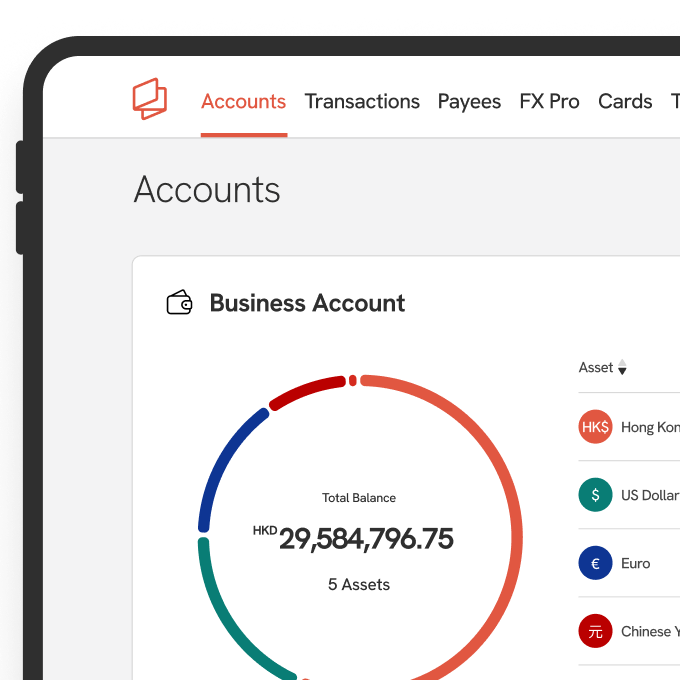

| Multi-currency Business Account | |||

| Supported Currencies in Business Account | GBP | 11 currencies, including SGD, HKD, USD, RMB, EUR, GBP, AUD, CAD, NZD, JPY, CHF | GBP, EUR, and USD |

| Eligible Countries | UK | Hong Kong, Singapore, and the BVI | UK |

| Accounting Software Integration | |||

| SWIFT Payments | |||

| Payment Tracking | Live chat, FAQ pages, query forms. | Help centre, Phone, and Email | |

| Customer Support Channels | In-app chat, Phone, Email | Website, Email, Phone, Live chat, WhatsApp, WeChat | In-app chat, Phone, Email |

| Cards | Physical cards | Physical and virtual cards | Physical and virtual cards |

| ATM Withdrawal | |||

| Account Opening Time | 48 hours | 3 business days | 1-18 days |

| Account Monthly Fee | From GBP 0 - 49.99 | HKD 88 (with a dedicated account manager | Free, with optional add-ons from GBP 2-7 per month |

| Trustpilot Reviews | 4.3/5 based on 18,369 reviews | 4.6/5 based on 246 reviews | 4.4/5 based on 38,381 reviews |

FAQs

Is the Tide business account safe?

Tide offers business current accounts through ClearBank, meaning deposits up to GBP 85,000 are protected under the Financial Services Compensation Scheme (FSCS).

Is Tide regulated?

What are the benefits of a Tide business account?

Disclaimer

Statrys does not directly compete with Tide because we do not provide business accounts in the UK. We're committed to providing an unbiased, thorough review to help you make an informed choice