Key Takeaways

Telegraphic transfer (TT) is an electronic funds transfer method primarily used for international wire transfers. This method allows users to send money across borders electronically.

Typically, sending a telegraphic transfer takes around 1-5 business days to arrive at its destination. It could be influenced by factors such as the country you are sending from and the destination countries.

The fees for telegraphic transfers differ depending on the destination. It is typically free to do domestic transfers, and for international transfers, it could range from USD 10 to USD 50, depending on the banks and currencies.

Telegraphic transfers are commonly used for larger transactions, such as business and trade payments. Personal money transfers are not recommended, and digital remittances are more suitable.

With the acceleration of globalization, telegraphic transfers have played a key role in bridging the gap between people and businesses across the globe. In 2021 alone, 1.1 million new businesses were established in the US. Moreover, the US ecommerce sector now includes 3.9 million companies, contributing to a global ecommerce market valued at USD 4.9 trillion.

In this article, we will explain what telegraphic transfer is, how it works, and how you can utilize this method to transfer money. We will also look into the pros and cons of telegraphic transfer to provide you with the facts to make the right decision for your business.

Let’s dive into it.

What Is a Telegraphic Transfer?

Telegraphic transfer (TT) is a method of electronically transferring funds from one bank account to another. It is still one of the most popular ways to transfer money globally due to its convenience, speed, and security.

📌 Note: The term “telegraphic” refers to information sent by telegram or by using telegraphy: the transmission of written messages through cables using coded signals.

Commonly, telegraphic transfer is abbreviated to TT, TT payments, or TT transfers.

What makes a telegraphic transfer complicated is not the technical part but the terminology used between countries to capture this type of international transfer.

Here are some alternative terms that can be used instead of "telegraphic transfer."

- SWIFT payment or transfer

- International bank transfer

- Telex transfers

- International money transfer (IMT) (common in Australia)

- International wire transfers

Although these terms all label international money transfers, telegraphic transfer broadly refers to any international transfers using the SWIFT network.

TT transfers can be both domestic and international transfers, and they are typically fast and secure. It's important to note that there may be fees associated with this type of transfer, so it's best to check with your bank before initiating one. For instance, in Hong Kong, domestic TT transfers in HKD, CNY, USD, and EU might be processed via the local payment system named the Clearing House Automated Transfer System(CHATS), which allows for even faster processing times.

📌 Note: Wire transfer is another method of sending money electronically. Read our articles to learn how it’s different from TT and its processing time.

How Does a Telegraphic Transfer Work?

In the past, telegraphic transfers relied on telegraph cables and Morse code to send detailed instructions for moving money from a sender to a receiver. With technological advancements, this method has been transformed into an efficient electronic system, such as cable networks or cloud-based apps that connect banks and financial institutions globally.

Here’s a breakdown of the process:

- Initiation of Transfer: The process typically starts when the sender provides their bank with essential details like the recipient's account information and the amount of money they wish to send.

- Message Transmission: The sender's bank then initiates the transaction by sending a message through a secure network (often through the SWIFT network) to the recipient’s bank. This message specifies the amount to be transferred.

- Security Measures: Telegraphic transfers are conducted through secure channels, with banks employing various measures to safeguard the funds and personal information involved in the transaction.

- Exchange Rates and Fees: In international transfers, exchange rates play a critical role. The transferred amount may be subject to currency conversion, potentially affecting the final amount received. Additionally, each bank in the transfer chain, including intermediary banks, may add its own fees, influencing the overall cost of the transfer.

- Completion of Transfer: The recipient's bank, upon receiving the instructions, credits the recipient's account with the transferred funds. While the process is generally efficient, the total time can vary, typically ranging from one to several business days, depending on the bank’s processing times and policies.

It's important to note that due to the involvement of multiple banks and the potential for currency exchange, the cost of TT transfers can be higher compared to other payment methods. However, their speed and reliability often justify the expense, particularly in business or urgent personal transactions.

In general, payments take 1-5 business days to reach the recipient's account. Nonetheless, delays may occur due to factors such as time zones, bank cut-off times, and fraud prevention measures.

💡 Insight: Currency and intermediary banks are also factors that influence the processing time of SWIFT payments.

How Much Does It Cost to Send a Telegraphic Transfer?

When transferring funds with a telegraphic transfer, various fees are involved. Here are the key components that determine the overall expense.

- Sending Bank Fees: A service fee charged by the bank initiating transfers. This can be a fixed or a percentage of the transfer amount.

- Receiving Bank Fees: Often deducted from the amount transferred, which can affect the total sum received. However, senders can choose to pay for this fee instead.

- Intermediary Bank Costs: If your transfer is routed through intermediary banks, each of these banks might apply their own fees.

- Currency Conversion Fees: When transferring money in a different currency, banks apply a conversion fee. It is often not a direct charge but is included in the exchange rate.

- SWIFT Network Fees: Additional charges for utilizing the SWIFT network may be applied.

- Extra Services: For instance, sending large amounts of money may come with an extra cost.

In short, sending an overseas transfer with SWIFT can cost around USD 10-50, while domestic rates start from USD 0 upwards, depending on the financial provider.

📌 Note: Always check with your bank or financial institution for up-to-date fees on transfers.

How to Send a Telegraphic Transfer

Sending a Telegraphic Transfer (TT) involves a few steps, which can vary slightly depending on your bank:

- Verify with Your Bank: Ensure your bank offers TT services. This is usually available at most major banks.

- Collect Recipient Information: Include their name, account number, and their bank’s BIC/SWIFT code for international transfers.

- Specify Transfer Details: Decide the amount and currency for the transfer. Be mindful of exchange rates and possible conversion fees if sending in a foreign currency.

- Initiate the Transfer: You can do this online (via an online banking portal and mobile application), or in person at a branch.

- Fill in Payment Information: Enter all necessary transfer information, and check if additional details are required for larger transactions.

- Review Fees and Confirm Transaction: Be aware of all associated fees, including any charges for currency conversion, before finalizing the transfer.

- Track and Record: Use the provided reference number to track your transfer.

Pros and Cons of Telegraphic Transfer

When you need to make a telegraphic transfer, there are two sets of rules that you need to follow: those of your bank and the SWIFT network policies. These rules determine the advantages and disadvantages of making a transfer.

Pros of Telegraphic Transfers

- Security and Safety: Telegraphic transfers are a safe and secure method of sending money overseas.

- Traceability: Each transfer is traceable, with detailed tracking information.

- Convenience: TTs can be initiated from anywhere at any time, as many financial institutions offer this service online.

- Higher Transaction Limits: TTs are ideal for large payments like international business transactions or property purchases due to their higher transaction limits compared to other methods.

Cons of Telegraphic Transfers

- Fees: Making a TT can cost a high fee. It can vary and sometimes lack transparency, making it difficult to predict the total cost.

- Intermediary Banks Involvement: Transfers can go through several intermediary banks, adding potential additional costs.

- Transfer times can be slower than other methods, varying anywhere from 1-5 business days to a few weeks for your funds to arrive.

Wire transfers internationally don't always go smoothly. One time, a payment got seriously delayed because of some errors, and sorting it out required working with different bank teams across time zones.

It really showed me how backup plans and close relationships with bank contacts can be so valuable when issues come up when moving money between countries. Communication is key.

Alternative Solution: Statrys

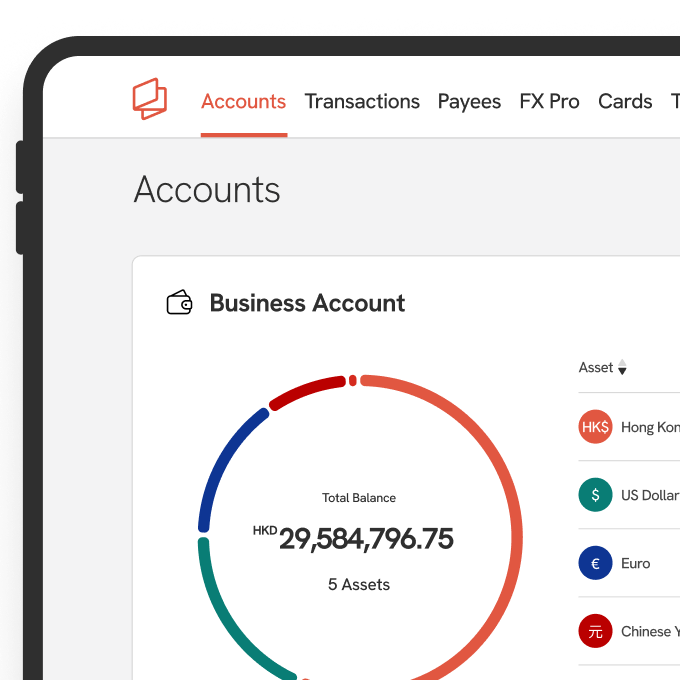

Sending and receiving money electronically has become the new norm, and so is using traditional banking alternatives such as virtual banks and payment service providers. If you own a business in Asia or are considering entering the Asian market, then we recommend you consider Statrys.

Statrys is a licensed Money Service Operator in Hong Kong that provides financial services and solutions to businesses incorporated in Hong Kong, Singapore, and the BVI. These services include:

- A multi-currency business account that can hold 11 major currencies.

- Local payout in 14 different currencies.

- Virtual and physical business cards have built-in controls to manage expenses and cash withdrawals through ATMs.

- FX services with competitive exchange rates (spot and forward contracts).

- Xero integration to save time and resources using automated accounting.

- A dedicated account manager for every client.

With its excellent reputation and customer service, Statrys has received a score of 4.6/5 from over 200 reviews on Trustpilot.

Moreover, the application process for opening an account with Statrys is simple and fast, with 85% of its customers being able to open an account within 3 business days.

If you own a growing business and have clients and partners in Asia, be sure to check out Statrys' business account to see how Statrys can support your business with payment.

FAQs

Is a telegraphic transfer the same as a bank transfer?

The term “telegraphic transfers” refers to domestic and international money transfers made from one account to another. This is synonymous with terms like bank transfer, wire transfer, or SWIFT transfer.

How long does a telegraphic bank transfer take?

How does a telegraphic transfer work?

What is the difference between SWIFT and telegraphic transfer?

How much do telegraphic transfers cost?