Key Takeaways

Standard Chartered Group is a leading international banking institution headquartered in London, England, with an extensive global network of over 1,750 branches in more than 70 countries.

It operates in the Asia Pacific Region, South Asia, the Middle East, Africa, the United Kingdom, and the Americas.

The bank offers a range of banking services in Hong Kong, including personal banking, corporate and institutional banking, and private banking.

Services encompass digital banking, loans, mortgages, investments, insurance, wealth management, and more.

Standard Chartered Hong Kong Overview

Standard Chartered Bank (Hong Kong) Limited has been operating since 1859 and is one of the three note-issuing banks authorised by the Hong Kong Monetary Authority in Hong Kong.

As an established bank, Standard Chartered Hong Kong offers banking services for personal and business needs. Their products include savings accounts, time deposit accounts, business accounts, credit cards, loans, foreign exchange, and insurance.

This article will walk you through the Standard Chartered Hong Kong business account opening process. We’ll be sharing helpful information about eligibility criteria and required documents to set up your account smoothly.

💡Tip: Visit our Standard Chartered business account review for more in-depth information, such as key features and applicable fees.

| Key Information | Description |

| Eligible countries and regions | Hong Kong and other countries and regions, including China, Taiwan, and the BVI. |

| Eligible company types | Sole proprietorship, limited company, partnership, society or association, and owner incorporation. |

| Initial deposit | Not specified |

| Account opening fee (including company search fee) | Local company: HKD 1,200 Overseas Company: HKD 10,000 |

| How long it takes to complete the application? | Depends on the complexity of your business and the availability of the required documents and information |

| Average opening time | 3 weeks or more, depending on the circumstance |

| 100% online application | No |

| Key Things to Know | • You are required to visit a physical branch to open a business account. • Overseas companies are eligible to apply for a business bank account with additional fees. |

| Best Standard Chartered Alternatives | Statrys is a virtual bank alternative for SMEs based in Hong Kong, Singapore, and the BVI. You can benefit from comprehensive services like multi-currency business accounts, FX, real-time SWIFT payment tracking, cash withdrawal, and more. ZA Bank is a virtual bank that offers Hong Kong-based businesses the convenience of managing financial transactions and banking needs online. |

Types of Accounts Available

Standard Chartered Hong Kong offers bank accounts for both individual and business clients.

Personal Accounts

There is a variety of Standard Chartered bank accounts for personal use. The primary types of personal accounts include:

- Easy Banking: Easy Banking is Standard Chartered Hong Kong’s one-stop banking service for easy financial management. You can open this account conveniently online on the SC mobile app without a minimum balance requirement.

- Integrated Deposits Account: With this savings account, you can hold and manage your funds in multiple foreign currencies, including HKD, USD, RMB, AUD, EUR, GBP, and SGD. Optional current accounts in USD and RMB are also available, with RMB savings and current accounts being specifically available to valid HKID holders.

- Time Deposit Account: This account is tailored for growing wealth with higher interest returns, with flexible tenor options from as short as one week. It offers ten different currencies for selection, including HKD, USD, CNY, AUD, NZD, CAD, GBP, EUR, CHF, and JPY.

- Payroll Accounts: This account maximises your earnings' value by providing rewards when you save, spend, and invest. Clients who apply online with a minimum monthly salary of HKD 20,000 can enjoy benefits like a cash rebate of at least HKD 800.

Business Accounts

Standard Chartered Bank Hong Kong offers bank accounts for businesses of all sizes, from SMEs to businesses expanding internationally and established corporations.

A Standard Chartered business account allows you to access a global remittance service in 11 major currencies, including AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD, and RMB. Moreover, their business accounts support international and local transactions through SWIFT payment and FPS bank transfers.

As a business banking client, you can manage and send money via Standard Chartered Bank’s online banking platform, Straight2Bank, through the mobile app or web browser.

For more information regarding the types of accounts and banking plans, we recommend you visit Standard Chartered’s bank accounts and deposits services page or contact their Business Banking Centre directly.

🔍Tip: Discover other options for business accounts in Hong Kong in our guide.

Eligibility

Your company must not be involved in prohibited activities to open a Standard Chartered Hong Kong business account. Examples of restricted actions include the following:

- Involvement in child or forced labour and human rights violations.

- Engagement in oil and gas exploration or production in the Amazon Basin and the Arctic region.

- Production, manufacture, or trade of fur and Angora wool.

- Trading in shark fin products.

Here are the eligible criteria for opening a Standard Chartered Hong Kong business account.

Countries Eligible

Companies incorporated in and outside Hong Kong can apply to open a Standard Chartered business account in Hong Kong. However, overseas companies need to pay additional fees and meet other requirements.

Standard Chartered does not allow direct or indirect access to any of its banking services in sanctioned countries and regions, which include Cuba, Iran, North Korea, Sudan, Syria, Crimea, and Sevastopol. Companies operating in these countries cannot apply for a business account.

Company Types Eligible

The following are the eligible company types:

- Sole Proprietorship

- Partnership

- Limited Companies

- Society / Association

- Owners Incorporation

What Documents Do I Need to Open a Standard Chartered Business Account?

The documents you will need to open a business account with Standard Chartered Hong Kong vary according to the structure of your business.

Primarily, you will need to provide the following documents and information:

- Company History (including the company formation date, reason for setting up a business, and the source of capital to set up the company)

- Company Ownership Structure

- Company Organisational Chart showing the shareholding and management structure of the company

- A copy of the Business Registration Certificate and/or Certificate of Incorporation

- A resolution by the board of directors, which is a document that records decisions made by a corporation's board of directors or shareholders

- Copies of Identity Documents of the directors, shareholders, and ultimate beneficial owners, such as Hong Kong Permanent resident cards, ID cards, or passports

Additionally, you must provide information regarding the nature of your business, including:

- The principal place of operation

- The main products or services that you provide

- Number of employees and anticipated net profit

- Major import and export countries

- Your primary source of funds and income

- Information on direct or indirect dealings or ownership interests in countries such as Iran, Syria, North Korea, Cuba or regions such as Crimea or Sevastopol

| Key Information | Description |

| Sole Proprietorship | • Copy of individuals’ identity documents • Copy of Business Registration Certificate • Account Opening Form, Mandate, and Schedule (Signatories) • Account Opening Supplement |

| Partnerships | • Copy of individuals’ identity documents • Copy of a shareholding structure chart for companies with multiple layers of ownership • Copy of Business Registration Certificate • Partnership deed (if applicable) • Account Opening Form, Mandate, and Schedule (Signatories) • FATCA Form • CRS Entity Self Certification Form |

| Limited Companies | • Copy of individuals’ identity documents • Articles of Association • Related documents for companies with Corporate Directors • Copies of Particulars of directorship and company secretary • Copy of a shareholding structure chart for companies with multiple layers of ownership • Copy of Business Registration Certificate • Copy of Certificate of Incorporation/Registration • Account Opening Form, Mandate, and Schedule (Signatories) • FATCA Form • CRS Entity Self Certification Form |

| Society/Association | • Copy of individuals’ identity documents • Copy of Certificate of Registration • Copy of Application for Charges of Particulars of Registered and Exempted Societies • Copy of Constitution / By-laws • Account Opening Form, Mandate, and Schedule (Signatories) • FATCA Form • CRS Entity Self Certification Form |

| Owners Incorporation | • Copy of individuals’ identity documents • Copy of Certificate of Registration • Copy of subsequent notice of change of particulars of office-bearers of its management committee • Account Opening Form, Mandate, and Schedule (Signatories) • FATCA Form • CRS Entity Self Certification Form |

Application Forms and Useful Resources

You can download the company account opening form online from Standard Chartered Bank Hong Kong’s website.

Please visit their useful forms page for other relevant documents, such as:

- Document checklist for companies incorporated in different countries and regions

- Account opening form supplement for sole proprietor

- Amendment for Business Banking Services

⚡ Important: All documents must be in English or Chinese. The English version shall prevail in cases of inconsistency or conflict.

How To Open a Standard Chartered Business Account

While it is possible to begin the application process for a Standard Chartered business account online, an in-person visit is required to complete the process.

Mobile account opening is not available for business banking services.

Here are the primary steps to follow:

Step 1 - Download the Account Opening Form

Firstly, you will have to visit the account opening page to download the bank account opening form. You can also check the business information requirements on this page.

Step 2 - Gather All Required Documents

Secondly, complete the account opening form and gather all the supporting documents according to your company type. You can download the account opening checklist from their website.

Step 3 - Make an Appointment

After you have all the required documents ready, the next step is to make an appointment to submit them in person. You can fill out the form online on the account opening page, and Standard Chartered will contact you back within seven working days.

Step 4 - Submit Your Application

The final step is to visit Standard Chartered Hong Kong’s business banking branch to submit your account opening form and supporting documents.

After presenting all your documents, the bank will review your application. Standard Chartered may contact you for additional details or documents during the approval process.

How Long Does It Take To Open a Standard Chartered Business Account?

If you have all the essential information at hand, completing the business account opening form should not take longer than an hour.

However, you will have to wait for an appointment confirmation from Standard Chartered, which could take up to 7 business days or more before you can submit the account opening application.

Depending on circumstances, such as the complexity of your business, the account approval process may take several weeks to months. The process might also be extended in cases where you are required to provide additional documents.

How Much Does It Cost to Open a Standard Chartered Business Account?

Standard Chartered Bank charges different opening fees for companies incorporated in Hong Kong and overseas. The account opening fees are HKD 1,200 for each local company and HKD 10,000 for international companies.

The company search fee is included in the business account opening fee. You can refer to their service charges document for other fees, including cross-border transactions and credit card fees.

| Fee Type | Amount |

| Account Opening Fee | Local company: HKD 1,200 Overseas company: HKD 10,000 |

| Monthly Fee | HKD 300/month (waived if the average 6-month balance is greater than HKD 200,000) |

| Account closure fee (if within three months from the opening date) | HKD 200 |

How to Contact Standard Chartered Customer Support?

You can ask the virtual assistant chatbot on Standard Chartered’s website if you have general questions regarding personal banking or credit cards. You can request to chat with a live agent if the chatbot cannot provide helpful answers.

For business accounts and banking queries, call the Business Banking Service Hotline at +852 2886 6988 from 9 AM to 6 PM on weekdays and from 9 AM to 1 PM on Saturdays. Additionally, you can visit a branch for in-person customer support.

Customers with Priority and Priority Private banking plans can contact a dedicated Relationship Manager (MyRM) online via text messages and audio calls.

Standard Chartered Hong Kong Alternative: Statrys

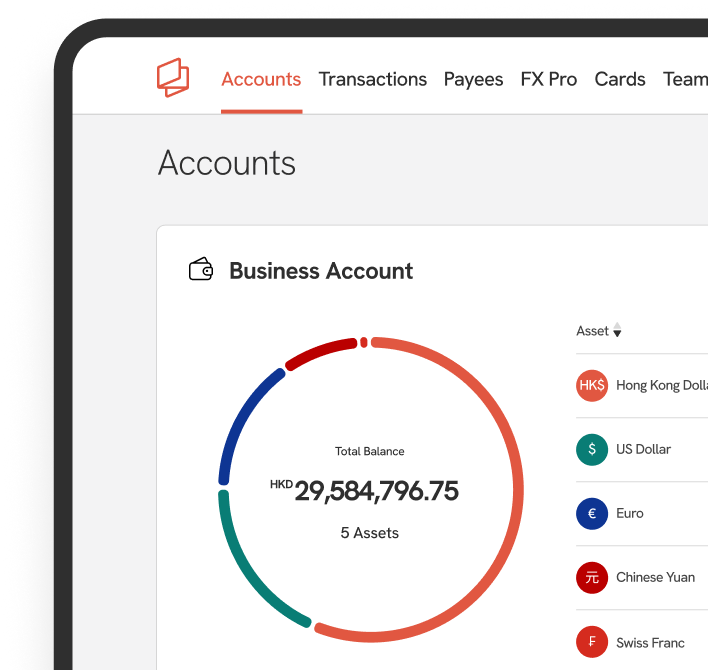

If you are looking for an alternative to traditional banks and prefer a hassle-free way to save, send, and receive money in multiple currencies, consider Statrys.

Although not a bank, Statrys is fully licensed and operates as a Money Service Operator in Hong Kong and Small Payment Institution in the UK. We offer simplified digital financial services for modern SMEs, providing multi-currency business accounts and human-centred dedicated customer support for global business operations.

Our services include multi-currency accounts, free invoicing software, and company registration services in Hong Kong and Singapore. For businesses incorporated in Hong Kong, Singapore, or the BVI, Statrys is your gateway to seamless financial management.

Statrys Services

| Key Features | Description |

| Multi-Currency Business Account | Hold, receive, and send money in 11 currencies: USD, HKD, CNY, AUD, EUR, GBP, SGF, JPY, CHF, NZD, and CAD. |

| Business Account Opening Requirements | Must be incorporated in Hong Kong, Singapore, or the BVI. |

| Business Account Opening Time | 3 days on average |

| Initial deposit | HKD 0 |

| Account Opening Fee | HKD 0 Except for special companies registered outside Hong Kong, Singapore, the BVI or companies with complex structure |

| Monthly Fee | HKD 88 (with a dedicated account manager) |

| Customer Support Channels | Website, Live Chat, Email, Phone, WhatsApp, and WeChat |

| Swift Payments & Tracking | |

| Local Payments | Send local payments in 14 currencies: HKD, AUD, EUR, GBP, IDR, INR, KRW, PHP, SGD, THB, TRY, USD, and VND |

| Payment Cards | Virtual and physical business cards with built-in controls to manage expenses |

| ATM cash withdrawals | |

| FX Rate and Fee | Competitive exchange rates with fees as low as 0.1% (spot and forward contracts) |

| Xero Integration | |

| Free Invoicing Software | Create, manage, and send invoices efficiently |

| Company Registration Service | 100% online Hong Kong and Singapore company registration. |

| Trustpilot Score | 4.6/5, based on 254 Statrys reviews on Trustpilot |

FAQs

Can I open an account with Standard Chartered Bank online?

You can open personal accounts with Standard Chartered on the SC Mobile App. However, this function is not available for business account openings.

How much does it cost to open a Standard Chartered business bank account?

How do I apply for a Standard Chartered business account?

How long does the application process take?

What if my Standard Chartered business account application gets declined?