Bank Of China Hong Kong Overview

Bank of China (Hong Kong) Limited, commonly referred to as BoCHK, is a leading commercial banking group in Hong Kong. It operates as a subsidiary of the Bank of China, one of the largest commercial banks in China.

BoCHK holds the distinction of being one of the three banks authorised to issue Hong Kong Dollar (HKD) notes. In addition, the bank serves as the sole clearing bank for renminbi (RMB) transactions in Hong Kong. Moreover, BoCHK has extensive RMB franchises, making it a top choice for customers engaged in the RMB business.

BoCHK provides a comprehensive range of banking services to retail and corporate customers. Their offerings include personal banking, business banking, insurance, wealth management, and more.

| Key Information | Description |

| Eligible Countries | • Bermuda • The British Virgin Islands (BVI) • Cambodia • The Cayman Islands • Great Britain • Hong Kong • Indonesia • Laos • Macau • Mainland China • The Marshall Islands • Mauritius • Myanmar • The Philippines • Singapore • Taiwan • Thailand • Vietnam • Western Samoa (Samoa) |

| Eligible Company Types | All types of businesses |

| Initial Deposit | We cannot find information regarding the initial deposit requirement. |

| Account Opening Fee | Hong Kong companies: HKD 1,200 Mainland China companies: HKD 3,200 Macau/Taiwan companies: HKD 6,200 Overseas companies: HKD 6,200 An additional fee of HKD 5,000 applies for companies with 4 or more layers. |

| How Long Does It Take to Complete the Application? | Within 20 minutes |

| Average Opening Time | For sole proprietorships, partnerships, or single-layer limited companies incorporated in Hong Kong, the business account can be opened within 3 business days |

| 100% Online Application | Only if your business is eligible to open a business account remotely. |

| Key Things To Know | Remote account opening requirements are • Your business is registered and incorporated in Hong Kong; • Your business entity is a sole proprietorship, partnership, or limited company (including limited by guarantee company) with annual sales turnover that meets the BoCHK conditions; • Your business should not have corporate shareholders; • The related party(ies) should not exceed 10 and must be a Hong Kong Identity Card holder(s). |

| Best BoC Hong Kong Alternative | Statrys: A multi-currency business account capable of holding 11 different currencies under one account number, featuring a cost-effective and transparent pricing structure. |

Types of Accounts Available

Bank of China Hong Kong business accounts offer companies comprehensive banking services, including deposits, loans, credit cards, payroll services, trade services, and investments. BoCHK categorises its business accounts into three tiers:

- Business Integrated Account,

- Business Integrated Account Plus,

- Business Integrated Account Elite.

The key differences between the 3 tiers can be found in the Business Integrated Account comparison document.

Eligibility

We will outline the eligibility requirements to help you determine if you can open a business account with BoCHK.

Eligible Countries

Here is the list of countries and territories eligible for opening a business account with the Bank of China Hong Kong.

- Bermuda

- The British Virgin Islands (BVI)

- Cambodia

- The Cayman Islands

- Great Britain

- Hong Kong

- Indonesia

- Laos

- Macau

- Mainland China

- The Marshall Islands

- Mauritius

- Myanmar

- The Philippines

- Singapore

- Taiwan

- Thailand

- Vietnam

- Western Samoa (Samoa)

💡 Helpful Resource: Learn how to register your Hong Kong business with our detailed guide.

Company Types Eligible

Bank of China Hong Kong offers business account services to a broad range of company types, including but not limited to sole proprietorships, partnerships, society, limited liability companies, and public limited companies.

What Documents Do I Need to Open a BoC Hong Kong Business Account?

BoCHK outlines the required documents for opening a business account. For example,

- A valid business registration certificate,

- A valid certificate of incorporation,

- Identification documents of directors, major shareholders, and all authorised signatories,

- Organisational structure of the company (if it is a company with more than 4 layers),

- Residential address proof,

- Business proof (i.e., business plan, source of wealth and funds, and tax record).

All submitted copies of documents to the bank must be certified as true copies of the originals, and any documents related to account opening must also be witnessed by one of the following:

- A recognised certified public accountant, lawyer, banker, or notary public,

- A member of the Hong Kong Institute of Chartered Secretaries (HKICS),

- BoCHK team.

In addition, at least one of the key persons must visit the BoCHK branch for account opening.

Lastly, please refer to the complete document checklist for SME businesses, Hong Kong companies, and overseas companies for more details.

How To Open a BoC Hong Kong Business Account Online

To open a Bank of China Hong Kong business account remotely, you must fulfil the following criteria.

- Your business is registered and incorporated in Hong Kong;

- Your business entity is a sole proprietorship, partnership, or limited company (including limited by guarantee company) with annual sales turnover that meets the BoCHK conditions;

- Your business should not have corporate shareholders;

- The related party(ies) should not exceed 10 and must be a Hong Kong Identity Card holder(s).

Step 1: Make an Account Application

First, access the “Remote Account Opening” page and click “Apply Now” at the bottom of your screen to create your account application.

Step 2: Create Your Profile

Create your account profile with basic business information, including

- the full name of the contact person,

- the HKID card number,

- business email,

- mobile number,

- and the number of your business registration certificate or certificate of incorporation.

Then, agree on terms and conditions to proceed.

Step 3: Enter Details of Your Business

Fill in the account application form with details of your business.

Step 4: Submit Your Documents

Upload the necessary documents and submit your application. After review, the Bank of China Hong Kong team will contact you to confirm whether you can proceed with the remote account opening process.

Step 5: Digital Verification

Download the BOCHK iGTB MOBILE app to verify your identity online.

Step 6: Confirm Your Application

Confirm the information and supporting documents you submitted. Complete the “Self-Certification Form” and read all the rules to confirm the account opening.

Step 7: Pay the Fee and Activate Your Account

An account opening fee will be applied. After payment, you can access Corporate Internet Banking to activate your business account.

How Long Does it Take to Open a BoCHK Business Account?

If your business operates as a sole proprietorship, partnership, or single-layer limited company in Hong Kong, your account can be opened within 3 business days after the submission and payment of your application.

However, if a physical visit is required to complete your business account application, the timeframe can be extended to several weeks.

How Much Does It Cost to Open a BoCHK Business Account?

| Fee Type | Amount |

| Hong Kong companies | HKD 1,200 |

| The Mainland China companies | HKD 3,200 |

| Macau/Taiwan companies | HKD 6,200 |

| Overseas companies | HKD 6,200 |

| Additional fee for 4 or more layers of a company | HKD 5,000 |

How to Contact Bank of China Hong Kong's Customer Support

You can contact the Bank of China Hong Kong via multiple channels, including

- Hotline: +852 3988 2288 (for new customers), +852 3988-1333 (for existing users),

- Chatbot,

- Visiting at any branch (appointment needed),

- Fill in the query form.

Moreover, BoCHK provides dedicated hotlines for various services. Please visit the “enquiry hotline” page for details.

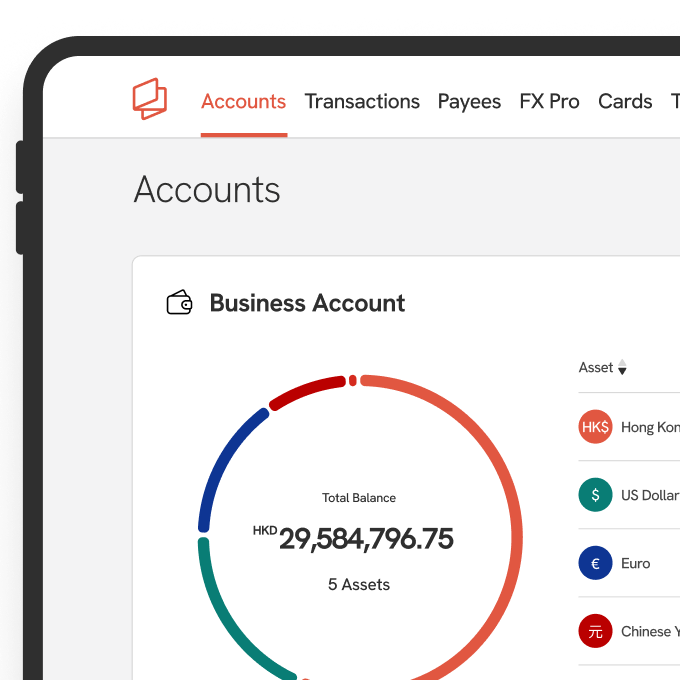

Alternative Solution: Statrys

Hong Kong is a major financial centre that offers a wide range of financial and banking services. Among these options, we will introduce you to a notable alternative – Statrys.

Established in 2019 by Bertrand Theaud, Statrys is a fintech firm dedicated to enhancing financial solutions for SMEs. As a licensed Money Service Operator in Hong Kong, Statrys offers multi-currency accounts, supporting 11 major currencies to companies incorporated in Hong Kong, Singapore, and the British Virgin Islands (BVI).

Statrys has simplified the account opening process by offering remote account opening to all applicants. Furthermore, 85% of our applicants successfully open their business accounts as fast as 3 business days.

Statrys’ Key Services

| Key Features | Description |

| Multi-Currency Business Account | Hold, receive, and send money in 11 currencies: USD, HKD, CNY, AUD, EUR, GBP, SGF, JPY, CHF, NZD, and CAD. |

| Business Account Opening Requirements | Must be incorporated in Hong Kong, Singapore, or the BVI. |

| Business Account Opening Time | 3 days on average |

| Initial deposit | HKD 0 |

| Account Opening Fee | HKD 0 Except for special companies registered outside Hong Kong, Singapore, the BVI or companies with complex structure |

| Monthly Fee | HKD 88 (with a dedicated account manager) |

| Customer Support Channels | Website, Live Chat, Email, Phone, WhatsApp, and WeChat |

| Swift Payments & Tracking | |

| Local Payments | Send local payments in 14 currencies: HKD, AUD, EUR, GBP, IDR, INR, KRW, PHP, SGD, THB, TRY, USD, and VND |

| Payment Cards | Virtual and physical business cards with built-in controls to manage expenses |

| ATM cash withdrawals | |

| FX Rate and Fee | Competitive exchange rates with fees as low as 0.1% (spot and forward contracts) |

| Xero Integration | |

| Free Invoicing Software | Create, manage, and send invoices efficiently |

| Company Registration Service | 100% online Hong Kong and Singapore company registration. |

| Trustpilot Score | 4.6/5, based on 254 Statrys reviews on Trustpilot |

FAQs

What is the Bank of China Hong Kong?

The Bank of China (Hong Kong) Limited, commonly known as BoCHK, is a leading commercial banking group in Hong Kong. It operates as a subsidiary of the Bank of China, one of the largest commercial banks in China. BoCHK is one of three note-issuing banks, and it serves as the only clearing bank for Renminbi (RMB) transactions in Hong Kong.

What are the services provided by the Bank of China Hong Kong?

Can I open a business account with Bank of China Hong Kong online?

How much is the account opening fee for Bank of China Hong Kong?

What documents do I need to apply for an account?

Disclaimer

Statrys competes directly with the Bank of China Hong Kong in the payment industry. However, we're committed to providing an unbiased, thorough review to help you make an informed choice.