What are CHAPS and BACS Payments?

CHAPS payment stands for Clearing House Automated Payment System. CHAPS typically guarantees same-day transfers, provided it was initiated before the daily cut-off time. It is often used if the transfer is time-sensitive or is high-value.

BACS payment stands for Bankers Automated Clearing System. BACS is typically used for low-value, non-urgent or recurring transactions such as payroll and direct debits, which can take up to three business days to clear.

When you are making payments or wire transferring money in the UK, you may have come across the terms CHAPS or BACS payment. The reason why is that these payment methods are the go-to choices used for bank-to-bank payments in the UK.

For people outside of the UK, it is not uncommon to not be familiar with these terms.

In this article, we will cover what CHAPS and BACS payments are, their differences, their features and how most people use them.

What are CHAPS payments?

CHAPS payments are an electronic payment system that is used for paying money from an account in one bank to another account in another bank on the same day. It is the primary method used in the UK for time-sensitive and high-value payments such as putting a downpayment on a house, paying suppliers, purchasing a car or any other large assets.

According to UK Finance, there were 48 million CHAPs payments processed in 2021, worth a total of 86 trillion pounds. The biggest factor that influences the number of CHAPS payments and their volume is the UK's economy.

💡CHAPS stands for "Clearing House Automated Payment System".

What are BACS payments?

BACS payments are electronic bank-to-bank transfers that allow individuals and businesses to move funds between bank accounts.

BACS payments are processed in batches and can take up to three working days to clear. They are commonly used for payroll, direct debits, and other regular payments, as well as for one-time transactions such as paying bills or making purchases.

According to Pay UK, the total BACS direct credit transaction in 2022 was estimated at around 1.9 billion transactions. For direct debits, the total transaction is estimated to be around 4.7 billion.

BACS payments are generally considered a safe and reliable method of transferring funds, as they are backed by the UK's banking industry and regulated by the Financial Conduct Authority (FCA). BACS payments can also be initiated through online banking, telephone banking, or by submitting a paper form to the bank. The process typically involves providing details of the recipient's bank account and the amount to be transferred.

💡BACS stands for "Bankers Automated Clearing System"

Difference between CHAPS and BACS payments

When deciding which payment method is the most suitable to use for sending money, it conclusively stirs toward the intention of the transfer with the consideration of these factors.

1. Transaction Speed

In terms of transaction speed, CHAPS payments are a faster payment method because they are usually processed on the same day, as long as the request was initiated before the cut-off time. The cut-off time will vary between banks, so make sure you check the cut-off time for your bank.

Alternatively, BACS payments can take up to 3 to 5 business days to process. It is generally used for day-to-day transactions that do not require immediate clearances.

2. Transaction Volume

CHAPS payments are used for transferring large sums of money that require instant clearance. Therefore, CHAPs payments are the clear option for larger transfers.

BACS payment is the option for your day-to-day transfers that don't require immediate clearance such as direct debit payments, paying invoices and bills to suppliers, and sending employees monthly wages.

3. Fees

BACs payments are the cheaper method of payment of the two as BACS transfer cost ranges from 10p to 50p (HKD 1.08 to 5.41) per transaction and in some cases, some banks may charge extra additional fees.

💡 In contrast, CHAPs payments are typically more expensive due to their stronger threshold of security and faster processing time.

You can typically expect to pay the range from £20 to £35 per transaction.

4. Availability

BACs payment can be initiated at any time of the day while CHAPS payments are only available during certain business hours of the day, usually the time period from 7:00 AM to 5:30 PM.

To sum up, CHAPS payments are faster but more expensive and generally used for high-value crucial transactions whereas BACS payments are slower and cheaper and often used for frequent and smaller value transfers.

💭Did you know: A telegraphic transfer is a way to send money electronically between banks, where the start and the end of a transfer are in different countries?

An alternative option to CHAPS and BACS

Faster Payment System (FPS)

Faster Payments System (FPS) was introduced in 2008 as a new method of payment to replace the traditional three-day BACS payment.

The concept of FPS is an electronic payment processing method that enables near-instantaneous payments amidst bank accounts that are finished within minutes or even seconds.

BACS, CHAPS, and the Faster Payment System dominate UK payment transactions.

🔎According to Pay UK, FPS processed 340.6 million payments in April 2023 which is a 10% increase on the amount processed in April 2022.

In Hong Kong, FPS is another popular method of payment due to its convenience and efficient payment method.

HKMA states that there are over 12 million FPS registered users in Hong Kong.

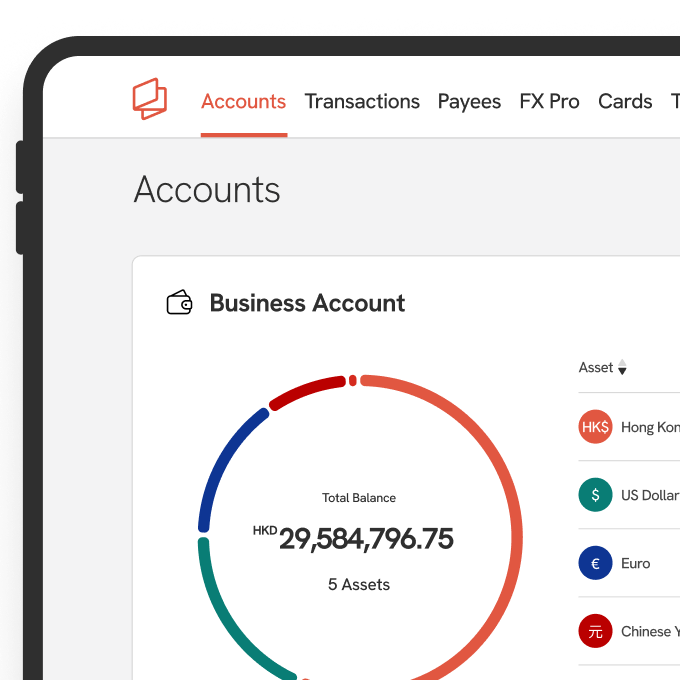

It's important to make sure your business is matching its payments with a business account that is ready to both send and receive them.

It's even more important to make these payments with confidence no matter where you are.

Therefore if you are looking for an alternative option to BACS or CHAPS payment, give Statrys a try for an efficient and user-friendly FinTech option.

At Statrys, we offer a multi-currency business account in Hong Kong that has access to GBP and EUR allowing for flexibility in East and West payment method

FAQs

What is CHAPS?

CHAPS is primarily used for single, large payments from one bank to another.

What are CHAPS and BACS Payments?

What is BACS?

How long does a CHAPS payment take to clear?

How long does a BACS payment take to clear?